Bruce Berkowitz's Strategic Reduction in The St. Joe Co Holdings

Overview of the Recent Transaction

On May 3, 2024, Fairholme Capital Management, led by Bruce Berkowitz (Trades, Portfolio), executed a significant transaction involving The St. Joe Co (NYSE:JOE), a prominent player in the real estate sector. The firm reduced its holdings by 606,600 shares, which resulted in a 2.67% decrease in its stake, bringing the total shares held to 22,072,548. This move had a notable impact on the portfolio, decreasing its exposure to JOE by 2.29%, with the shares traded at a price of $58.84 each.

Profile of Bruce Berkowitz (Trades, Portfolio)

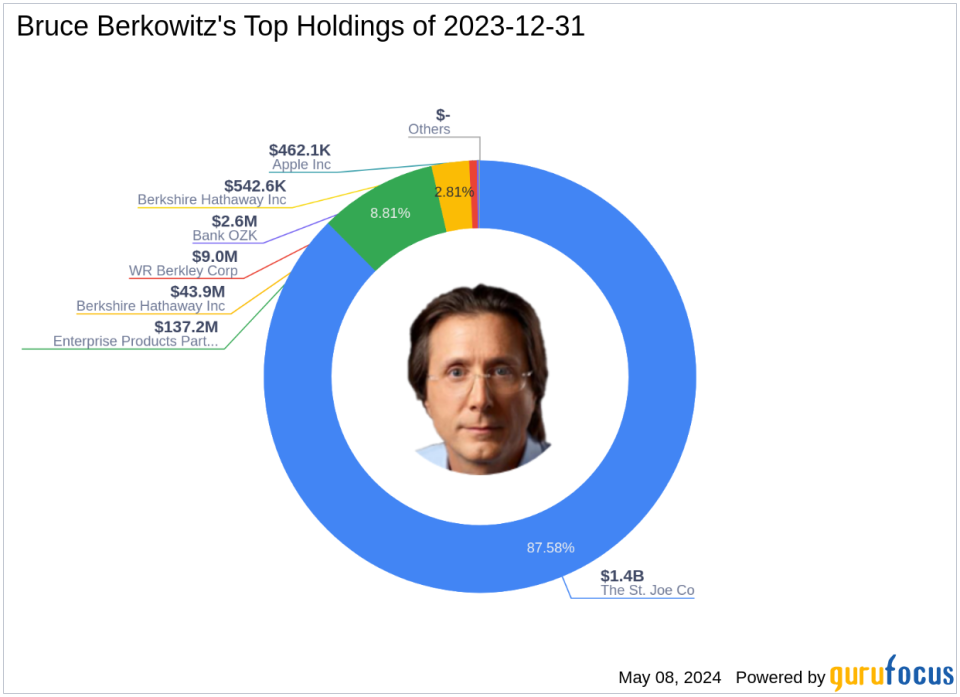

Bruce Berkowitz (Trades, Portfolio), the founder and Managing Member of Fairholme Fund (Trades, Portfolio), is renowned for his focused investment approach, often concentrating on a limited number of undervalued stocks with exceptional management. His investment philosophy is heavily influenced by Benjamin Graham's "The Intelligent Investor," emphasizing investments in companies that are not only managed well but also generate significant free cash flow and are available at a discount to their intrinsic value. Fairholme's top holdings include Bank OZK (NASDAQ:OZK), Berkshire Hathaway Inc (NYSE:BRK.B), and The St. Joe Co (NYSE:JOE), predominantly in the real estate and energy sectors, with an equity portfolio valued at approximately $1.56 billion.

Insight into The St. Joe Co

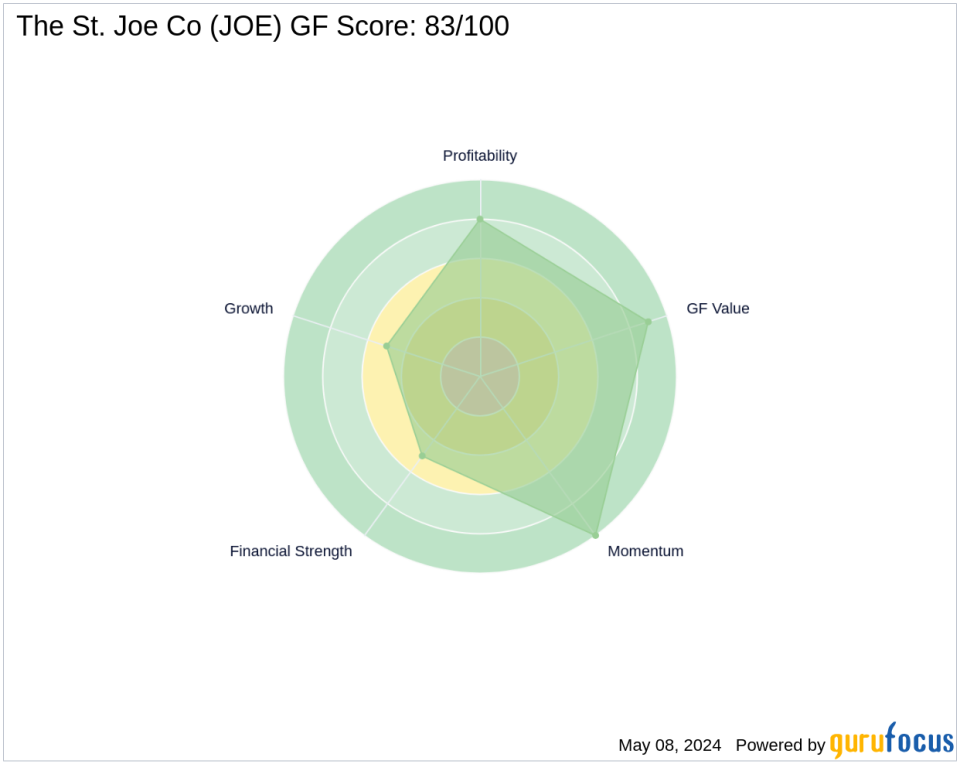

The St. Joe Co, listed under the ticker JOE, operates extensively within the real estate domain, focusing on residential and commercial development, hospitality, and asset management. With a market capitalization of $3.39 billion and a current stock price of $58.09, the company is considered modestly undervalued with a GF Value of $69.93. The stock's price-to-GF Value ratio stands at 0.83, indicating a potential undervaluation. The St. Joe Co has shown a robust long-term performance with a 478.59% increase since its IPO in 1992 and maintains a GF Score of 83/100, suggesting good potential for future performance.

Analysis of the Trade Impact

The recent reduction in JOE shares by Fairholme Capital Management reflects a strategic adjustment in Berkowitz's investment portfolio, which still retains a significant 37.80% stake in the company. This move aligns with Berkowitzs philosophy of investing heavily in companies with strong management and financials, suggesting a recalibration rather than a shift in investment conviction.

Comparative Analysis with Other Gurus

Notably, other esteemed investors like Mario Gabelli (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) also hold positions in The St. Joe Co, although their holdings are not as substantial as those of Fairholme Capital Management. This shared interest by multiple renowned investors underscores the attractiveness of JOE within the investment community.

Sector and Market Context

The real estate sector, where The St. Joe Co operates, is currently experiencing dynamic shifts, influenced by economic factors and market conditions. The companys strategic focus on diverse real estate segments, from residential to hospitality, positions it well to capitalize on these market dynamics.

Conclusion

Bruce Berkowitz (Trades, Portfolio)s recent transaction involving The St. Joe Co reflects a nuanced strategy in managing a high-conviction investment. Despite the reduction, Fairholmes substantial remaining stake in JOE highlights a continued belief in the companys value and management. As the market evolves, this investment may continue to play a pivotal role in Fairholmes portfolio, influenced by its significant market standing and potential for growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.