Enovix (NASDAQ:ENVX), a frontrunner in innovative battery technology, is on the verge of bringing a revolutionary battery with state-of-the-art silicon anode-based technology to the market. Since the company disclosed it had secured strategic partnerships with prominent smartphone original equipment manufacturers (OEM), the stock has increased by over 50%, meaning investors interested in emerging technologies may find this stock an intriguing opportunity.

Enovix Readies for Robust Demand

Enovix is a pioneering battery technology company developing and producing high-energy density, silicon-anode lithium-ion batteries. This technology offers substantially improved performance and energy density compared to current options for IoT, computing devices, mobiles, and the auto industry.

Enovix’s technology could potentially increase smartphone battery capacity by 50%, addressing the growing strain on device batteries caused by power-draining AI applications.

The latest news disclosed that Enovix has received specifications from a leading smartphone OEM to manufacture its EX-1M battery cells. The company plans to provide samples to six of the world’s top eight smartphone manufacturers by the second quarter of 2024, representing a market worth around $7 billion.

In anticipation of a growing demand, the company is enhancing its high-volume manufacturing capacity, particularly at its facilities in Malaysia.

Analysis of Recent Financial Results & Outlook

The first quarter of 2024 saw significant top-line growth for the company, reporting revenue of $5.3 million, surpassing forecasts of $3.5-4.5 million, primarily due to higher sales of batteries to IoT customers. This revenue spike made the company’s non-GAAP gross margins turn positive for the first time. However, earnings per share (EPS) of -$0.31 missed expectations of -$0.29.

The company ended the first quarter with $262.4 million in cash, cash equivalents, and short-term investments. The company focuses on identifying more efficiencies while scaling its operations to minimize cash burn and aiming to slash over one-third of its fixed costs, translating to more than $35 million annually. This suggests that the company has sufficient cash to sustain it through the roll-out of its EX-1M battery.

For the second quarter of 2024, management anticipates revenue between $3.0 million and $4.0 million, an adjusted EBITDA loss of -$26 million to -$32 million, and a non-GAAP EPS loss of -$0.22 to -$0.28.

Is ENVX Stock a Buy?

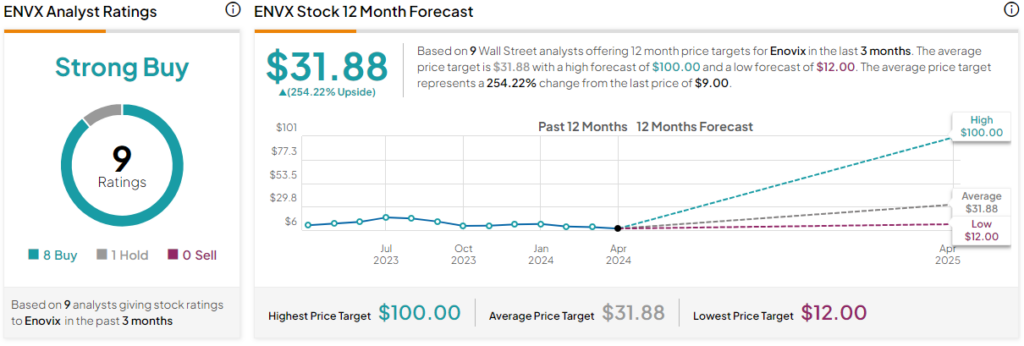

Enovix is rated a Strong Buy based on nine Wall Street analysts’ recommendations and price targets over the past three months. The average price target for ENVX stock is $31.88, though the forecast is taken from a relatively wide range of $12 to $100.00. However, the average price target represents a 254.22% upside from current levels.

The analysts covering the stock are bullish on its prospects. Craig-Hallum analyst Anthony Stoss recently set a price target on Enovix of $15 while keeping a Buy rating on the shares, citing the massive upside potential of the battery technology.

The stock shows positive momentum, trading above the 20-day (6.83) and 50-day (7.98) moving averages. However, it still trades at the low end of its 52-week price range of $5.70-$23.90.

Bottom Line on ENVX

Enovix is riding high on positive events and looking to continue that momentum into a robust product launch. Shares of ENVX have jumped up, though they are still trading well below their previous highs, suggesting a successful launch and strong Q2 results could catalyze the stock to higher levels.