Does Federal International Holdings Berhad (KLSE:FIHB) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Federal International Holdings Berhad (KLSE:FIHB), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Federal International Holdings Berhad

How Quickly Is Federal International Holdings Berhad Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Federal International Holdings Berhad's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 44%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Federal International Holdings Berhad's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Federal International Holdings Berhad shareholders is that EBIT margins have grown from 7.4% to 15% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

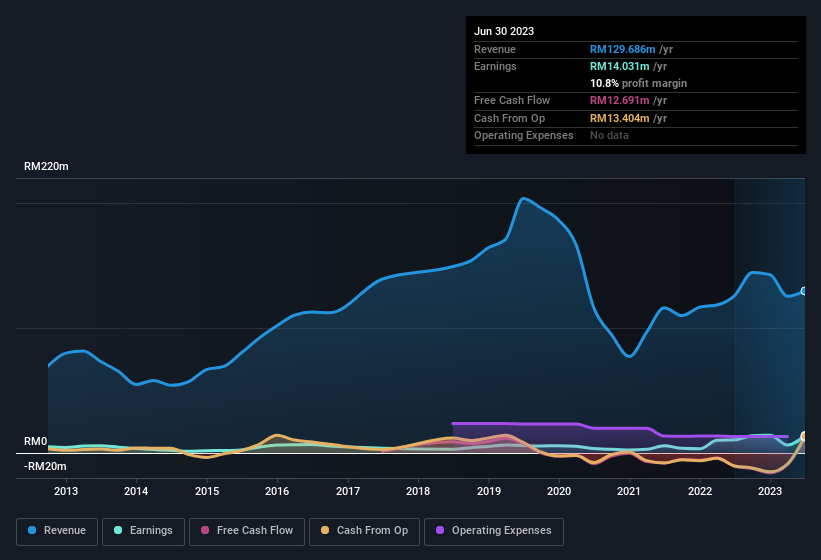

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Federal International Holdings Berhad is no giant, with a market capitalisation of RM81m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Federal International Holdings Berhad Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Federal International Holdings Berhad insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 63% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Although, with Federal International Holdings Berhad being valued at RM81m, this is a small company we're talking about. So despite a large proportional holding, insiders only have RM51m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Federal International Holdings Berhad, with market caps under RM929m is around RM520k.

The Federal International Holdings Berhad CEO received RM352k in compensation for the year ending June 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Federal International Holdings Berhad Worth Keeping An Eye On?

Federal International Holdings Berhad's earnings per share have been soaring, with growth rates sky high. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Federal International Holdings Berhad certainly ticks a few boxes, so we think it's probably well worth further consideration. You still need to take note of risks, for example - Federal International Holdings Berhad has 1 warning sign we think you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.