Agilon Health Inc (AGL) Q1 2024 Earnings: Aligns with EPS Projections Despite Revenue Surge

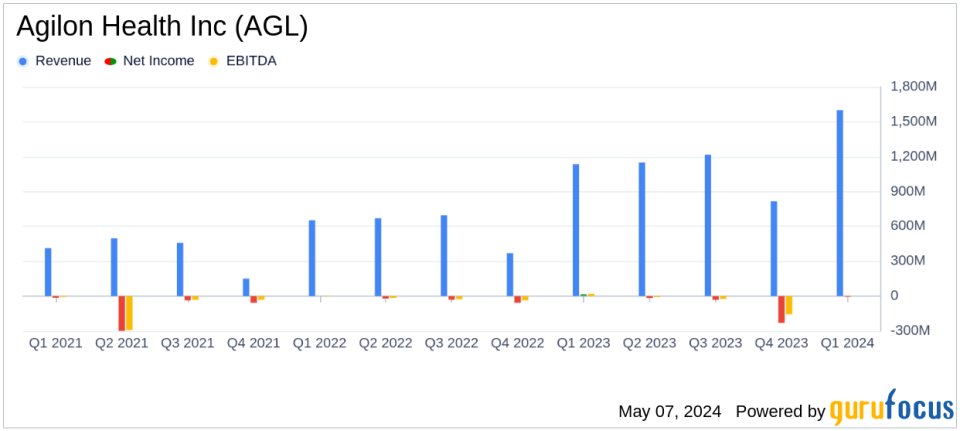

Revenue: Reported at $1.6 billion in Q1 2024, marking a 52% increase year-over-year, falling short of the estimate of $1.603 billion.

Net Loss: Recorded a net loss of $6 million in Q1 2024, compared to a net income of $16 million in Q1 2023, exceeding the estimated net loss of $5.32 million.

Medicare Advantage Membership: Grew by 43% to 523,000 members, demonstrating strong growth in the company's core customer base.

Adjusted EBITDA: Increased by 21% to $29 million in Q1 2024 from $24 million in the previous year, indicating improved operational efficiency.

Medical Margin: Slightly increased to $157 million in Q1 2024 from $156 million in Q1 2023, with a noted impact from prior year claims adjustments.

Membership Growth: Total members on the platform increased to 654,000, up 44% from the previous year, reflecting expansion across both Medicare Advantage and ACO model beneficiaries.

Guidance: Maintained full-year 2024 guidance for Medical Margin and Adjusted EBITDA, signaling confidence in continued financial health and operational strategy.

On May 7, 2024, Agilon Health Inc (NYSE:AGL) released its 8-K filing, announcing the financial results for the first quarter ended March 31, 2024. The company, a pivotal force in transforming healthcare by empowering primary care physicians, reported a significant revenue increase of 52% year-over-year, reaching $1.6 billion. This growth is attributed to a 43% increase in Medicare Advantage membership and a broader expansion to 654,000 total members on the Agilon platform.

Financial Performance Highlights

Despite the impressive revenue growth, Agilon Health reported a net loss of $6 million for the quarter, a stark contrast to the net income of $16 million recorded in the same period last year. This downturn is partly due to a $8.7 million negative impact from prior year claims adjustments. However, the company's adjusted EBITDA saw a 21% increase to $29 million, reflecting continued operational improvements and cost-efficiency measures under its performance action plan.

The company's gross profit marginally increased to $75 million from $73 million year-over-year, while the medical margin remained relatively stable at $157 million, compared to $156 million in the first quarter of 2023. These figures underscore Agilon's ongoing efforts to enhance its operating efficiency and profitability amidst challenging market conditions.

Strategic Developments and Future Outlook

Agilon Health is actively executing a performance action plan aimed at refining payer relationships and enhancing support for its network of primary care physicians. This includes significant investments in data analytics and operational efficiencies. CEO Steve Sell highlighted the importance of these initiatives, stating,

As payors adjust to the current funding environment for Medicare Advantage, we remain well positioned as our value proposition to primary care doctors and payors is increasingly important and well-recognized."

Looking ahead, Agilon Health maintains its full-year 2024 guidance with a projected total revenue between $6,125 million and $6,175 million and an adjusted EBITDA ranging from a loss of $60 million to a loss of $15 million. These projections reflect the company's cautious yet optimistic outlook towards achieving sustainable growth and profitability.

Operational and Market Expansion

Agilon announced new partnerships with five leading physician groups, which is expected to significantly enhance its market presence in Illinois, North Carolina, Kentucky, and Minnesota. These strategic alliances are poised to add over 60,000 Medicare Advantage members to the Agilon platform, reinforcing its expansion strategy and commitment to providing value-based care.

The company's balance sheet remains robust with $426 million in cash, cash equivalents, and marketable securities, alongside a manageable debt level of $37 million. This financial stability supports Agilon's strategic initiatives and its ability to navigate the evolving healthcare landscape effectively.

Conclusion

Agilon Health's first quarter results of 2024 reflect a transformative phase with significant revenue growth and strategic expansions, despite facing challenges such as a net loss due to prior year claims adjustments. With a clear focus on enhancing operational efficiencies and expanding its physician network, Agilon is well-positioned to continue its trajectory towards sustainable growth and improved profitability. Investors and stakeholders may look forward to the company's continued evolution in the rapidly changing healthcare sector.

Explore the complete 8-K earnings release (here) from Agilon Health Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance