DOW & Freepoint Ink Agreement to Transform Plastic Waste

Dow Inc. DOW and Freepoint Eco-Systems have agreed to use an estimated 65,000 metric tons per year of certified-circular, plastic waste-derived pyrolysis oil to generate new, virgin-grade equivalent polymers in Dow's Gulf Coast operations. Dow and Freepoint Eco-Systems are developing a recycling system that turns plastic waste into valuable materials and promotes a circular economy for plastics in North America.

The pyrolysis oil will be manufactured at a new refined recycling facility owned and run by Freepoint Eco-Systems Eloy Recycling LLC, a Freepoint Eco-Systems affiliate. Once completed, the advanced recycling facility in Arizona will be ISCC Plus-certified. The facility will treat end-of-life plastic waste in the region, diverting it from landfills or incineration and converting it into recycled pyrolysis oil. For each ton of plastic waste, around 70% is planned to be turned to pyrolysis oil and sold exclusively to Dow for the facility's first phase, which will begin as early as 2026.

Dow will use the circular liquid supply to create new products using virgin-grade equivalent polymers, replacing those generated from conventional feedstock. The resulting products will be ideal for use in a variety of applications, including food-grade packaging (such as pet food, confectionery and snacks), as well as medical and pharmaceutical packaging while retaining current product performance and minimizing reliance on fossil feedstocks.

Dow's agreement with Freepoint Eco-Systems is another significant step toward sourcing circular supply and transforming end-of-life plastic waste into solutions that assist its clients in reaching their recycled content targets.

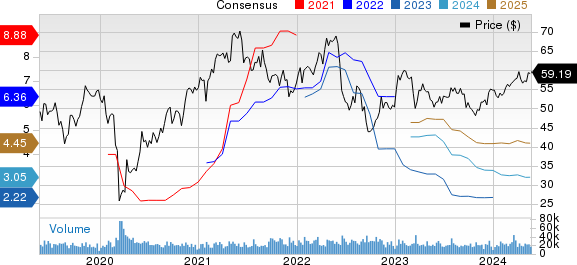

Shares of Dow have gained 14.3% over the past year compared with a 2% rise of its industry.

Image Source: Zacks Investment Research

On the first-quarter call, Dow said that demand in key end-use markets such as packaging, mobility and energy applications is trending higher sequentially, which is in sync with its expectations at the beginning of the year.

The company expects its high-value organic growth investments and advantaged portfolio to allow it to deliver earnings growth and increased shareholder value as the economic recovery gains strength. This provides DOW with the financial flexibility to advance its Decarbonize and Grow and Transform the Waste strategies, which are expected to deliver more than $3 billion in underlying earnings improvement annually by 2030.

Dow Inc. Price and Consensus

Dow Inc. price-consensus-chart | Dow Inc. Quote

Zacks Rank & Key Picks

Dow currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include ATI Inc. ATI, Carpenter Technology Corporation CRS and Ecolab Inc. ECL.

ATI carries a Zacks Rank #1 (Strong Buy) at present. ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have soared 61.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Carpenter Technology currently carries a Zacks Rank #1. CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared 128.5%% in the past year.

The Zacks Consensus Estimate for Ecolab's current-year earnings is pegged at $6.59 per share, indicating a year-over-year rise of 26.5%. ECL, a Zacks Rank #2 (Buy) stock, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 1.3%. The company’s shares have rallied roughly 35.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Dow Inc. (DOW) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance