NAPCO Security Technologies Inc (NSSC) Reports Record-Breaking Q3 Earnings, Surpassing Analyst ...

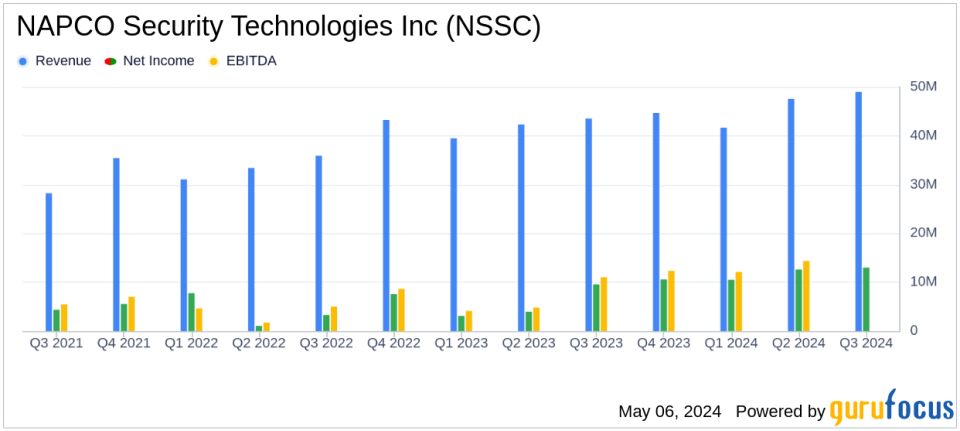

Revenue: $49.3 million, up 13% year-over-year, surpassing estimates of $48.44 million.

Net Income: $13.2 million, an increase of 38% from the same quarter last year, exceeding estimates of $12.12 million.

Earnings Per Share (EPS): Reported at $0.36, exceeding the estimated $0.33.

Adjusted EBITDA: Reached $15.6 million, marking a 37% increase from the previous year, with an Adjusted EBITDA margin of 32%.

Recurring Service Revenues: Grew by 29% to $19.5 million, contributing significantly to the revenue mix with a gross margin of 92%.

Gross Margin: Improved to 54% for the quarter, up from 49% in the same quarter last year, driven by high-margin recurring service revenues.

Dividend: Quarterly dividend declared at $0.10 per share, reflecting continued financial strength and shareholder value focus.

NAPCO Security Technologies Inc (NASDAQ:NSSC), a prominent manufacturer of high-tech electronic security devices, announced a stellar performance in its third fiscal quarter of 2024, achieving record revenues, net income, and Adjusted EBITDA. According to the 8-K filing released on May 6, 2024, the company reported a significant increase in net sales, which rose 13% to $49.3 million, surpassing the estimated $48.44 million. Net income for the quarter also exceeded expectations, reaching $13.2 million against an estimated $12.12 million.

NAPCO Security Technologies specializes in a range of security products, including access control systems, door-locking products, intrusion and fire alarm systems, and video surveillance products. These are widely used across commercial, residential, institutional, industrial, and governmental sectors.

Financial and Operational Highlights

The company's financial strength was particularly evident in its recurring service revenues, which saw a remarkable increase of 29% to $19.5 million, contributing significantly to the total revenue. The gross margin on these services reached a historic high of 92%, underscoring their profitability. Additionally, the hardware segment, consisting of Alarm Lock and Marks locking product lines, also reported robust growth. This segment grew approximately 16% compared to the previous year, with hardware sales making up 66% of the total hardware revenue.

R&D expenses rose to $2.8 million, reflecting a 19% increase as NAPCO continues to invest in innovation, particularly in its new Prima All-in-One Panel, which targets a significant segment of the security market. The balance sheet further strengthened with cash and cash equivalents, other investments, and marketable securities growing by 31% to $87.5 million, showcasing the company's solid financial position.

Strategic Developments and Future Outlook

Richard Soloway, Chairman and CEO of NAPCO, highlighted the strategic initiatives contributing to the quarter's success. The introduction of the Prima by NAPCO, an all-in-one panel designed for security, fire, video, and connected home applications, is expected to address significant market needs and add more recurring-revenue generating accounts. The company's focus on expanding its presence in school and classroom security, healthcare, and retail loss-prevention sectors is also expected to drive future growth.

Looking ahead, NAPCO is optimistic about sustaining its growth trajectory, supported by strong recurring revenues and innovative product offerings. The company's commitment to maintaining high profitability and financial strength was further evidenced by the declaration of a quarterly dividend of $0.10 per share, payable on June 24, 2024.

Investor and Market Implications

The impressive financial results and strategic expansions underline NAPCO's robust position in the security technology market. Investors and market watchers will likely view the consistent performance and promising outlook as positive indicators of the company's future prospects. NAPCO's ability to exceed analyst expectations and its strategic focus on high-margin recurring revenues and market expansion are pivotal in driving long-term shareholder value.

For detailed financial figures and further information, investors are encouraged to refer to the full earnings report and the upcoming conference call, details of which can be found on the company's Investor Relations website.

Explore the complete 8-K earnings release (here) from NAPCO Security Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance