S&P 500 didn‘t look back following the underwhelming NFPs and the stark tech leadership coupled with meaningful enough retreat in yields provide for an inflection point in equities. Not that yields would have topped, but running with Powell‘s not hawkish message easing Treasuries financing and ushering more of yen appreciation as well, is changing the game, and answering the dip vs. deeper downleg question for the week ahead.

Junk corporate bonds and Treasuries support more gains ahead as the QT taper means less pressure when financing budget deficits, hence less competition for stocks from bonds. It‘s a subtle change that has to play out still more – so ingrained has the belief in dovish Fed become that the market is once again ready to salivate for rate cuts (for now Sep only, but we are to see some more rise in the underdog Jun cut bets) even if all that‘s responsible for such a stark shift, is the absence of government hiring that did not bring NFPs in line with expectations as a result, just as per my tweet linked to above.

This also allows for more risk taking as yields become less attractive. Look though at 2y Treasury and compare its daily candle to the 10y year – the more sensitive 2y yield failed to keep all the daily decline made, meaning that it‘s less convinced about easy Fed from here on. This is semantics for very short-term traders that are likely to get a little retracement of sharp equities gains before Monday‘s US open – but bigger picture, the boot on equities‘ neck courtesy by bonds, is being lifted for as long as sensitivity to poor incoming data is on par with Friday - in other words, for as long as Powell is taken as dovish when all he is doing via the QT taper, is helping to keep a lid on rates.

This is still the most important chart, indicating some relief from risk-off environment, is at hand, and may even send gold with silver a bit up following the disappointing sell into Friday‘s turn.

Source: stockcharts.com

Just as the dollar struggled at my 106.50, so the 10y correspondingly won‘t make it this fast above 4.90% - and that‘s a generally risk-on development that makes a break below pre-FOMC S&P 500 lows unlikely. At least till the week of May 13 when new inflation data come out.

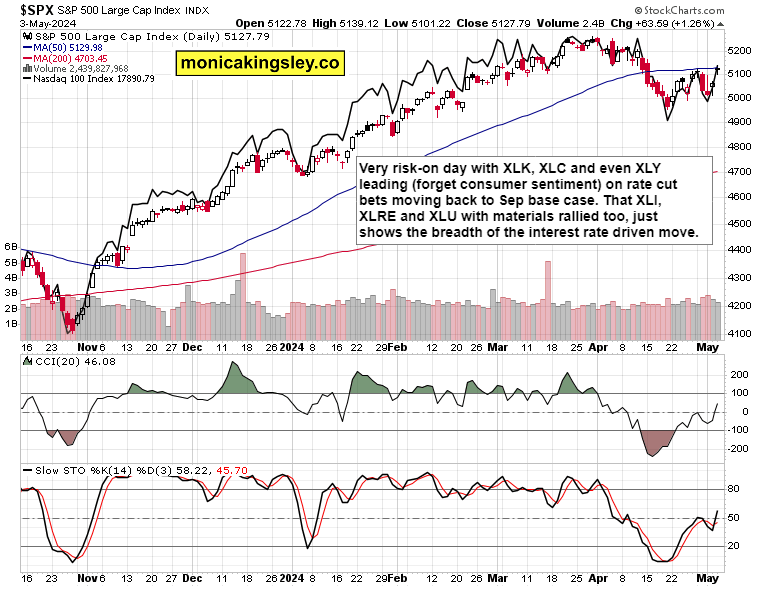

S&P 500 and Nasdaq

Source: stockcharts.com

S&P 500 even moved up 1 min before NFPs announcement, and looked back just once, typically midsession and after hot ISM services prices. Russell 2000 is a bit mirroring the 2y Treasury‘s relative caution – but the market breadth is good, and strong Nasdaq showing shaking off META, NFLX, SMCI and TSM earnings impact via AAPL follow through, bodes well for higher stock prices in the days ahead.

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0850 after US inflation data

EUR/USD trades in positive territory above 1.0850 in the American session on Friday. The US Dollar struggles to preserve its strength following the April PCE inflation data and helps the pair hold its ground heading into the weekend.

GBP/USD retreats from 1.2765, holds on to modest gains

GBP/USD posted a two-day high peat at 1.2765 in the American session, as US data showed that the core PCE inflation held steady at 2.8% on a yearly basis in April. The pair retreated afterwards as risk aversion triggered US Dollar demand.

Gold falls towards $2,330 as the mood sours

US inflation-related data took its toll on financial markets. Wall Street turned south after the opening and without signs of easing price pressures in the world’s largest economy. The US Dollar takes the lead in a risk-averse environment.

Here’s why Chainlink price could crash 15% despite spike in social volume Premium

Chainlink price has flashed multiple sell signals after its recent climb, hinting at a short-term correction. This signal comes despite a double-digit growth in its social volume. LINK bulls need to exercise caution as this forecast is backed by on-chain metrics.

Week ahead – ECB rate cut might get eclipsed by BoC surprise and NFP report

ECB set to slash rates on Thursday, focus on forward guidance. But will the BoC take the lead when it meets on Wednesday? US jobs report eyed on Friday as Fed unyielding on cuts. OPEC+ might extend some output reductions into 2025.