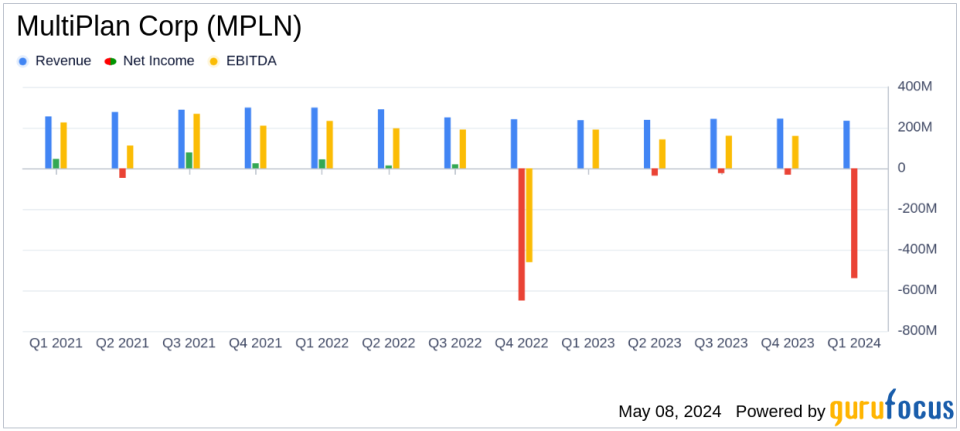

MultiPlan Corp (MPLN) Q1 2024 Earnings: Significant Impairment Charge Leads to Net Loss

Revenue: Reported $234.5 million in Q1 2024, a slight decrease of 0.9% year-over-year, falling short of estimates of $244.12 million.

Net Loss: Recorded a significant net loss of $539.7 million in Q1 2024, primarily due to a $519.1 million impairment charge, sharply above the estimated net loss of $36.71 million.

Earnings Per Share (EPS): Reported EPS of -$0.83, significantly below the estimated EPS of -$0.05.

Adjusted EBITDA: Achieved $146.8 million in Q1 2024, down from $156.3 million in the same quarter the previous year.

Free Cash Flow: Generated $19.2 million in Q1 2024, a decrease from $41.1 million in Q1 2023.

Debt Repayment: Utilized $18.2 million of cash to repurchase or repay $24.4 million face value of debt, including $21.1 million of 6.0% Senior Convertible PIK Notes.

Stock Repurchase: Used $10.4 million of cash to buy back shares of its common stock in the open market.

On May 8, 2024, MultiPlan Corp (NYSE:MPLN), a leader in healthcare cost management solutions, disclosed its financial outcomes for the first quarter ending March 31, 2024, through an 8-K filing. The company reported a significant net loss due to a substantial impairment charge, although it managed to generate solid adjusted EBITDA figures. The details reveal a challenging quarter that nonetheless aligns with the company's strategic adjustments and market expectations.

Company Overview

MultiPlan Corp is at the forefront of the U.S. healthcare industry, offering data analytics and technology-enabled solutions designed to enhance affordability, efficiency, and fairness. The company provides a comprehensive range of services including payment integrity, network-based, and analytics-based solutions, catering to a diverse client base that includes healthcare payors and providers.

Financial Performance Insights

For Q1 2024, MultiPlan reported revenues of $234.5 million, a slight decrease of 0.9% from $236.6 million in Q1 2023. This figure fell short of the estimated revenue of $244.12 million. The net loss for the quarter was substantial, totaling $539.7 million, including a hefty $519.1 million impairment of goodwill and indefinite-lived intangible assets. This is a stark contrast to the net income of $0.2 million reported in the same quarter the previous year. Adjusted EBITDA was $146.8 million, down from $156.3 million in Q1 2023.

The company's balance sheet shows $58.7 million in unrestricted cash and cash equivalents. Despite the financial setbacks, MultiPlan demonstrated prudent financial management by repurchasing or repaying $24.4 million of debt face value, including $21.1 million of 6.0% Senior Convertible PIK Notes.

Operational Highlights and Challenges

CEO Travis Dalton highlighted the impact of a cybersecurity incident at a major medical claims clearinghouse, which disrupted claims flows and slightly affected the company's revenue streams. Despite these challenges, MultiPlan identified approximately $5.7 billion in potential medical cost savings during the quarter, marking a 3% increase from Q1 2023.

"Our first quarter was affected by a cybersecurity incident... Despite this disruption, our first quarter results were just below the low end of our guidance ranges for revenues and Adjusted EBITDA," stated Travis Dalton, CEO of MultiPlan.

Strategic Moves and Forward Guidance

Looking forward, MultiPlan is maintaining its full-year 2024 guidance, projecting revenues between $1,000 million and $1,030 million, and adjusted EBITDA between $630 million and $650 million. These projections reflect the company's confidence in its operational resilience and strategic initiatives aimed at overcoming current challenges and capitalizing on new market opportunities.

Conclusion

While the first quarter of 2024 posed significant financial challenges for MultiPlan, marked by a substantial impairment charge, the company's management is taking strategic steps to stabilize and grow its operations. Investors and stakeholders may find reassurance in the company's steady adjusted EBITDA and proactive measures to manage debt and enhance operational efficiency.

For more detailed information, please refer to the official 8-K filing by MultiPlan Corp.

Explore the complete 8-K earnings release (here) from MultiPlan Corp for further details.

This article first appeared on GuruFocus.