Evertec Inc (EVTC) Q1 2024 Earnings: Mixed Results Amidst Expansion and Acquisition Costs

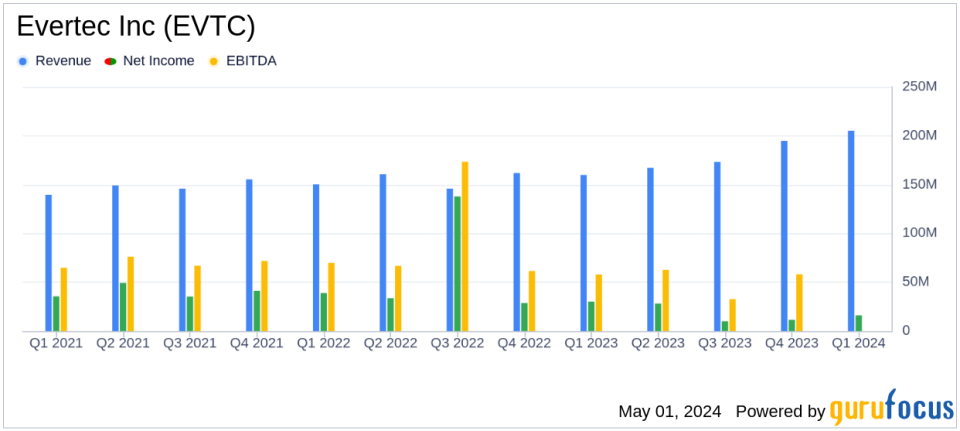

Revenue: Reached $205.3 million, a 28% increase year-over-year, surpassing the estimated $202.24 million.

Net Income: GAAP Net Income attributable to common shareholders was $16.0 million, significantly below the estimated $45.59 million.

Earnings Per Share (EPS): Reported at $0.24 per diluted share, falling short of the estimated $0.68.

Adjusted EBITDA: Grew by 16% to $78.2 million, despite a decrease in Adjusted EBITDA margin to 38.1%.

Adjusted Earnings Per Share: Increased to $0.72, up from $0.69 year-over-year, exceeding the estimated $0.68.

Share Repurchase: Implemented an accelerated share repurchase agreement for $70 million, with completion expected by Q3 2024.

2024 Financial Outlook: Projects total consolidated revenue between $846 million and $854 million and adjusted earnings per share between $2.85 to $2.94.

On May 1, 2024, Evertec Inc (NYSE:EVTC), a prominent transaction processing company in Latin America and the Caribbean, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The report presents a complex financial landscape marked by significant revenue growth juxtaposed with a notable decline in GAAP net income attributable to common shareholders.

Financial Highlights and Performance Analysis

Evertec's revenue for the quarter soared by 28% year-over-year to $205.3 million, surpassing the analyst's expectation of $202.24 million. This increase primarily reflects the contributions from the Sinqia acquisition and organic growth across all business segments. However, GAAP net income saw a sharp decline of 47%, totaling $16.0 million, or $0.24 per diluted share, falling short of the estimated $0.68 per share. This decrease was largely due to increased costs associated with the acquisition, including higher interest expenses and operational costs.

Despite the lower GAAP earnings, Evertec reported a 4% increase in adjusted earnings per share to $0.72, which is above the analyst's estimate of $0.68. Adjusted EBITDA also rose by 16% to $78.2 million, although the adjusted EBITDA margin contracted by approximately 390 basis points to 38.1%, reflecting lower margin contributions from the newly acquired Sinqia.

Strategic Moves and Market Expansion

President and CEO Mac Schuessler commented on the quarter's performance, highlighting the strategic expansion in Latin America and the integration of Sinqia. Schuessler noted, "We are pleased with our first quarter results that reflect the strength of our business in Puerto Rico while we continue to successfully expand in Latin America." The acquisition of Sinqia is a pivotal part of Evertecs strategy to enhance its service offerings and geographic footprint.

Additionally, the company has actively returned value to shareholders through an accelerated share repurchase agreement totaling $70 million, expected to conclude in Q3 2024. During the quarter, Evertec repurchased 1.5 million shares at an average price of $37.92.

Financial Position and Outlook

Evertec's balance sheet remains robust with $293.7 million in cash and cash equivalents. The company forecasts total consolidated revenue for 2024 to be between $846 million and $854 million, indicating a growth rate of approximately 22% to 23%. Adjusted earnings per share are projected to range from $2.85 to $2.94, representing a growth of 1% to 4% compared to 2023.

The company's capital expenditures for 2024 are anticipated to be around $80 million, including expenditures related to the integration of Sinqia. The effective tax rate is expected to be between 6% and 7%.

Conclusion

Evertec's first quarter of 2024 paints a picture of a company in transition, balancing the costs of aggressive expansion and acquisition against robust revenue growth and strategic positioning in key markets. While the dip in GAAP net income highlights the financial burdens of such strategies, the growth in adjusted earnings per share and revenue suggests a potentially strong underlying business performance poised for future growth.

Investors and stakeholders will likely watch closely how Evertec manages its integration and expansion strategies moving forward, particularly in terms of profitability and margin performance.

Explore the complete 8-K earnings release (here) from Evertec Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance