Solid Power Inc (SLDP) Q1 2024 Earnings: Revenue Surpasses Estimates Despite Wider Losses

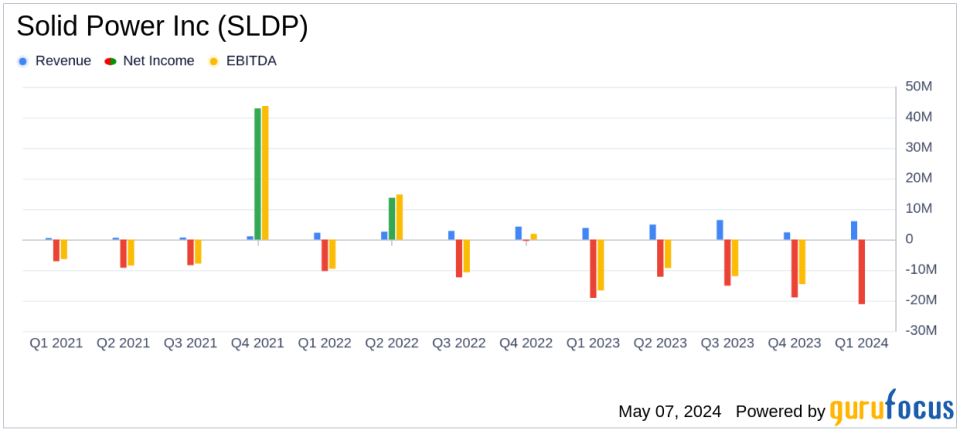

Revenue: Reported $6.0 million for Q1 2024, a significant increase from $3.8 million in Q1 2023, surpassing the estimate of $4.83 million.

Net Loss: Increased to $21.2 million in Q1 2024 from $19.2 million in Q1 2023, exceeding the estimated net loss of $17.17 million.

Earnings Per Share (EPS): Recorded a loss of $0.12 per share, worse than the estimated loss of $0.09 per share.

Operating Expenses: Rose to $31.7 million due to higher labor and materials costs, compared to $25.1 million in the same period last year.

Liquidity: Strong with total liquidity at $378.9 million as of March 31, 2024, though slightly down from $415.6 million at the end of 2023.

Capital Expenditures: Totaled $4.1 million, primarily for enhancing electrolyte production capabilities.

2024 Outlook: Reaffirmed revenue expectations for the year to be in the range of $20 million to $25 million.

Solid Power Inc (NASDAQ:SLDP), a pioneer in solid-state battery technology, disclosed its first-quarter financial results for 2024 on May 7, 2024, through its 8-K filing. The company reported a revenue of $6.0 million, which not only reflects a significant increase from the previous year but also exceeds the analyst's expectation of $4.83 million. However, the net loss widened to $21.2 million, or $0.12 per share, failing to align with the anticipated loss of $17.17 million and earnings per share of -$0.09.

Operational Highlights and Strategic Focus

Under the leadership of President and CEO John Van Scoter, Solid Power continues to make strides in its strategic initiatives. The company has been actively shipping electrolyte samples to new and returning potential customers, indicating robust interest in its products. Furthermore, advancements in cell technology, specifically the transition from A-1 to A-2 cell designs, underscore Solid Power's commitment to overcoming previous challenges and enhancing its product offerings.

Financial Performance and Liquidity

The increase in revenue is attributed to the successful execution of joint development agreements and other collaborative projects. However, the company faced higher operating expenses, primarily due to rising labor and materials costs, which contributed to an operating loss of $25.8 million. Despite these challenges, Solid Power maintains a strong liquidity position with total liquidity standing at $378.9 million as of March 31, 2024.

Balance Sheet and Future Outlook

The balance sheet remains robust with significant holdings in marketable securities and long-term investments. Looking ahead, Solid Power reaffirms its revenue guidance for 2024, projecting figures between $20 million and $25 million. The company also plans substantial investments in operations and capital expenditures, anticipating total cash investments to range from $100 million to $120 million for the year.

Investor and Analyst Perspectives

During the earnings call, executives expressed confidence in meeting the year's objectives, emphasizing the strategic installations and technology transfers with partners like SK On. Analysts might view the increased R&D expenditures as a positive indicator of future competitiveness and market positioning, despite the short-term impact on profitability.

Conclusion

While Solid Power's Q1 earnings showcased a revenue beat, the widened net loss highlights ongoing challenges in scaling operations amidst rising costs. However, the company's robust liquidity and strategic advancements in solid-state battery technology provide a foundation for potential long-term growth and market leadership. Investors and stakeholders will likely watch closely how Solid Power manages its ambitious investment and development plans in the coming quarters.

For detailed insights and further information on Solid Power Inc's financial health and strategic direction, visit our full coverage on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Solid Power Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance