MetLife's (MET) My Leave Navigator to Boost Leave Experience

MetLife, Inc. MET recently unveiled My Leave Navigator, a new digital tool designed to enhance the employee experience from pre-leave planning to accessing different employer-sponsored programs. This offering, integrated into MetLife's MyBenefits suite, aims to provide personalized, intuitive support for employees taking leave due to various life events, including expansion of their families, caring for family members, or recovering from an illness.

The company's recent research highlights that 62% of employees lack full confidence in their knowledge of all available benefits. Additionally, 38% of employees who feel neglected at work believe that they were not adequately informed about beneficial programs by their employers.

This emphasizes the high demand for services like My Leave Navigator. MetLife introducing tailored products according to the market demand, enables it to diversify its portfolio and generate steady premiums.

My Leave Navigator is customized to meet the unique needs of each employee's leave situation. It assists employees in comprehending their available options while ensuring they feel supported throughout the entire leave process.

Additionally, the digital solution connects employees' disability insurance with other employer-sponsored programs, like the Paid Family Medical Leave and Family Medical Leave Act, to offer cohesive support.

The new product is expected to generate a sense of support in employees, which is expected to lead to increased loyalty and productivity. It is likely to help them focus on significant life events without the added stress of managing multiple claims, thereby delivering an efficient leave experience.

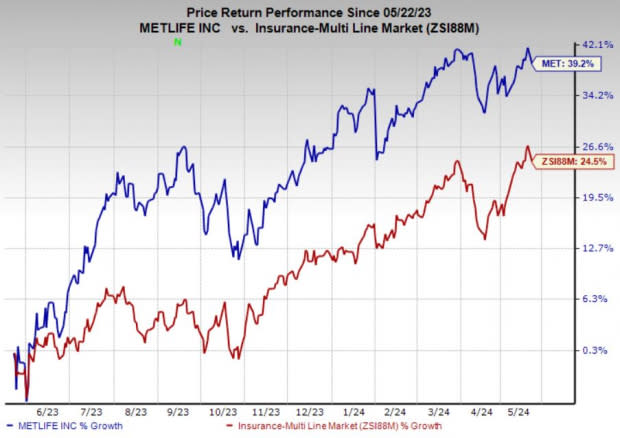

Price Performance

MetLife’s shares have gained 39.2% in the past year, outperforming the 24.5% growth of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

MetLifecurrently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Finance space are Ambac Financial Group, Inc. AMBC, Brown & Brown, Inc. BRO and Root, Inc. ROOT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ambac Financial’s current-year earnings is pegged at $1.45 per share, which witnessed one upward estimate revision in the past month against no movement in the opposite direction. AMBC beat earnings estimates in all the past four quarters, with an average surprise of 893.5%.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. It has witnessed six upward estimate revisions against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%.

The consensus mark for ROOT’s current-year earnings indicates a 35.6% year-over-year improvement. It beat earnings estimates in all the past four quarters, with an average surprise of 34.1%. Furthermore, the consensus estimate for Root’s 2024 revenues suggests 125.3% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Ambac Financial Group, Inc. (AMBC) : Free Stock Analysis Report

Root, Inc. (ROOT) : Free Stock Analysis Report