最新

熱門

美聯儲研究:自 2020 年以來退休的增長 「佔目的地的所有缺點」 在勞動力宗教

「退休人數增加的一半以上被認為是疫情的直接結果。」

$SPDR 標普500指數ETF(SPY.US$ $納指100ETF-Invesco QQQ Trust(QQQ.US$ $亞馬遜(AMZN.US$ $微軟(MSFT.US$ $蘋果(AAPL.US$ $特斯拉(TSLA.US$

「退休人數增加的一半以上被認為是疫情的直接結果。」

$SPDR 標普500指數ETF(SPY.US$ $納指100ETF-Invesco QQQ Trust(QQQ.US$ $亞馬遜(AMZN.US$ $微軟(MSFT.US$ $蘋果(AAPL.US$ $特斯拉(TSLA.US$

已翻譯

1

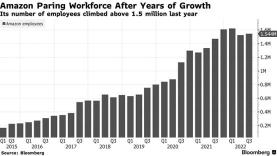

$亞馬遜(AMZN.US$ 現正在解僱超過 18,000 名工人,遠超過先前計劃的一萬人。

這些變化將有助於我們以更強大的成本結構來追求長期機會。」其行政總裁安迪·賈西在給員工的備忘錄中說。

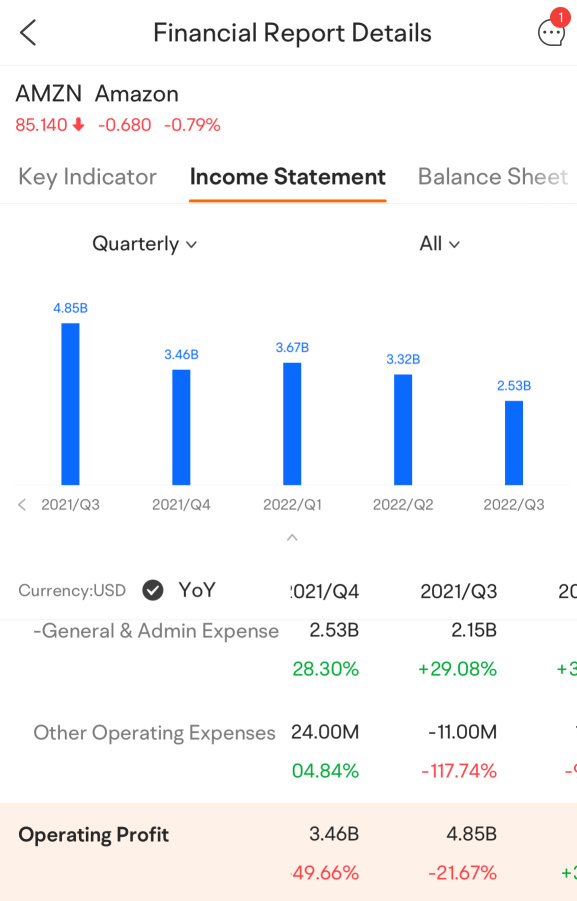

員工人數高峰發生在 2021 年第三季和第四季度,當財務報告顯示營業利潤按年下降時也是一個轉折點。

亞馬遜的...

這些變化將有助於我們以更強大的成本結構來追求長期機會。」其行政總裁安迪·賈西在給員工的備忘錄中說。

員工人數高峰發生在 2021 年第三季和第四季度,當財務報告顯示營業利潤按年下降時也是一個轉折點。

亞馬遜的...

已翻譯

+1

12

3

$亞馬遜(AMZN.US$ could lay off as many as 20,000 employees in the coming months, double the number initially reported, according to Computerworld, an information technology publication.

Earlier this month the New York Times reported the retailer would lay off about 10,000 corporate workers, primarily affecting employees in the retail and human resources divisions, as well as those who work on Amazon devices such as the voic...

Earlier this month the New York Times reported the retailer would lay off about 10,000 corporate workers, primarily affecting employees in the retail and human resources divisions, as well as those who work on Amazon devices such as the voic...

4

1

$GlobalFoundries(GFS.US$ $英偉達(NVDA.US$ $3倍做多半導體ETF-Direxion(SOXL.US$ 領先的半導體製造商 GlobalFoundries 正準備解僱多達 800 名員工,佔公司全球約 15,000 人員的 5.3%。

據總部位於弗蒙特的新聞網站 VTDigger 發布了有關解僱人數的消息的新聞網站 VTDigger 稱,解僱人士並不集中在任何一個地理區域。 彭博首次報告...

據總部位於弗蒙特的新聞網站 VTDigger 發布了有關解僱人數的消息的新聞網站 VTDigger 稱,解僱人士並不集中在任何一個地理區域。 彭博首次報告...

已翻譯

3

失業期間

推特,Facebook,西爾斯,CVS,沃爾格林,雜貨店,石油鑽機,各種類型的銀行,卡車司機,任何類型的醫院,酒店,各種類型汽車經銷商,餐廳和海洋船,然後學校。

推特,Facebook,西爾斯,CVS,沃爾格林,雜貨店,石油鑽機,各種類型的銀行,卡車司機,任何類型的醫院,酒店,各種類型汽車經銷商,餐廳和海洋船,然後學校。

已翻譯

1