Whales with a lot of money to spend have taken a noticeably bullish stance on Dell Technologies.

Looking at options history for Dell Technologies (NYSE:DELL) we detected 47 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 31% with bearish.

From the overall spotted trades, 16 are puts, for a total amount of $758,867 and 31, calls, for a total amount of $2,027,688.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $90.0 to $160.0 for Dell Technologies during the past quarter.

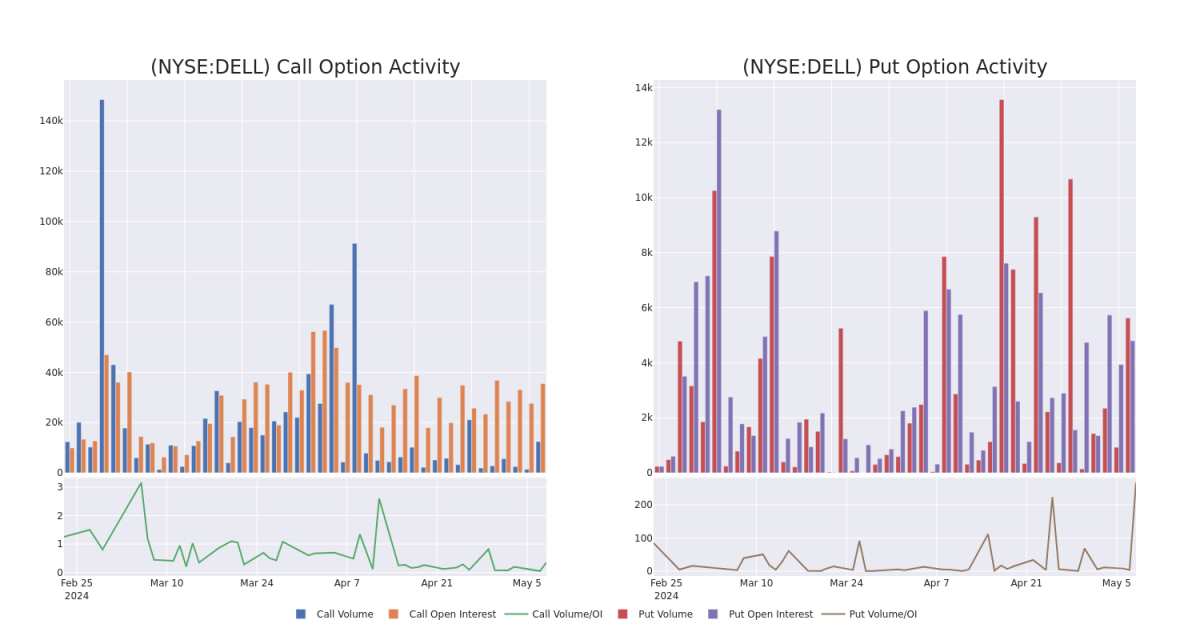

Analyzing Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Dell Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Dell Technologies's significant trades, within a strike price range of $90.0 to $160.0, over the past month.

Dell Technologies Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | SWEEP | BEARISH | 07/19/24 | $17.7 | $17.5 | $17.5 | $120.00 | $241.5K | 1.1K | 31 |

| DELL | CALL | SWEEP | NEUTRAL | 07/19/24 | $34.1 | $33.1 | $33.1 | $100.00 | $231.7K | 932 | 0 |

| DELL | PUT | TRADE | NEUTRAL | 01/16/26 | $12.2 | $11.0 | $11.6 | $100.00 | $174.0K | 191 | 150 |

| DELL | CALL | SWEEP | BULLISH | 05/17/24 | $10.5 | $9.8 | $10.5 | $120.00 | $158.5K | 1.8K | 214 |

| DELL | CALL | SWEEP | BULLISH | 05/17/24 | $7.1 | $6.4 | $7.1 | $125.00 | $142.0K | 2.7K | 459 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium personal computers and enterprise on-premises data center hardware. It holds top-three shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell is vertically integrated but has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

Having examined the options trading patterns of Dell Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Dell Technologies

- With a trading volume of 3,109,125, the price of DELL is up by 1.84%, reaching $129.9.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 22 days from now.

Professional Analyst Ratings for Dell Technologies

1 market experts have recently issued ratings for this stock, with a consensus target price of $141.0.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on Dell Technologies with a target price of $141.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.