FTI Consulting (FCN) Stock Gains Since Q1 Earnings Beat

FTI Consulting, Inc. FCN reported impressive first-quarter 2024 results, with both earnings and revenues beating the Zacks Consensus Estimate.

The stock has gained 2% since the earnings release on Apr 25, in response to the better-than-expected results. Shares have gained 18.8% in the past year, outperforming the 16.3% rally of the industry it belongs to.

Quarterly earnings per share of $2.23 surpassed the Zacks Consensus Estimate by 26.7% and increased 66.4% on a year-over-year basis. Total revenues of $928.6 million beat the consensus mark by 4.9% and increased 15.1% from the year-ago quarter.

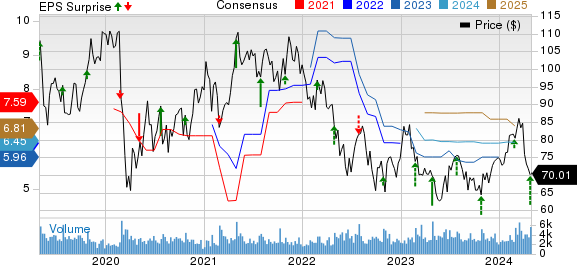

FTI Consulting, Inc. Price, Consensus and EPS Surprise

FTI Consulting, Inc. price-consensus-eps-surprise-chart | FTI Consulting, Inc. Quote

All Segments Grow Double Digits

Technology revenues increased 11% year over year to $100.7 million and outpaced our anticipation of $96.9 million. The uptick was due to higher demand for M&A-related “second request” and information governance, and privacy & security services.

Economic Consulting revenues jumped 20.6% from the year-ago quarter to $204.5 million, surpassing our estimate of $192.5 million. Higher financial economics, non-M&A related antitrust and international arbitration revenues led to this growth.

Corporate Finance & Restructuring revenues gained 16% year over year to $366 million and outpaced our estimate of $336.3 million. The upward movement was due to higher restructuring, business transformation & strategy and transactions revenues.

Strategic Communications revenues climbed 11.1% year over year to $81.2 million and lagged our prediction of $82.2 million. The increase was primarily due to a surge in demand for corporate reputation and Public Affairs services.

Forensic and Litigation Consulting revenues rose 11.6% year over year to $176.1 million, beating our estimate of $163.6 million. The uptick was backed by higher demand for investigations and dispute services.

Margins Expand

Adjusted EBITDA came in at $111.1 million, up 41.6% on a year-over-year basis. This beat our estimate of $100.2 million, up 27.8% year over year. Adjusted EBITDA margin climbed 230 basis points year over year to 12%. This compared favorably with our expectation of 11.5%.

Key Balance Sheet and Cash Flow Figures

FTI Consulting exited the quarter with cash and cash equivalents of $244 million compared with the prior quarter’s $303.2 million. The company had a long-term debt of $205 million at the end of the quarter. FCN used $274.8 million of cash in operating activities in the quarter. The capital expenditure was $4.6 million.

The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshots of Some Business Service Stocks

Omnicom OMC reported impressive first-quarter 2024 results, wherein both earnings and revenues beat the Zacks Consensus Estimate.

OMC’s earnings of $1.67 per share beat the consensus estimate by 9.9% and increased 7.1% year over year. Total revenues of $3.6 billion surpassed the consensus estimate by 1.6% and increased 5.4% year over year.

Equifax EFX reported mixed first-quarter 2024 results, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same.

EFX’s adjusted earnings were $1.5 per share, ahead of the Zacks Consensus Estimate by 4.2% and up 4.9% from the year-ago quarter. Total revenues of $1.4 billion missed the consensus estimate by a slight margin but increased 6.7% from the year-ago quarter.

ManpowerGroup MAN reported mixed first-quarter 2024 results, with earnings beating the Zacks Consensus Estimate but revenues missing the same.

Quarterly adjusted earnings of 94 cents per share surpassed the consensus mark by 4.4% but declined 41.6% year over year. Revenues of $4.4 billion lagged the consensus mark by 0.6% and fell 7% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance