Time to Buy Amazon (AMZN) Stock After AWS Fuels Strong Q1 Results

Amazon AMZN was the latest tech giant to impressively top Q1 expectations reporting after market hours on Tuesday and seeing its stock spike +2% in today’s trading session.

As part of the “Magnificent Seven”, Amazon has continued to lift the market’s performance in recent years with AMZN now up +18% year to date. That said, let’s review Amazon’s Q1 results and see why now may still be a good time to buy stock in the e-commerce behemoth.

Image Source: Zacks Investment Research

Q1 Review & Cloud Growth

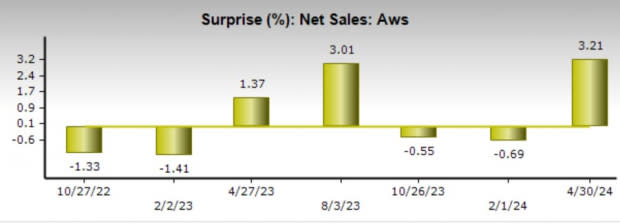

Amazon’s AWS cloud computing segment fueled its strong Q1 results driven by growth in generative AI and non-generative AI workloads across various industries. First quarter sales increased 12% to $143.3 billion and came in slightly above estimates of $142.52 billion. AWS contributed $25 billion to the top line, beating estimates by 3% and increasing 17% year over year as Amazon remains the domestic cloud leader ahead of Microsoft’s (MSFT) Azure and Alphabet’s (GOOGL) Google Cloud.

Image Source: Zacks Investment Research

More importantly, Amazon’s operating income skyrocketed 221% to 15.3 billion. This led to earnings of $1.13 per share which beat the Zacks Consensus of $0.83 a share by 36% and climbed from $0.31 a share in the comparative quarter. Notably, Amazon has now exceeded earnings expectations for six consecutive quarters and has posted an average earnings surprise of 48.17% in its last four quarterly reports.

Image Source: Zacks Investment Research

Q2 Revenue Guidance

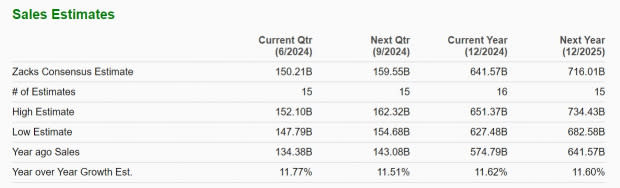

For the second quarter, Amazon expects net sales to be between $144-$149 billion or 7%-11% growth which falls slightly below the current Zacks Consensus of $150.21 billion or roughly 12% growth (Current Qtr below). According to Zacks estimates, Amazon’s total sales are projected to expand 11% this year and jump another 11% in fiscal 2025 to $716.01 billion.

Image Source: Zacks Investment Research

Average Zacks Price Target

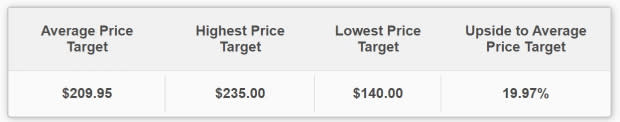

With many analysts raising their price targets for Amazon’s stock this morning including those of UBS and Oppenheimer, it's noteworthy that the Average Zacks Price Target of $209.95 suggests 20% upside from current levels.

Image Source: Zacks Investment Research

Bottom Line

At the moment, Amazon's stock sports a Zacks Rank #2 (Buy). Although Amazon’s revenue guidance fell slightly below the Zacks Consensus, earnings estimate revisions could go up after the company comfortably exceeded Q1 EPS estimates and posted strong growth outside of its e-commerce buisness.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance