Why Confluent Stock Is Soaring Today

Chalk up another quarterly earnings win for the technology sector. This one comes courtesy of Confluent (NASDAQ: CFLT). The cloud computing and data-optimization outfit handily topped its sales and earnings expectations for fiscal Q1, sending shares up to the tune of 8.8% as Wednesday's closing bell approaches.

Confluent shines in Q1

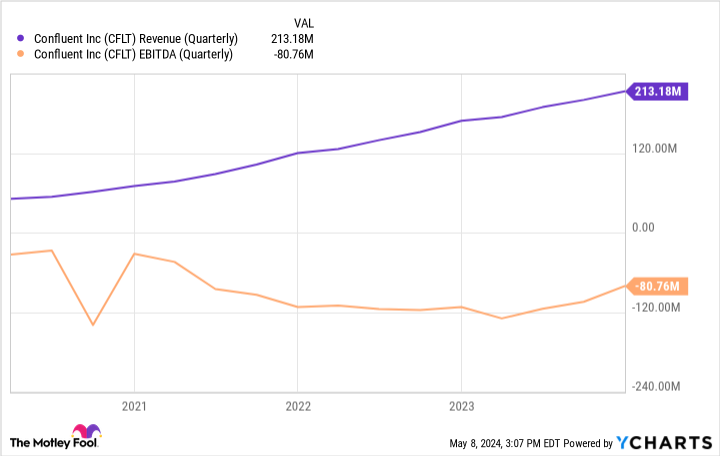

Confluent did $217 million worth of business during the three-month stretch ending in March, up 25% year over year, and beating estimates of $211.7 million. The company also swung from an adjusted per-share loss of $0.09 in the first quarter of last year to a profit of $0.05 per share this time around, topping analysts' consensus forecast of only $0.02. These results extend a lengthening, steady streak of improvement.

Guidance for the quarter now underway as well as for the remainder of the year, however, is just as responsible for the stock's bullish action on Wednesday. Confluent believes its Q2 top line will improve 22% year over year, while 2024's sales are expected to grow 23%. Better still, the company anticipates remaining operationally profitable for the entire year, guiding for a 2024 per-share profit of between $0.19 and $0.20.

Is there room for more?

In most cases a near-9% gain in one day is a tough act to follow, in that it invites profit-taking once the euphoria fades. This may well be what's in the cards for Confluent stock following today's surge, too.

On balance, however, there's apt to be more upside ahead than what's behind it -- and it won't necessarily first require a pullback from Wednesday's rally to realize it.

Although it's a well-followed midcap stock, Confluent hasn't exactly been a star performer of late. Shares soared following their 2021 initial public offering, but haven't budged since peeling back from that 2021 peak in 2022. Even with today's big gain, the stock remains below this past March's high. This leaves room for more immediate upside. In this vein, the current consensus price target of $35.27 is still 16% above the stock's present, post-earnings-surge price.

The underlying opportunity, though, suggests there's even more long-term upside on the table. The amount of digital data being created and consumed by the world will multiply by a factor of 10 between 2020 and 2030, according to UBS, placing an increasing amount of strain on the world's computer and cloud computing networks. Confluent is one of only a handful of companies -- and arguably one of the best -- directly addressing this challenge. It's a solid opportunity for investors who can stomach its likely continued volatility.

Should you invest $1,000 in Confluent right now?

Before you buy stock in Confluent, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Confluent wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Confluent. The Motley Fool has a disclosure policy.

Why Confluent Stock Is Soaring Today was originally published by The Motley Fool