Welltower Inc's Dividend Analysis

Exploring the Sustainability and Performance of Welltower Inc's Dividends

Welltower Inc (NYSE:WELL) recently announced a dividend of $0.61 per share, scheduled for payment on 2024-05-22, with the ex-dividend date set for 2024-05-10. As investors anticipate this upcoming disbursement, it is crucial to delve into the company's history of dividend payments, alongside its yield and growth rates. This analysis, powered by data from GuruFocus, aims to evaluate the sustainability and attractiveness of Welltower Inc's dividends.

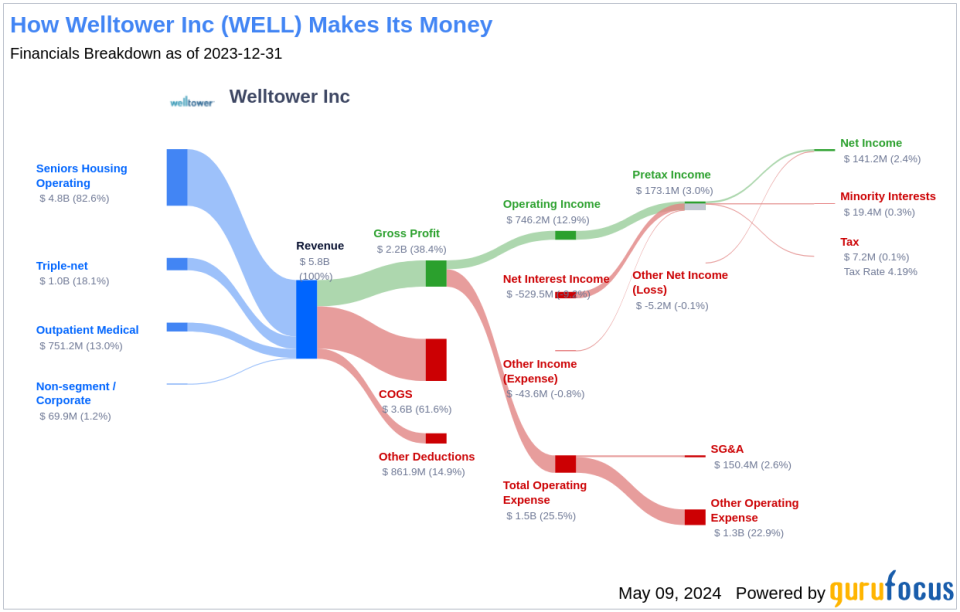

What Does Welltower Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Welltower Inc operates a vast and diversified healthcare portfolio, comprising approximately 2,100 properties. These include senior housing, medical office buildings, and skilled nursing/post-acute care facilities, with significant holdings in both Canada and the United Kingdom. The company continues to seek investment opportunities in nations with mature healthcare systems akin to the United States, indicating a strategic approach to global expansion.

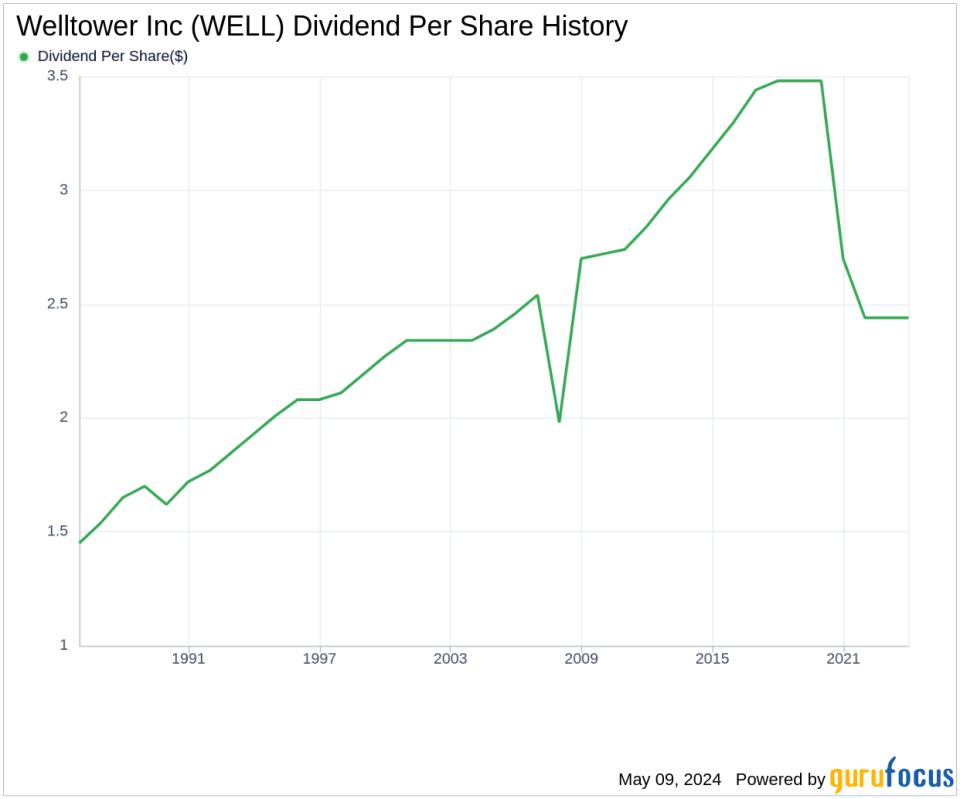

A Glimpse at Welltower Inc's Dividend History

Since 1985, Welltower Inc has upheld a consistent record of dividend payments, distributed quarterly to its shareholders. This long-standing practice underscores the company's commitment to returning value to its investors.

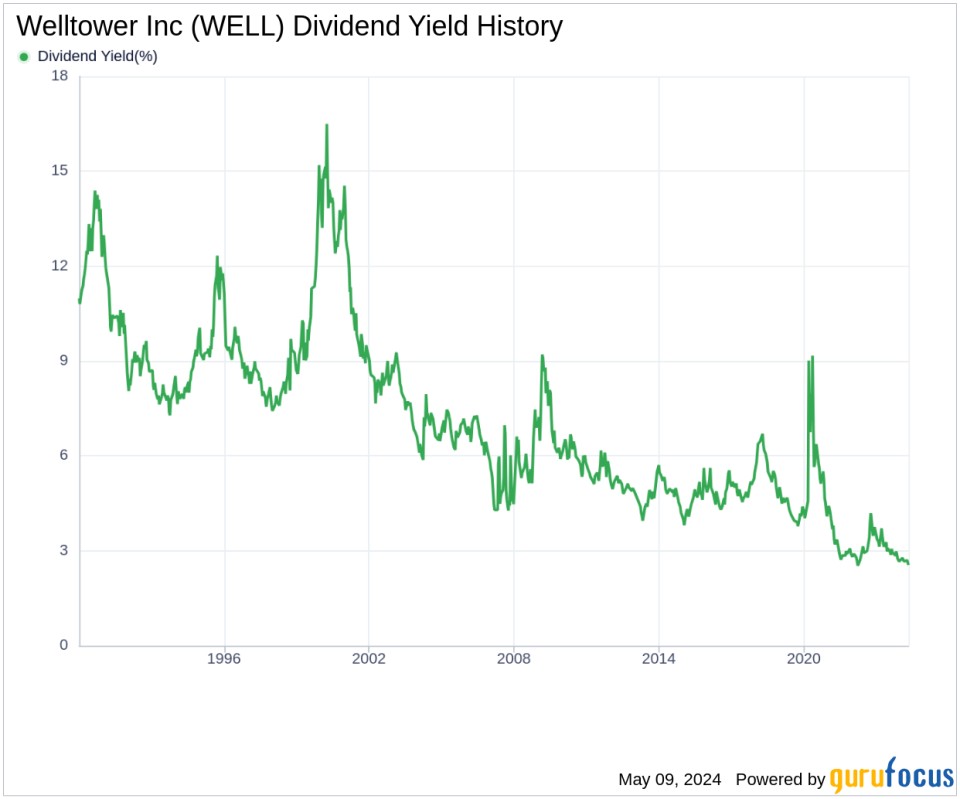

Breaking Down Welltower Inc's Dividend Yield and Growth

Currently, Welltower Inc boasts a trailing twelve-month dividend yield of 2.50% and an equivalent forward dividend yield, suggesting stable dividend payouts in the foreseeable future. However, with a yield near a 10-year low and underperforming 93.41% of global REIT industry peers, the dividend yield might not appear enticing to yield-focused investors.

In terms of growth, Welltower Inc has experienced a 3-year annual dividend growth rate of -3.30%, a 5-year rate of -8.10%, and a decade-long rate of -3.20%. These figures indicate a downward trend in dividend growth, potentially raising concerns about future increases in dividend payments. The 5-year yield on cost for Welltower Inc stock is approximately 1.64%.

The Sustainability Question: Payout Ratio and Profitability

An essential factor in assessing dividend sustainability is the dividend payout ratio, which for Welltower Inc stands at 2.57 as of 2024-03-31. This low ratio suggests that the company retains a substantial portion of its earnings, which could support future growth and buffer against economic downturns. However, the low payout ratio also raises questions about the sustainability of future dividend increases.

Welltower Inc's profitability rank is 7 out of 10, reflecting robust earnings capabilities relative to its peers. The company has consistently reported positive net income over the past decade, reinforcing its strong profitability track record.

Growth Metrics: The Future Outlook

Welltower Inc's growth rank of 7 out of 10 indicates a promising growth trajectory. The company's revenue per share has grown by an average of 4.40% annually, outperforming 51.4% of global competitors. However, its 3-year EPS growth rate and 5-year EBITDA growth rate have declined, suggesting challenges in sustaining earnings and operational profitability in the longer term.

Conclusion: Assessing Welltower Inc's Dividend Viability

While Welltower Inc has demonstrated a commitment to dividends and shown strong profitability, the declining dividend growth rates and challenging earnings metrics suggest potential concerns for future dividend sustainability. Investors should weigh these factors carefully when considering Welltower Inc as a dividend investment. For those looking to explore further, GuruFocus Premium offers tools like the High Dividend Yield Screener to identify high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.