Ryerson Holding Corp (RYI) Q1 2024 Earnings: Misses EPS Estimates Amidst Strategic Investments ...

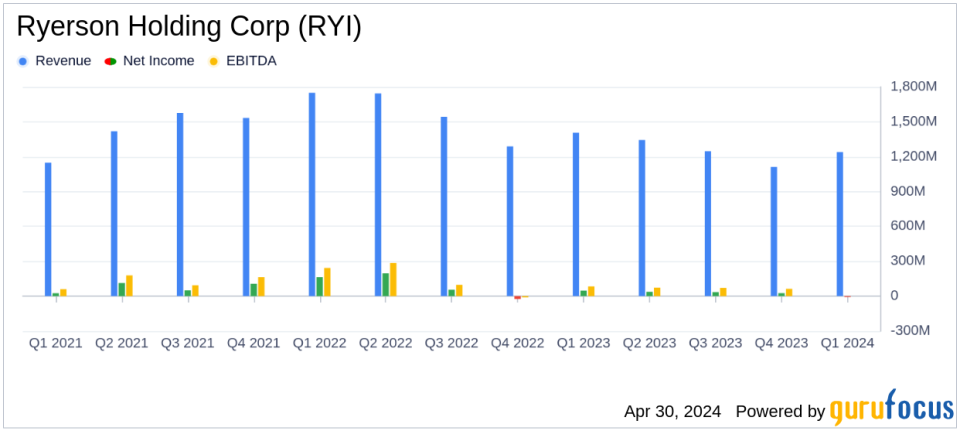

Revenue: Reported $1.24 billion for Q1 2024, slightly exceeding the estimated $1.224 billion.

Net Loss: Posted a net loss of $7.6 million, significantly below the estimated net income of $10 million.

Earnings Per Share (EPS): Recorded a loss of $0.22 per share, falling short of the estimated earnings of $0.32 per share.

Gross Margin: Contracted to 17.6% in Q1 2024 from 22.2% in the previous quarter, indicating a decrease in profitability.

Debt Levels: Total debt rose to $497 million from $436 million at the end of the previous quarter, increasing financial leverage.

Operational Highlights: Launched operations at the University Park, IL service center and completed ERP integration across 31 service centers.

Future Outlook: Anticipates revenue between $1.25 billion and $1.29 billion for Q2 2024, with expected EPS ranging from $0.15 to $0.25.

Ryerson Holding Corp (NYSE:RYI), a prominent value-added processor and distributor of industrial metals, disclosed its financial results for the first quarter ended March 31, 2024, through its recent 8-K filing. The company reported a net loss of $7.6 million, contrasting sharply with the analyst's estimated earnings per share of $0.32 and a net income of $10 million. Despite the earnings miss, Ryerson achieved revenue of $1.24 billion, aligning closely with expectations.

Company Overview

Ryerson operates primarily in North America, with additional facilities in China, serving a diverse range of customers from local shops to large multinational corporations. The company offers an extensive array of products, including stainless steel, aluminum, carbon steel, and alloy steels, generating the majority of its revenue from metal sales in the United States.

Operational and Strategic Highlights

The first quarter saw Ryerson initiating operations at its new service center in University Park, IL, and completing the integration of its ERP system across 31 service centers. These milestones are part of Ryerson's broader strategy to enhance operational efficiency and prepare for future market upturns. Despite these advancements, the company faced significant challenges, including counter-cyclical industry conditions and increased operating expenses linked to its ongoing investment in capital expenditures and acquisitions.

Financial Performance Analysis

Ryerson's revenue saw a sequential increase of 11.4% from Q4 2023, driven by a 10.4% rise in tons shipped and a modest 0.8% increase in average selling price per ton. However, the company's profitability was impacted negatively, with a net loss of $7.6 million for the quarter, a stark reversal from the net income of $25.8 million in the previous quarter. This loss was attributed to lower gross margins, which contracted by 460 basis points sequentially, and higher costs associated with the sales of higher-cost materials.

Financial Position and Liquidity

As of March 31, 2024, Ryerson reported an increase in total debt to $497 million, up from $436 million at the end of 2023. The company's net debt also rose to $455 million, reflecting a 19.2% increase. This escalation in debt levels is a concern, especially as it pushes the net leverage ratio to 2.5x, which is above the company's target range. However, Ryerson's global liquidity remains robust at $684 million, providing a cushion against ongoing financial commitments.

Outlook and Forward Guidance

Looking ahead to Q2 2024, Ryerson anticipates an increase in customer shipments by 1% to 3% and expects net sales to range between $1.25 billion and $1.29 billion. The company projects adjusted EBITDA, excluding LIFO, to be between $47 million and $53 million, with earnings per diluted share estimated to be between $0.15 and $0.25.

Conclusion

While Ryerson's strategic investments position it for potential future growth, the immediate financial results reflect the challenges of operating in a volatile market. The company's ability to navigate these conditions while managing its debt levels and capitalizing on market recovery will be critical in determining its success in the upcoming quarters.

For detailed insights and further information, investors and stakeholders are encouraged to refer to the full earnings report and financial statements available on Ryerson's investor relations website.

Explore the complete 8-K earnings release (here) from Ryerson Holding Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance