Jeff Auxier's Firm Dissolves Textainer Group Position, Trims Biogen

Insights into the First Quarter Moves of Auxier Asset Management

Jeff Auxier (Trades, Portfolio), the seasoned investor at the helm of Auxier Asset Management, has recently disclosed his firm's 13F filings for the first quarter of 2024. Known for his meticulous investment strategy, Auxier focuses on acquiring undervalued companies with robust fundamentals and strong competitive advantages. His approach emphasizes low-risk opportunities with the potential for above-average returns, leveraging thorough research to make informed investment decisions.

Summary of New Buys

Jeff Auxier (Trades, Portfolio)'s portfolio saw the addition of three new stocks in this quarter:

JPMorgan Chase & Co (NYSE:JPM) was the most significant new addition with 1,163 shares, representing 0.04% of the portfolio and valued at $232,950 million.

NVIDIA Corp (NASDAQ:NVDA) followed, with 263 shares also making up about 0.04% of the portfolio, totaling $237,640.

Principal Financial Group Inc (NASDAQ:PFG) was added with 2,322 shares, accounting for 0.03% of the portfolio and valued at $200,410.

Key Position Increases

Auxier also increased his stakes in 20 existing holdings:

Keurig Dr Pepper Inc (NASDAQ:KDP) saw a significant increase of 29,650 shares, bringing the total to 76,949 shares. This adjustment represents a 62.69% increase in share count and a 0.14% impact on the current portfolio, valued at $2,360,030.

Philip Morris International Inc (NYSE:PM) was also upped by 9,985 shares, bringing the total to 220,212 shares. This adjustment represents a 4.75% increase in share count, with a total value of $20,175,820.

Summary of Sold Out Positions

During the first quarter of 2024, Jeff Auxier (Trades, Portfolio) exited four positions:

Textainer Group Holdings Ltd (TGH) was completely dissolved, with all 72,338 shares liquidated, resulting in a -0.58% impact on the portfolio.

Value Line Inc (NASDAQ:VALU) saw all 4,239 shares sold, causing a -0.03% impact on the portfolio.

Key Position Reductions

Significant reductions were made in 106 stocks, including:

Biogen Inc (NASDAQ:BIIB) was reduced by 5,053 shares, resulting in a -23.33% decrease in shares and a -0.21% impact on the portfolio. The stock traded at an average price of $234.20 during the quarter and has returned -8.29% over the past three months and -14.83% year-to-date.

Elevance Health Inc (NYSE:ELV) saw a reduction of 2,350 shares, a -5.1% decrease, impacting the portfolio by -0.18%. The stock's average trading price was $497.33 this quarter, with a return of 6.55% over the past three months and 13.47% year-to-date.

Portfolio Overview

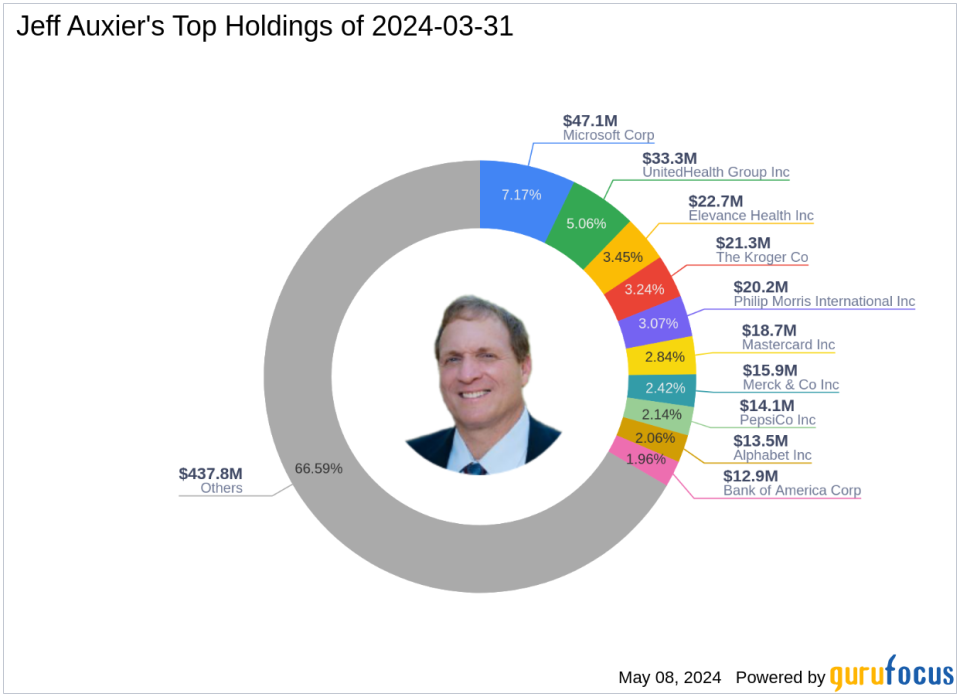

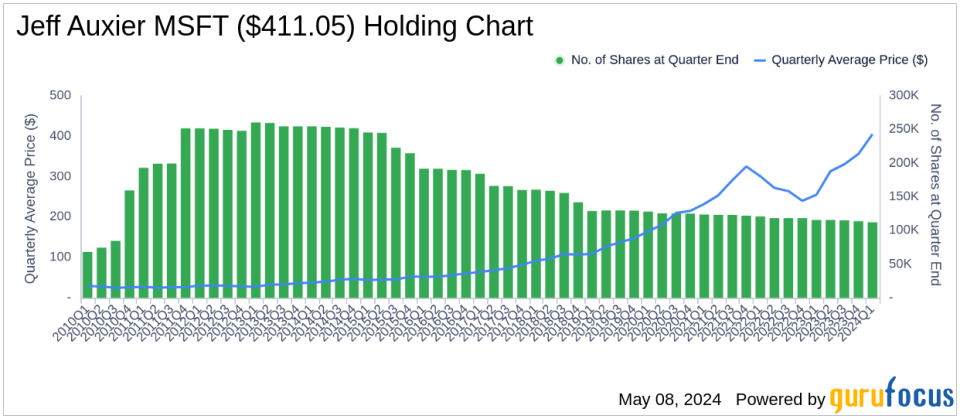

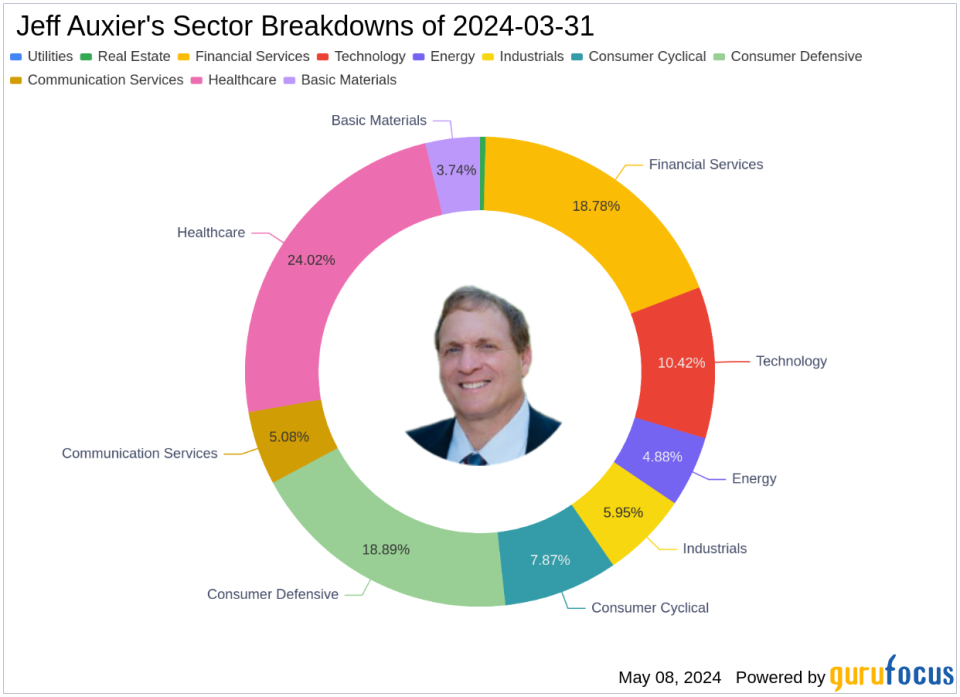

As of the first quarter of 2024, Jeff Auxier (Trades, Portfolio)'s portfolio included 173 stocks. The top holdings were 7.17% in Microsoft Corp (NASDAQ:MSFT), 5.06% in UnitedHealth Group Inc (NYSE:UNH), 3.45% in Elevance Health Inc (NYSE:ELV), 3.24% in The Kroger Co (NYSE:KR), and 3.07% in Philip Morris International Inc (NYSE:PM). The holdings are mainly concentrated across 11 industries, reflecting a diverse investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance