Viant Technology Inc (DSP) Q1 2024 Earnings: Aligns with EPS Projections Amid Revenue Growth

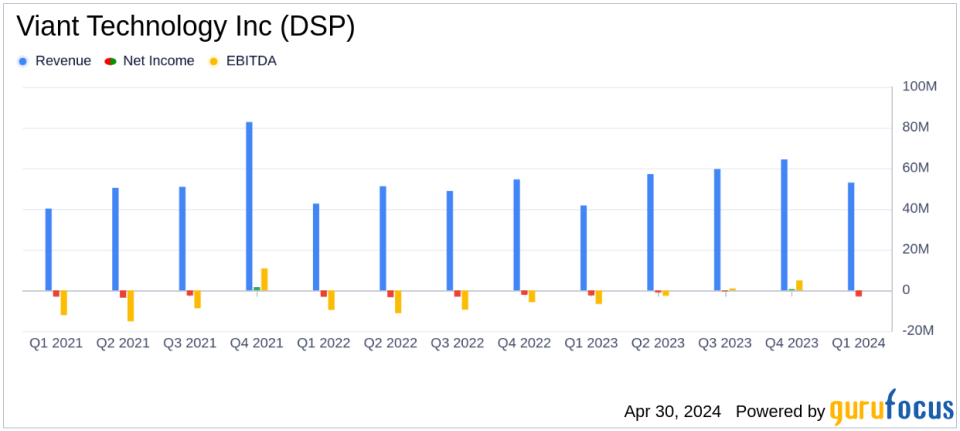

Revenue: Reported at $53.39 million, showing a significant increase of 28% year-over-year, surpassing the estimated $50.83 million.

Net Loss: Recorded a net loss of $3.21 million, a notable improvement from the previous year's loss of $9.38 million, but fell short of the estimated net loss of $2.20 million.

Earnings Per Share (EPS): Reported a loss per share of $0.06, which is an improvement from the previous year's loss of $0.17 per share but below the estimated loss per share of $0.07.

Adjusted EBITDA: Achieved $3.08 million, a significant turnaround from a loss of $390,000 in the previous year, indicating strong operational improvements.

Cash and Cash Equivalents: Ended the quarter with $206.06 million, providing a solid liquidity position to support ongoing operations and strategic initiatives.

Stock Repurchase Program: Announced a new $50 million stock repurchase program, underscoring confidence in the company's financial health and commitment to delivering shareholder value.

Guidance for Q2 2024: Expects revenue between $63.5 million and $66.5 million, reflecting continued growth momentum.

Viant Technology Inc (NASDAQ:DSP) unveiled its financial results for the first quarter ended March 31, 2024, showcasing a significant revenue increase and alignment with analyst EPS projections. The company reported on April 30, 2024, through its 8-K filing, a revenue of $53.39 million, surpassing the estimated $50.83 million and marking a 28% increase year-over-year. Despite this, Viant reported a net loss of $3.21 million, which shows improvement from the previous year's $9.38 million loss, and a non-GAAP net income of $1.35 million, aligning with the EPS estimate of $0.02.

About Viant Technology Inc

Viant Technology Inc is a pioneer in advertising technology, facilitating programmatic ad purchases across a variety of platforms including Connected TV (CTV), mobile, and digital billboards. This capability allows marketers to efficiently manage ad placements across diverse channels, enhancing the effectiveness of advertising campaigns.

Financial Highlights and Operational Achievements

The first quarter saw Viant's CTV segment grow over 50% year-over-year, driven largely by the adoption of its Direct Access program, which offers streamlined access to premium CTV content. This growth segment now represents more than half of the company's total advertising spend. Additionally, Viant's adjusted EBITDA turned positive at $3.08 million, a significant rebound from a $390,000 loss in the prior year, indicating improved operational efficiency and profitability.

Strategic Developments

Amid these financial results, Viant's Board of Directors has authorized a stock repurchase program of up to $50 million, underscoring confidence in the companys financial health and future prospects. This strategic move is aimed at enhancing shareholder value and reflects the strong cash and cash equivalents position of $206.06 million as reported at the end of the quarter.

Challenges and Market Position

Despite the positive revenue growth and operational improvements, Viant continues to face challenges, including a competitive market landscape and the ongoing shifts in advertising technology. The company's ability to sustain its growth in high-performance channels like CTV and streaming audio will be critical in maintaining its market share and capitalizing on industry trends.

Looking Forward

For Q2 2024, Viant anticipates revenue between $63.5 million to $66.5 million and aims to continue leveraging its technological advancements to capture further market share. The focus remains on enhancing programmatic advertising capabilities and driving better return on ad spend for customers.

In summary, Viant Technology Inc's first quarter of 2024 reflects a robust start to the year, with significant revenue growth and strategic initiatives poised to bolster its market position. Investors and stakeholders may look forward to potential value creation through the newly announced stock repurchase program and ongoing operational advancements.

Explore the complete 8-K earnings release (here) from Viant Technology Inc for further details.

This article first appeared on GuruFocus.