The Pinnacle Investment Management Group Ltd (ASX: PNI) share price is charging higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) financial services company closed yesterday trading for $9.98. At the time of writing on Friday morning, shares are changing hands for $10.87, up 8.9%

For some context, the ASX 200 is up 0.8% at this same time.

The Pinnacle share price is racing ahead of the ASX 200 following the release of the company's half-year results for the six months ended 31 December (1H FY2024).

Read on for the highlights.

What's piquing ASX 200 investor interest?

ASX 200 investors are bidding up the Pinnacle share price today after the company reported strong growth in its funds under management (FUM).

Pinnacle announced that its aggregate affiliates' FUM increased by 9% ($8.2 billion) over the six-month period, reaching $100.1 billion.

The company's aggregate retail FUM came in at $25.9 billion. That was up $3.2 billion or 14% from 30 June 2023.

Also likely helping lift the Pinnacle share price today was the $4.5 billion in reported net inflows for the half year. That's a big improvement from the $1.5 billion in net outflows in 1H FY 2023.

In other key metrics, the ASX 200 financial stock reported net profit after tax (NPAT) of $30.2 million, down 1% from the $30.5 million in 1H FY 2023.

And passive income investors should be pleased with the fully franked interim dividend of 15.6 cents per share. That's in line with the interim dividend paid out for 1H FY 2023.

The company also highlighted the ongoing medium-term outperformance of its affiliates, noting that 81% of five-year affiliate strategies have outperformed their respective benchmarks. Management said this "consistent alpha generation underpins the ongoing performance fee contributions" from its affiliates.

As at 31 December, Pinnacle had net cash and principal investments of $51.1 million.

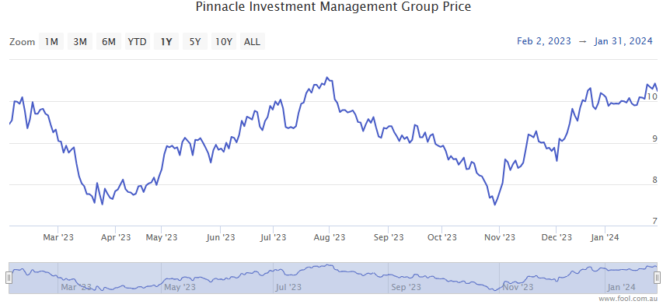

Pinnacle share price snapshot

With today's big lift factored in, the Pinnacle share price is up 16% over the past 12 months. And that's not including the two fully franked dividend payments.