Value Propositions of Williams-Sonoma and Its Peers

Williams-Sonoma Inc. (NYSE:WSM), founded by Chuck Williams in 1956 and publicly traded since 1983, is an omni-channel specialty retailer offering a diverse range of cooking, dining and entertainment products, as well as home furnishings and decorative accessories.

I became interested in this stock in early 2023. At that time, shares were trading at $130, had a low price-earnings ratio of under 8, free cash flow of nearly $700 million and extremely robust return metrics, including a return on invested capital of 34.05%, a return on equity of 66.31% and a return on assets of 25.42%. Since then, the stock has jumped to a peak of $317.53 on March 28 and has drifted down slightly to $287.82 at the time of writing. GuruFocus assesses shares as being significantly overvalued; however, the stock is still garnering rave reviews by analysts and the press and is estimated to have a free cash flow margin of safety of 59.71%. This analysis aims to discuss the stock, its relative position compared to five closely aligned competitors and whether the stock warrants the enthusiasm that surrounds it or if value investors should think about scaling back.

Industry overview and competitive landscape

GuruFocus categorizes Williams-Sonoma as belonging to the consumer cyclical sector, the retail cyclical industry and the retail specialty subindustry. These subindustries compare the retailer to other companies that offer an array of products and services, including automotive parts (Genuine Parts Company (NYSE:GPC)), electronics (Best Buy (BBY)), sporting goods (Dick's Sporting Goods (NYSE:DKS)), beauty (Ulta Beauty (NASDAQ:ULTA)) and personal care products (Bath & Body Works (NYSE:BBWI)), farm products (Tractor Supply Company (NASDAQ:TSCO)) and convenience stores (Casey's General Stores (NASDAQ:CASY)). I assessed this subcategory as still too broad, so I've narrowed it to include just retail specialty businesses that are focused on hardlines and home furnishings. These highly competitive subindustries encompass the manufacture, distribution and retail of various products related to home decor and functionality, including furniture, household decorative accessories, appliances, cookware and gardening equipment, and are part of the greater specialty e-commerce and retail business space which has shifted more toward e-commerce and intensified competition from both emerging internet and discount retailers as well as established companies.

Factors that determine the success of companies in this space include responsiveness to changing consumer demands and preferences, brand recognition, price competitiveness, cost management, effective promotional strategies and marketing, innovative shopping experiences (mobile applications, augmented reality capabilities, user-friendly shopping carts and check out, etc.) smartly leveraged artificial intelligence and machine learning to enhance the customer experience and streamline processes, product quality that appeals to a diverse set of consumers, product differentiation and supply chain and distribution management.

Product sales closely parallel those within the housing market, especially within the market for existing homes, which has seen constraints in the last year as current homeowners have been commonly locked into their low mortgage rates, preventing them from relocating. This will likely continue throughout 2024, but may ease in the last quarter with reports of the Federal Reserve possibly easing or reducing rates in the latter part of the year. The housing market is only expected to grow at an average annual rate of between 3% to 5% until 2030.

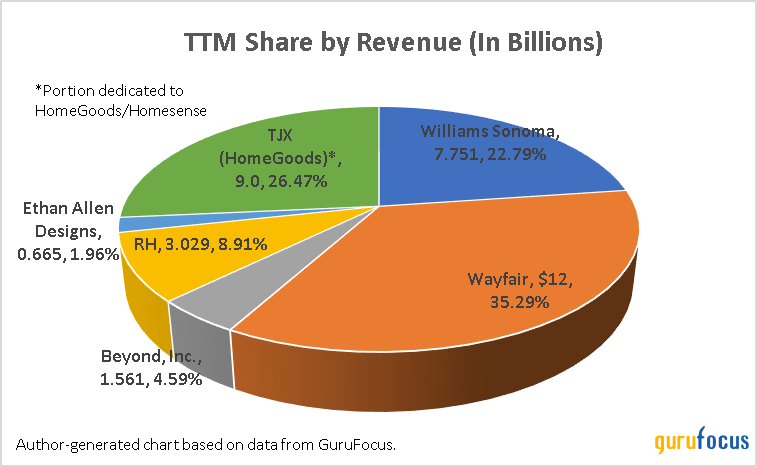

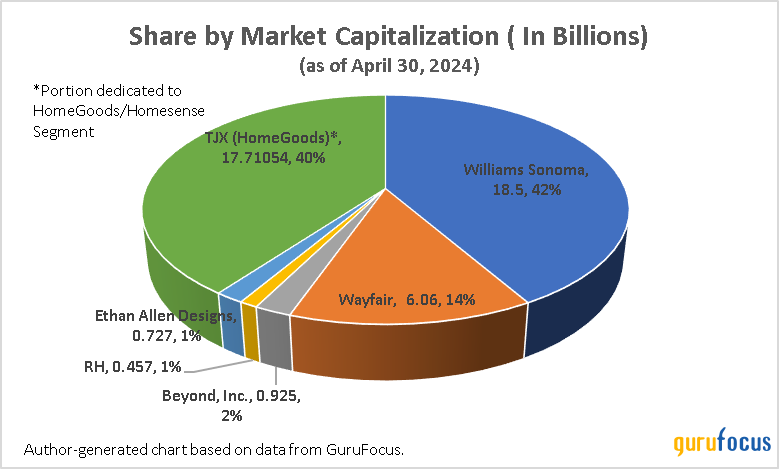

I came up with a list of five competitors that occupy those categories: Wayfair (NYSE:W), Beyond Inc. (NYSE:BYON), RH (NYSE:RH), Ethan Allen Designs (NYSE:ETD) and TJX Companies (NYSE:TJX). These companies have market capitalizations ranging in size from $718 million (Ethan Allen Interiors) to $107 billion (TJX Companies). Since TJX Companies is a holding company primarily focused on apparel, I have focused mainly on the portion of its business dedicated to the HomeGoods/HomeSense operating segment, which is involved in the home furnishings industry, in this study. Williams-Sonoma has a market capitalization of $18.43 billion. Three peers (RH, Ethan Allen Designs and HomeGoods) are traditional brick-and-mortar businesses that have expanded their omnichannel networks to include e-commerce, while Wayfair and Beyond are primarily asset-light internet businesses, although Wayfair does have four retail outlet locations. The charts below depict market distributions by capitalization and revenue:

Value evaluation based on CAPE and PE ratios

To assess value propositions in this sector, I compared the Shiller PE or CAPE ratio against the regular price-earnings ratio of the consumer cyclical sector versus those of other sectors. As of April 29, the CAPE ratio of the consumer cyclical sector was 45.30 versus a regular price-earnings ratio of 29.20. Thus, the CAPE ratio exceeds the price-earnings ratio by 43%. In contrast, the basic materials sector's CAPE ratio was 28.60 and its price-earnings ratio was 30.10, reflecting a PE ratio that exceeds the CAPE ratio by 5.11%. A CAPE ratio that exceeds the regular price-earnings ratio suggests the sector may be overvalued, thus basic material companies may be a better option for investors than consumer cyclical companies. However, basic materials are characterized by commodity pricing with little differentiation between competitors, while higher prices for companies in the consumer cyclical sector may be warranted if they have significant moats.

The retail cyclical industry has a median CAPE ratio of 17.135 (based on 560 companies) versus a median price-earnings ratio of 17.95 (based on 752 companies) representing a much narrower margin (4.65%) than that of the consumer cyclical sector. Williams-Somona's CAPE ratio is 33.66 versus a median price-earnings ratio of 19.84, representing an even larger gap (52.32%) between the excessive CAPE ratio and the PE ratio as compared to the sector. Williams-Sonoma is overvalued, as shown in the table below, based on the GF Value of $155.79; however, strong investor sentiment has been based on the company's strong free cash flow and fundamentals.

Williams-Sonoma's competitive advantages with those of its peers

Branding

Williams-Sonoma uses its focused brand strategy as the basis of its business operating segments. The long-running Williams-Sonoma and Pottery Barn brands are easily recognizable, often a trait of brick-and-mortar businesses as compared to asset-light internet companies. However, TJX's HomeGoods brand, originally launched in 1992, is also very well entrenched in the minds of consumers.

Intensive competition has muted these brands somewhat, and a review of other Williams-Sonoma brands compared to its five peers yields no significant difference. Most of these companies organize their brands into collections. Williams-Sonoma launched Pottery Barn Kids in 1999 and Pottery Barn Teen in 2009 to appeal to the market for children, but these efforts were duplicated by RH, which launched a baby and child's line in 2008 and a teen line sometime later. Furthermore, Beyond, whose branding strategy includes acquiring assets of now-defunct companies like Bed, Bath and Beyond and Zulily to beef up recognition is planning to launch its baby, child and teen lines later this year.

Williams-Sonoma has accumulated data from a long history of wedding and baby registries; however, the nature of product offerings with extreme price sensitivity and absence of switching costs has contributed very little advantage from a customer loyalty perspective. The only product offering advantage the company has in this competitive playing field is that its oldest business is focused on cookware and small appliances, which have more resiliency during business cycles than furnishings and other retail goods.

From a branding perspective, Williams-Sonoma's prior advantage has diminished as nimble competitors refine their marketing strategies and algorithms.

Capital allocation and return metrics

Compared to the other five companies in this playing field, Williams-Sonoma has the best returns on assets, invested capital and capital employed. Furthermore, of all six companies, it leads the pack for free cash flow margin. The ability to have good cash flow often excites investors.

In observing Williams-Sonoma's profitability and return metrics versus those of its peers, Wayfair and Beyond have spotty histories of profitability over 10 years, and currently have dreadfully unfavorable return metrics. The other three predominantly brick-and-mortar companies have comparable return metrics that either match or exceed those of Williams-Sonoma. Ethan Allen Designs' gross margin exceeds that of Williams-Sonoma by over 20%. A contributing factor to its high gross margin may be its active pursuit of franchises through its Independent Retailer program. Franchise operations also comprise approximately 21% of Williams-Sonoma's global store fleet. Franchise business models efficiently contribute to growth margins in that franchisers can expand global footprints while outsourcing daily operational costs to franchisees, keeping costs of expansion relatively light.

Williams-Sonoma's operating and net margins also lead the pack, indicating effective deployment of capital. RH's ROE is over 35% higher and TJX's ROE is over 12% higher than that of Williams-Sonoma.

Company | Williams Sonoma | Wayfair | Beyond, Inc. | RH | Ethan Allen Designs | TJX |

Profitability Rank | 9 | 3 | 3 | 8 | 7 | 9 |

Gross Margin % | 42.62 | 30.55 | 20.11 | 45.86 | 61.02 | 30 |

Operating Margin % | 16.05 | -6.12 | -7.57 | 12.09 | 13.01 | 10.69 |

Net Margin % | 12.25 | -6.15 | -19.72 | 4.21 | 10.63 | 8.25 |

FCF Margin % | 19.25 | -0.02 | -4.07 | -2.22 | 10.45 | 8 |

ROE % | 54.4 | NA | -56.28 | 89.98 | 15.13 | 66.72 |

ROA % | 19.9 | -21.7 | -38.64 | 2.75 | 9.58 | 15.32 |

ROIC % | 27.32 | -31.35 | -29.25 | 8.57 | 11.79 | 22.53 |

ROCE % | 40.95 | -51.79 | -44.85 | 10.76 | 16.29 | 32.57 |

Profitability over the Past 10 years | 10 | 1 | 5 | 9 | 10 | 10 |

Supply chain and distribution channels

Williams-Sonoma's long history of operations and data accumulation has also helped the company with advantages over those of its peers concerning supply chains, distribution networks and store fleet productivity. These channels have been honed by its long-running history of former catalog sales that has morphed into an omnichannel distribution network with two-thirds of sales from its e-commerce channel, minimizing expenses and maximizing margins. The company has become more focused on the business-to-business marketplace, further enhancing profit margins over that of its traditional brick-and-mortar business. TJX, which also has well-engrained operating and data accumulation histories, has also honed effective supply chain strategies, in part, due to their focus on apparel. TJX buys apparel from major retailers in the off-season at marked down prices, then turns around and sells it the following season for a profit. As TJX is primarily a discount retailer, it has not developed a business-to-business marketplace channel. Neither has Beyond, which other than its Overstock.com business is primarily in the development stages. But the remaining three competitors have. Ethan Allen Designs has a significant focus on wholesale operations, which is considered one of its two operating segments (the other being retail.) Wholesale operations comprise approximately 41% of sales. The company has a website page that targets interior designers, contractors, office planners and accommodations, a Trade page that offers incentives for professionals who use Ethan Allen products for their designs and an affiliate program. Wayfair and RH have branded channels called Wayfair Professional and RH Trade respectively.

Conclusion

Since I started writing this piece, investor sentiment has cooled somewhat on Williams-Sonoma. Indeed, insider transactions reveal a selling trend. Although the company has had a historically consistent record of generating cash, a review of the CAPE ratio, additional metrics and its differentiation indicate little advantage over peer companies. For those reasons, investors may want to pursue a conservative strategy when addressing this investment.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance