Unlocking ASX Trading Success: FORTESCUE LTD – FMG Stock Analysis & Elliott Wave Technical Forecast

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with FORTESCUE LTD – FMG. We have identified that wave (v) may return to FMG to continue pushing higher, but it needs to be monitored closely until the significant high is breached. This would increase confidence and renew the bullish outlook.

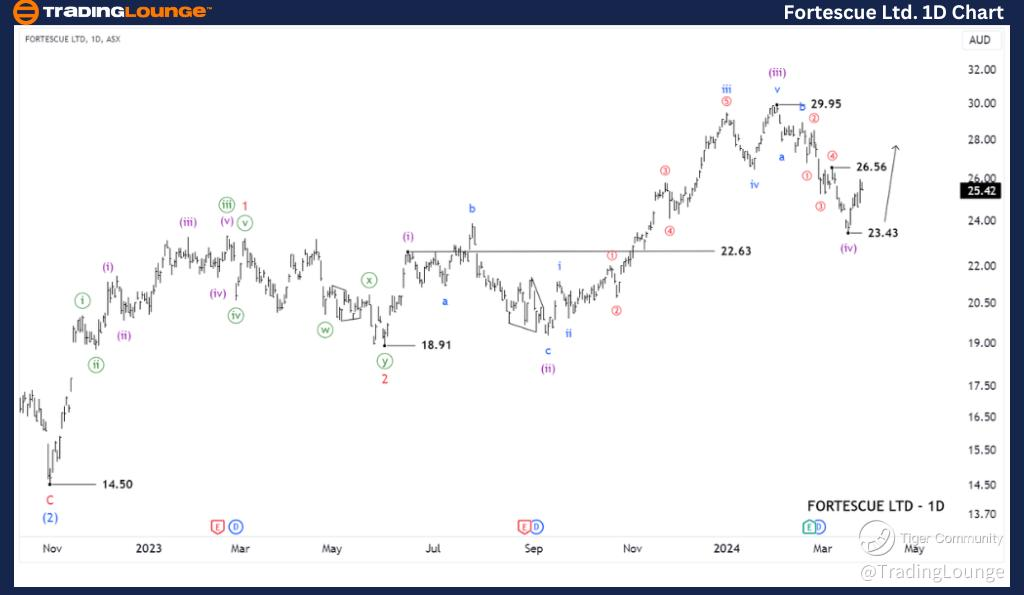

ASX:Fortescue LTD – (FMG) Elliott Wave technical analysis

Function: Major trend (Minuette degree, purple).

Mode: Motive.

Structure: Impulse.

Position: Wave (iv)-purple.

Details: The short-term outlook indicates that waves (i)-purple through (iii)-purple have concluded, so wave (iv)-purple is currently unfolding. It seems that it may have just ended at a low of 23.43. However, it's too early to definitively say this, and a rise above 26.56 would refresh the bullish perspective. Invalidation point: 22.63 Confirmation point: 26.56

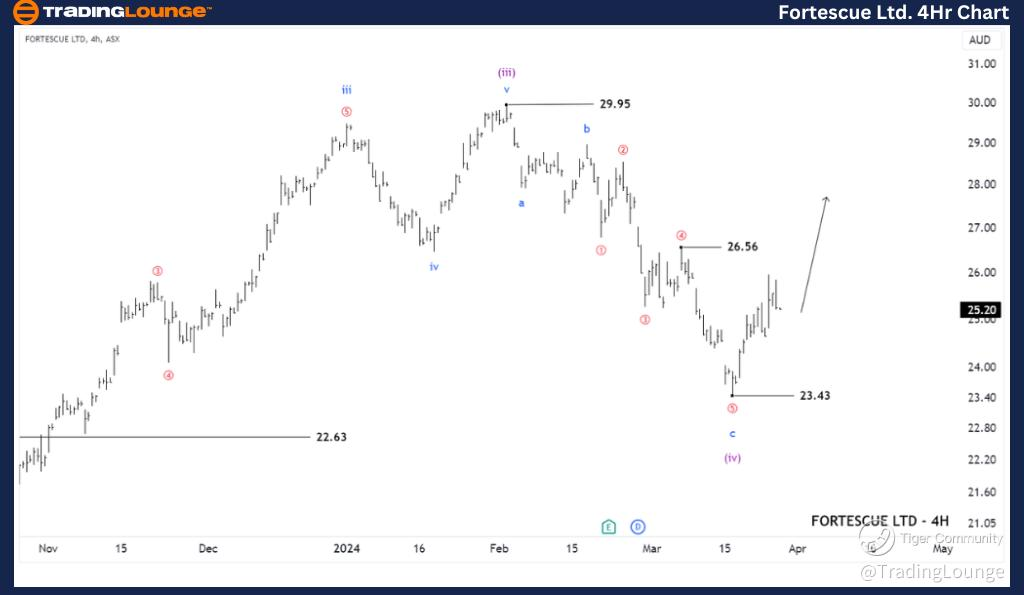

ASX: Fortescue LTD – (FMG) Elliott Wave technical analysis

ASX: FORTESCUE LTD – FMG 4-Hour Chart Analysis

Function: Major trend (Minuette degree, purple).

Mode: Motive.

Structure: Impulse wave.

Position: Wave (v)-purple.

Details: The short-term outlook suggests that wave (iv)-purple appears to have bottomed out around 23.43, and wave (v)-purple seems to be unfolding to push higher. However, it's important to note that wave (iv) experienced a significant decline, and it's still too early to confirm what's happening. Therefore, breaking above the recent high at 26.56 would renew the bullish view and increase confidence in the upward trend.

Invalidation point: 23.43

Conclusion

Our analysis, forecast of contextual trends, and short-term outlook for ASX: FORTESCUE LTD – FMG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

ASX: Fortescue LTD (FMG) Elliott Wave technical analysis [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD declines toward 1.0800 on renewed USD strength

EUR/USD stays on the back foot and declines toward 1.0800 following the modest rebound seen after German inflation data. The risk-averse market atmosphere, as reflected by the bearish action in Wall Street, supports the USD and weighs on the pair.

GBP/USD extends slide to 1.2700 area as mood sours

After moving sideways near 1.2750 in the European session, GBP/USD came under modest bearish pressure and dropped toward 1.2700. The negative shift seen in risk mood allows the USD to stay resilient against its rivals and drags the pair lower.

Gold pressures daily lows around $2,340

Gold trades in negative territory near $2,340 after closing the previous three trading days higher. The benchmark 10-year US Treasury bond yield gains more than 1% on the day above 4.6%, causing XAU/USD to continue to stretch lower.

Bitcoin bull market is still going strong, on-chain data shows

Bitcoin’s (BTC) price outlook remains positive in the short term despite its recent stabilization, on-chain data suggests, propelled by easing selling pressure by long-term holders and activity from large-wallet investors.

Big moves ahead: ECB’s interest rate cut and the future of EUR/USD

The European Central Bank is set for a major move: an interest rate cut in June. This decision, backed by top officials like ECB Vice President Luis de Guindos and French central bank chief Francois Villeroy de Galhau.