Itau Unibanco (ITUB) Q1 Earnings & Revenues Rise Y/Y, Costs Up

Itau Unibanco Holding S.A. ITUB reported recurring managerial results of R$9.8 billion ($1.98 billion) for first-quarter 2024, up 15.8% year over year.

The results were supported by higher revenues and an increase in managerial financial margin. Rising total deposits and assets reflected a strong balance sheet position. However, an increase in non-interest expenses was an undermining factor.

Revenues & Costs Increase

Operating revenues were R$40.35 billion ($8.15 billion) in the reported quarter, up 7.8% year over year.

The managerial financial margin increased 8.9% year over year to R$26.9 billion ($5.43 billion). Also, commissions and fees rose 4.9% to R$10.9 billion ($2.2 billion).

Non-interest expenses totaled R$14.4 billion ($3.09 billion), up 4.3% year over year.

In the first quarter, the efficiency ratio was 38.3%, down from 39.8% in the year-earlier quarter. A decrease in this ratio indicated increased profitability.

Credit Quality: Mixed Bag

The cost of credit charges declined 3.2% on a year-over-year basis to R$8.8 billion ($1.8 billion).

The non-performing loan ratio (loan transactions overdue more than 90 days) was 2.7% in the first quarter, down from the prior-year quarter’s 2.9%.

Balance Sheet Position Strong

As of Mar 31, 2024, Itau Unibanco’s total assets rose 3.4% to R$2.8 trillion ($558.13 billion) from the last reported quarter. Liabilities, including deposits, debentures, securities, borrowings and on-lending, totaled R$1.37 trillion ($273.1 billion), which increased 1.7% on a sequential basis.

As of Mar 31, 2023, ITUB’s credit portfolio, including corporate securities and financial guarantees provided, increased nearly 1% from the last quarter’s reported figure to R$1.18 trillion ($235.21 billion).

Capital & Profitability Ratios Rise

As of Mar 31, 2024, the Common Equity Tier 1 ratio was 13%, up from 12% as of Mar 31, 2023.

Annualized recurring managerial return on average equity was 21.9% in the first quarter, up from 20.7% reported in the year-earlier quarter.

Our Viewpoint

Itau Unibanco’s first-quarter results were driven by a rise in managerial financial margin. The declining efficiency ratio indicates a rise in profitability, which is a positive factor. Growth in commissions and fees, results from insurance operations and efforts to have a healthy credit portfolio are positives.

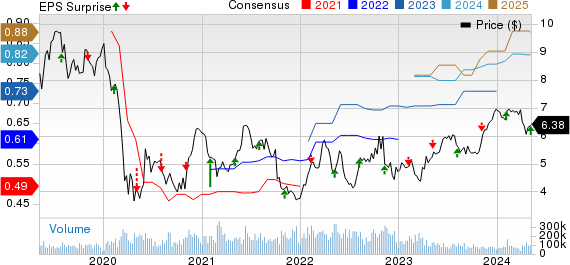

Itau Unibanco Holding S.A. Price, Consensus and EPS Surprise

Itau Unibanco Holding S.A. price-consensus-eps-surprise-chart | Itau Unibanco Holding S.A. Quote

Itau Unibanco currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

Deutsche Bank DB reported first-quarter 2024 profit attributable to its shareholders of €1.3 billion ($1.41 billion), up 10.1% year over year. The Germany-based lender reported a profit before tax of €2 billion ($2.17 billion), up 10% year over year.

DB’s results were positively impacted by higher net revenues and lower expenses. This led investors to turn bullish on the stock, resulting in a gain of 8.7%. However, higher provision for credit losses was an offsetting factor.

Barclays BCS reported first-quarter 2024 net income attributable to ordinary equity holders of £1.55 billion ($1.97 billion), down 13% year over year.

BCS recorded lower revenues in the quarter, which was a negative. However, a decline in operating expenses, along with lower credit impairment charges, aided the results to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance