A well-funded Cooper Metals Ltd (ASX:CPM) is ready to recommence drilling at the Brumby Ridge copper-gold prospect within the Mt Isa East Copper-Gold Project in northwest Queensland, having recorded an “excellent” induced polarisation (IP) survey result.

The company is now ready to restart drilling — around 1,000 metres of diamond drilling and up to 2,000 metres of RC drilling — at Brumby Ridge to help ascertain the size and grade potential of the mineralisation.

Survey success

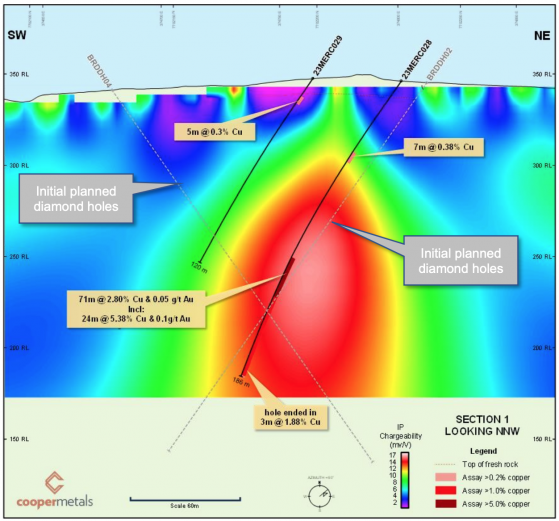

Ahead of the upcoming drilling, a first line of pole-dipole (PDP) IP survey has confirmed the strong depth potential of the chargeability anomaly at Brumby Ridge.

Cooper notes that the chargeability anomaly matches the geology quite well with the chargeability response starting about 50 metres below the surface and continuing at depth.

Designed to help optimise drill targeting at all three prospects, an IP survey over Brumby Ridge, along with Mafic Sweats South and Yarraman has also commenced which Cooper expects will take around two weeks to complete.

To fund the planned drilling program, Cooper has raised $3.5 million in an oversubscribed placement (before costs) with strong support from existing and new institutional and sophisticated investors.

Set for drilling

Cooper Metals managing director Ian Warland said: “We are ready to recommence drilling soon at Brumby Ridge.

"It’s highly encouraging to see the strong chargeability response from the first line of IP indicating the mineralisation is wide, steeply dipping and extends at depth.

"This corroborates what we have learnt from our earlier drilling and surface results.

“Recent heavy rains have temporarily paused the geophysics, but the IP survey will restart soon once access is available and diamond drilling will commence shortly thereafter.”

Diamond and RC drilling

Cooper has planned around 1,000 metres of diamond drilling and up to 2,000 metres of RC drilling at Brumby Ridge.

The initial diamond drilling will consist of scissor holes (two holes drilled in opposite directions) to test width and dip of the mineralisation. Following this, diamond holes will be drilled along strike and possibly down dip as required. Diamond drilling is on track to start in late February.

Last November, Cooper announced significant RC drill results at Brumby Ridge of up to 71 metres at a grade of 2.80% copper and 0.05 g/t gold from 115 metres, including 24 metres at 5.37% copper and 0.10 g/t gold from 115 metres in drill hole 23MERC028.

Significantly, this drill hole finished in copper-gold mineralisation, with the last 3 metres to the end of hole (186 metres) averaging 1.88% copper and 0.04 g/t gold.

Fieldwork has recommenced at the Brumby Ridge Prospect with a heritage survey now completed for the next phase of drilling.

The IP survey at Brumby Ridge will help optimise the drill targeting, although recent rainstorms in the Mt Isa area have temporarily suspended the IP survey.

Capital raise

The recent placement raised a total of $3.5 million via the issue of 14 million new fully paid ordinary shares at $0.25 per share. This represents a discount of around 16.5% to the last traded price of $0.30 and around 13.5% to the 15-day volume weighted average price of $0.29.

Read more on Proactive Investors AU