To say that discovering a meaningful new drug is difficult is a bit of an understatement: the process can take years, cost billions, and there are high failure rates along the way. Kiniksa Pharmaceuticals (NASDAQ:KNSA) has brought a novel drug treatment to market, which could have high upside potential.

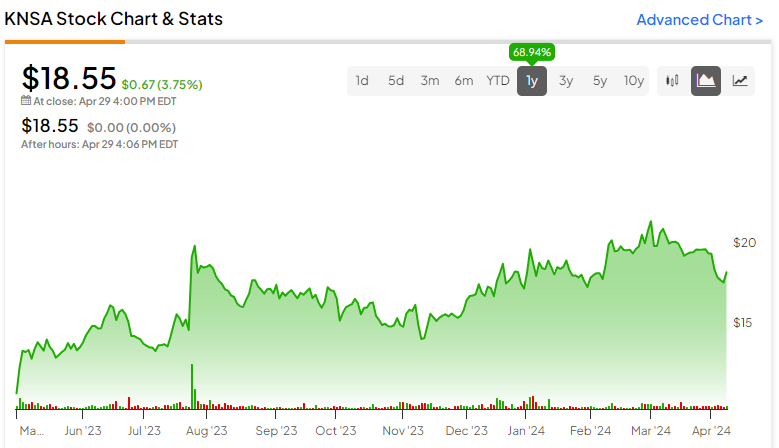

KNSA has the only FDA-approved treatment for recurrent pericarditis, which is the inflammation of the lining around the heart. The stock is up almost 70% in the past year and has the potential for significant upside.

Kiniksa’s Clinical Focus

Kiniksa is a biopharmaceutical firm that creates therapeutic medicines for patients with serious diseases and unfulfilled medical needs.

ARCALYST, Kiniksa’s FDA-approved therapy for recurrent pericarditis, stands as the first and only of its kind in the market. By the first quarter of 2024, ARCALYST had seen steady growth with net product revenue of $78.9 million, representing 85% year-over-year growth. The company estimates that it has a 9% penetration of a total addressable market of 14,000 (of which there is a 50% annual turnover).

The company is also exploring treatments in the autoimmune domain. It is working on a product that would target Sjögren’s Disease, an autoimmune disease that causes arthritis. No FDA-approved therapies exist for this disease, presenting a potential market of up to 300,000 patients in the U.S. alone. Kiniksa plans to conduct a clinical trials to determine the efficacy of its proposed treatment on patients with Sjögren’s Disease in the latter half of 2024.

Insight into Kiniksa’s Recent Financial Results

In the first quarter of 2024, Kiniksa reported a total revenue of $78.9 million, surpassing the consensus estimate of $78.46 million and showing a significant increase from the first quarter of 2023’s revenue of $48.3 million. However, increased distribution costs contributed to a rise in net loss from $12.3 million in the first quarter of 2023 to $17.7 million in the first quarter of 2024. They reported a Q1 EPS of -$0.25, which is a greater loss than the consensus of -$0.08.

As of March 31, 2024, Kiniksa had a robust financial position, with $213.6 million in cash, cash equivalents, and short-term investments and no outstanding debt. For 2024, the company has upgraded its ARCALYST net product revenue guidance from the previous range of $360 million to $380 million to a new range of $370 million to $390 million, indicating a 63% year-over-year growth at the midpoint. Expectations for such robust growth stem from recent data showing increasing prescriber adoption and high satisfaction among physicians and patients.

What is the Price Target for KNSA Stock?

The stock has been trending up, climbing up almost 70% over the past year. It appears to be relatively undervalued, with a P/S ratio of 4.46x comparing favorably to the Biotechnology industry average of 6.37x.

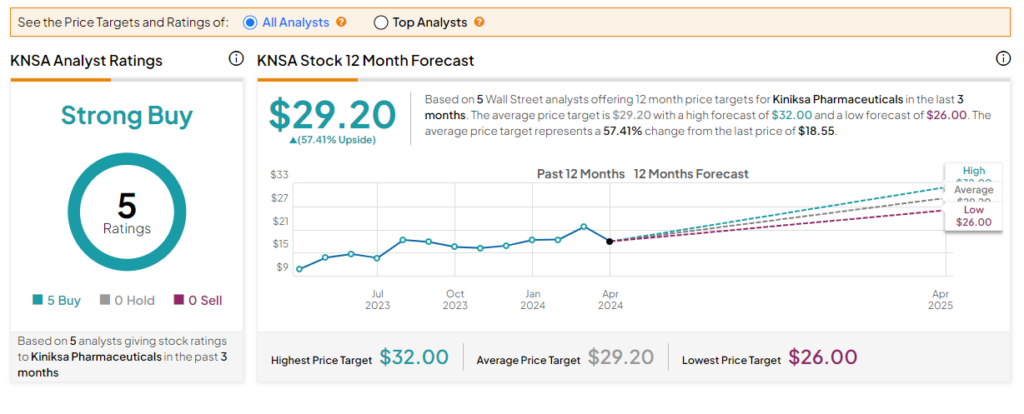

Analysts following the company have been bullish on the stock. For example, BofA analyst Geoff Meacham recently issued a Buy recommendation with a price target of $28, citing optimism on increased demand for Arcalyst.

Kiniksa Pharmaceuticals is rated a Strong Buy based on the recommendations and 12-month price targets of five Wall Street analysts issued over the past three months. The average price target for KNSA stock is $29.20, which represents a 57.41% upside from current levels.

Final Thoughts on KNSA

Kiniksa is well-positioned to grow the distribution of its lead therapy while nurturing its clinical pipeline. The stock has been trending upwards, though it still trades at a relative value, creating a window of opportunity for investors interested in the upside potential of this biopharma company.