Fresenius Medical Care's (ETR:FME) Upcoming Dividend Will Be Larger Than Last Year's

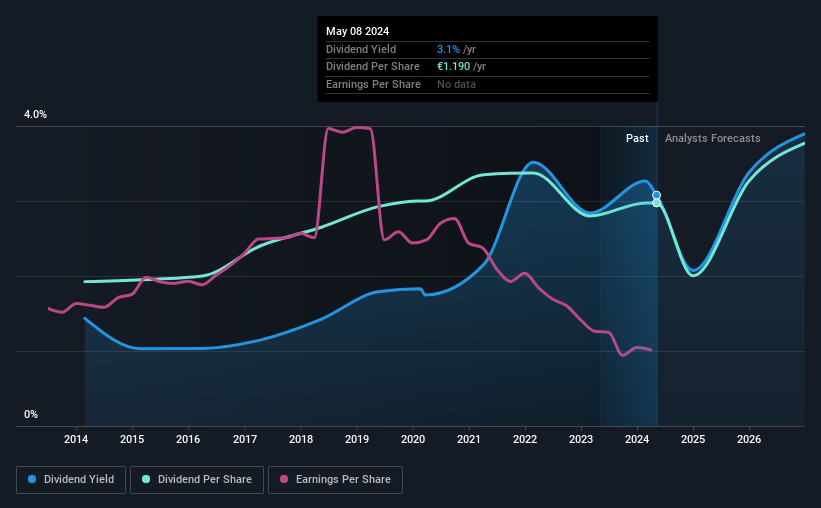

The board of Fresenius Medical Care AG (ETR:FME) has announced that it will be paying its dividend of €1.19 on the 22nd of May, an increased payment from last year's comparable dividend. The payment will take the dividend yield to 3.1%, which is in line with the average for the industry.

Check out our latest analysis for Fresenius Medical Care

Fresenius Medical Care's Earnings Easily Cover The Distributions

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. The last payment made up 72% of earnings, but cash flows were much higher. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 149.2% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 31%, which is in the range that makes us comfortable with the sustainability of the dividend.

Fresenius Medical Care Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was €0.77 in 2014, and the most recent fiscal year payment was €1.19. This implies that the company grew its distributions at a yearly rate of about 4.4% over that duration. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Earnings per share has been sinking by 24% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The earnings coverage is acceptable for now, but with earnings on the decline we would definitely keep an eye on the payout ratio. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Given that earnings are not growing, the dividend does not look nearly so attractive. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 18 analysts we track are forecasting for the future. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.