Avis Budget Group Inc (CAR) Reports Q1 2024 Earnings: Misses Analyst Revenue and Earnings Estimates

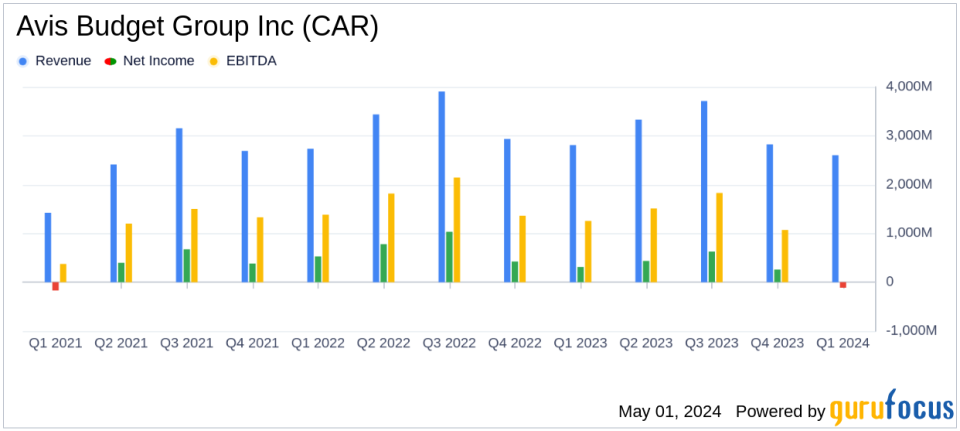

Revenue: Reported at $2.6 billion, surpassing the estimated $2.412 billion.

Net Loss: Recorded at $113 million, significantly above the estimated net loss of $75.53 million.

Earnings Per Share (EPS): Reported a loss of $3.21 per share, falling short of the estimated loss of $2.40 per share.

Liquidity: Ended the quarter with approximately $0.7 billion in liquidity and an additional $3.8 billion of fleet funding capacity.

Adjusted EBITDA: Achieved $12 million, indicating resilience despite a challenging quarter.

Fleet Management: Disposed of a record number of vehicles to align fleet size with demand, maintaining utilization in line with the previous year.

Debt Management: Well-laddered corporate debt with no significant maturities until 2027 following the repayment of euro notes in April 2024.

Avis Budget Group Inc (NASDAQ:CAR) disclosed its first quarter financial results for 2024 on May 1, revealing a challenging quarter despite robust travel demand. The company reported revenues of $2.6 billion and a net loss of $113 million, underperforming against analyst expectations of a net loss of $75.53 million and estimated revenues of $2412.88 million. The detailed financial outcomes can be viewed in their 8-K filing.

About Avis Budget Group Inc

Avis Budget Group Inc is a leading global provider of mobility solutions, operating under well-known brands such as Avis, Budget, and Zipcar. The company primarily serves North America, Europe, and Australasia directly, while operating through licensees in other parts of the world. Avis targets premium commercial and leisure travel segments, Budget focuses on value-conscious customers, and Zipcar offers car-sharing services.

Quarterly Performance Insights

The first quarter saw Avis continuing to benefit from strong travel demand, particularly in the Americas, where rental days increased by 5% compared to the first quarter of 2023. Despite this, the company faced a significant net loss, which CEO Joe Ferraro attributed to strategic fleet adjustments and vehicle disposals aimed at aligning fleet size with market demand. These steps, according to Ferraro, are foundational for capitalizing on the upcoming peak travel seasons.

Financial Challenges and Strategic Adjustments

While Avis experienced a lift in travel demand, the financial results tell a story of significant challenges. The Adjusted EBITDA for the Americas stood at $44 million, a stark contrast to the previous year's $516 million, illustrating the financial pressures despite top-line growth. Internationally, the company reported an Adjusted EBITDA loss of $15 million, further highlighting the global challenges faced.

Analysis of Financial Statements

The income statement reflects a stark downturn, with a net loss of $113 million compared to a net income of $312 million in the same quarter last year, a decline of 136%. This was accompanied by a diluted loss per share of $3.21. The balance sheet shows a slight decrease in cash and cash equivalents from $555 million at the end of December 2023 to $522 million as of March 31, 2024. Total corporate debt increased, indicating higher leverage, which could concern investors about the company's financial health amidst uncertain economic conditions.

Investor and Market Implications

The first quarter results of Avis Budget Group Inc reflect a complex scenario where increased travel demand does not directly translate into financial success. The company's strategic decisions in fleet management and cost adjustments are critical in navigating through the financial turbulence. Investors might remain cautious, watching closely how Avis leverages its operational strategies against ongoing economic pressures and competition within the mobility industry.

Conclusion

As Avis Budget Group Inc navigates through these challenging times, the focus remains on strategic adjustments and operational efficiency. The company's ability to adapt to market demands while managing financial health will be crucial for future stability and growth. Stakeholders and potential investors are advised to keep a close watch on the company's forthcoming quarterly performances and strategic initiatives.

Explore the complete 8-K earnings release (here) from Avis Budget Group Inc for further details.

This article first appeared on GuruFocus.