TransDigm (TDG) Beats on Q2 Earnings, Ups '24 Sales View

TransDigm Group Incorporated TDG reported second-quarter fiscal 2024 adjusted earnings of $7.99 per share, which beat the Zacks Consensus Estimate of $7.37 by 8.4%. The bottom line also improved 33.6% from the prior-year quarter’s reported figure of $5.98.

Barring one-time items, the company recorded GAAP earnings of $6.97 per share compared with $5.32 in the year-ago quarter.

Sales

Net sales amounted to $1.92 billion, up 20.5% from $1.59 billion registered in the prior-year period. The reported figure also beat the Zacks Consensus Estimate of $1.89 billion by 1.8%.

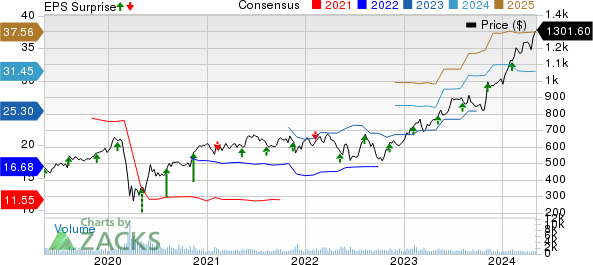

Transdigm Group Incorporated Price, Consensus and EPS Surprise

Transdigm Group Incorporated price-consensus-eps-surprise-chart | Transdigm Group Incorporated Quote

Operating Results

The gross profit for the quarter came in at $1.15 billion, up 24% from the year-ago quarter’s level of $929 million.

Net income increased 32.9% year over year to $404 million. The growth was primarily driven by an increase in net sales and the application of the company’s value-driven operating strategy.

Financial Position

Cash and cash equivalents as of Mar 30, 2024, amounted to $4.29 billion, up from $3.47 billion as of Sep 30, 2023.

Long-term debt totaled $21.33 billion compared with $19.33 billion as of Sep 30, 2023.

Cash from operating activities amounted to $865 million compared with $507 million at the end of the second quarter of fiscal 2023.

Guidance

TransDigm raised its guidance for fiscal 2024. The company now expects sales in the range of $7.68-$7.80 billion, up from the earlier guidance of $7.48-$7.68 billion. The Zacks Consensus Estimate for the same is pegged at $7.70 billion, lower than the midpoint of the company’s guided range.

TDG currently expects fiscal 2024 adjusted earnings in the band of $31.75-$33.09 per share, up from the prior guidance of $31.00-$32.94. The Zacks Consensus Estimate for earnings is pegged at $31.45 per share, lower than the company’s guided range.

Zacks Rank

TransDigm currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

General Dynamics Corporation GD reported first-quarter 2024 earnings per share (EPS) of $2.88, which missed the Zacks Consensus Estimate of $2.89 by 0.4%. However, the figure increased 9.1% from $2.64 per share recorded in the year-ago quarter.

GD’s revenues of $10,731 million beat the Zacks Consensus Estimate of $10,201 million by 5.2%. The top line also improved 8.6% from the prior-year reported figure.

RTX Corporation’s RTX first-quarter 2024 adjusted EPS of $1.34 beat the Zacks Consensus Estimate of $1.23 by 8.9%. The bottom line also improved 9.8% from the year-ago quarter’s level of $1.22.

RTX’s net sales were $19,305 million, which surpassed the Zacks Consensus Estimate of $18,412.6 million by 4.8%. The top line also improved 12% from $17,214 million recorded in the first quarter of 2023.

Lockheed Martin Corporation LMT reported first-quarter 2024 adjusted earnings of $6.33 per share, which beat the Zacks Consensus Estimate of $5.80 by 9.1%. The bottom line, however, declined 1.6% from the year-ago quarter's recorded figure of $6.43.

LMT’s net sales were $17.20 billion, which beat the Zacks Consensus Estimate of $16.19 billion by 6.2%. The top line also increased 13.7% from $15.13 billion reported a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

RTX Corporation (RTX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance