Stoke Therapeutics Inc (STOK) Reports Q1 2024 Financial Results: A Closer Look at Challenges ...

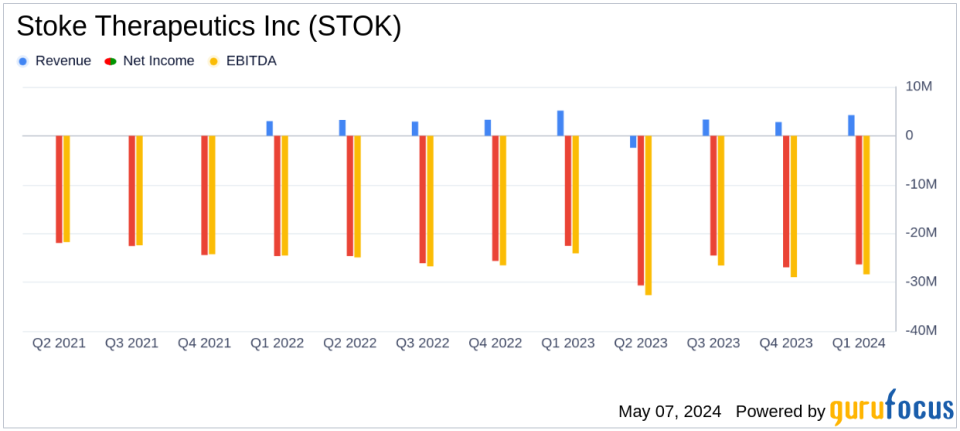

Revenue: Reported $4.2 million for Q1 2024, up from $5.2 million in Q1 2023, exceeding the estimated $3.56 million.

Net Loss: Increased to $26.4 million in Q1 2024 from $22.5 million in Q1 2023, with a per share loss of $0.57, slightly below the estimated loss of $0.55 per share.

Cash Position: Ended the quarter with $178.6 million in cash and cash equivalents, bolstered by $120.3 million in net proceeds from a public offering in April.

Research and Development Expenses: Rose to $22.4 million in Q1 2024 from $19.6 million in the same period last year, reflecting increased investment in clinical programs.

General and Administrative Expenses: Remained steady at $10.2 million compared to Q1 2023, indicating controlled operational spending.

Future Plans: Anticipates updates in H2 2024 following regulatory discussions on STK-001, with ongoing preparations to initiate a Phase 1 study of STK-002 for ADOA within the year.

On May 6, 2024, Stoke Therapeutics Inc (NASDAQ:STOK) released its 8-K filing, disclosing the financial results for the first quarter of 2024, along with significant updates on its clinical progress, particularly concerning its lead candidate, STK-001, for the treatment of Dravet syndrome. The biotechnology firm, headquartered in Bedford, Massachusetts, is focused on upregulating protein expression to tackle severe diseases using its proprietary TANGO technology.

Financial Performance Overview

For the quarter ended March 31, 2024, Stoke Therapeutics reported a net loss of $26.4 million, or $0.57 per share, which slightly missed the analyst estimates of a $0.55 loss per share. This compares to a net loss of $22.5 million, or $0.53 per share, in the same period last year. The company recognized $4.2 million in revenue, primarily from upfront license fees and services provided under a collaboration agreement with Acadia Pharmaceuticals. This revenue figure represents a decrease from the $5.2 million reported in the first quarter of 2023.

Clinical and Operational Highlights

Stoke Therapeutics has made notable advances in its clinical development pipeline. The company shared promising data from ongoing studies of STK-001 in Dravet syndrome, showing significant reductions in seizure frequency and improvements in cognition and behavior. These results reinforce the potential of STK-001 as a disease-modifying therapy. Stoke plans to discuss a registrational study design with regulatory agencies, with updates expected in the latter half of 2024.

Additionally, the company is preparing for the initiation of a Phase 1 study for STK-002, aimed at treating Autosomal Dominant Optic Atrophy (ADOA), within the year. Financially, Stoke strengthened its position through a public offering in April 2024, raising net proceeds of $120.3 million.

Analysis of Financial Health

As of March 31, 2024, Stoke's cash and cash equivalents stood at $178.6 million, bolstered by the recent capital raise. This financial cushion supports the company's ongoing and planned clinical trials. Research and development expenses increased to $22.4 million from $19.6 million in the prior year's quarter, reflecting intensified activities in clinical development and new therapeutic research. General and administrative expenses remained stable at $10.2 million.

Strategic Collaborations and Future Outlook

Stoke's collaboration with Acadia Pharmaceuticals continues to be a pivotal part of its strategy to develop novel RNA-based medicines for severe and rare genetic neurodevelopmental diseases. Looking forward, the company remains focused on advancing its clinical programs and expects to provide further updates on regulatory discussions and study designs in the upcoming months.

Conclusion

While the slight miss on earnings per share might concern some investors, Stoke Therapeutics' robust clinical pipeline and strategic initiatives appear to position the company well for future growth. The ongoing development of STK-001 and the upcoming clinical trials for STK-002 highlight Stoke's commitment to addressing unmet medical needs in severe genetic disorders.

For detailed financial tables and further information, refer to the original 8-K filing linked at the beginning of this article.

Explore the complete 8-K earnings release (here) from Stoke Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance