Articore Group (ASX:ATG) shareholders have endured a 89% loss from investing in the stock three years ago

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Articore Group Limited (ASX:ATG), who have seen the share price tank a massive 89% over a three year period. That'd be enough to cause even the strongest minds some disquiet. Unfortunately the share price momentum is still quite negative, with prices down 20% in thirty days. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Articore Group

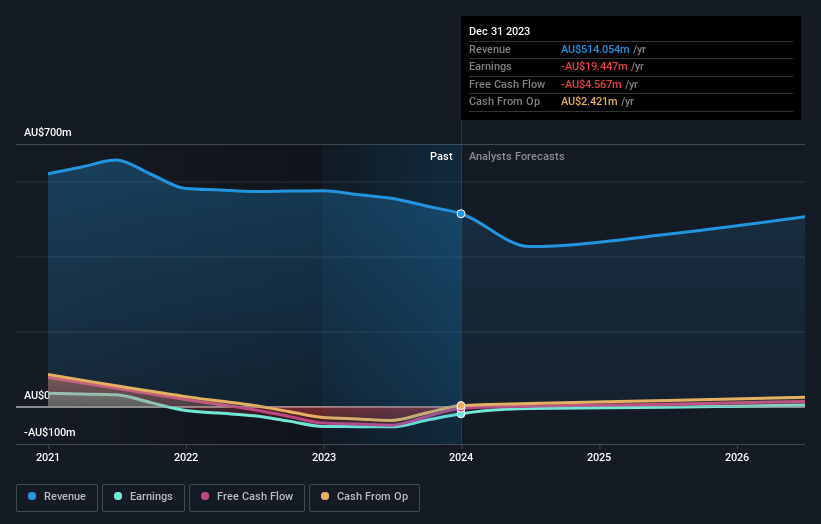

Given that Articore Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Articore Group saw its revenue shrink by 6.6% per year. That is not a good result. The share price fall of 24% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Articore Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Articore Group shareholders have received a total shareholder return of 14% over the last year. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Articore Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Articore Group .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance