Is Tilray Brands Stock a Buy?

Last week marked a historic moment for the financial markets as the Dow Jones Industrial Average soared to unprecedented heights, and the S&P 500 continued its impressive bull run, now nearing two years.

Amidst this financial fervor, a particular industry has been making waves, albeit more quietly -- cannabis stocks. In 2024, these stocks have not only kept pace but have outshone these benchmark indices in many instances.

Investors have shown a keen interest in the cannabis market this year, channeling their funds into leading companies such as Aurora Cannabis, Canopy Growth, Curaleaf Holdings, Green Thumb Industries, Innovative Industrial Holdings, and Tilray Brands (NASDAQ: TLRY). This surge is rooted in two fundamental factors:

The cannabis market's growth trajectory: The global cannabis market is poised for significant growth over the next 10 years and beyond. Industry expert forecasts suggest that the medical marijuana market will expand at a mid-double-digit rate throughout this decade. Recreational marijuana is set to surpass this figure, with expectations of over 20% annual growth, per multiple industry analysts in the last year.

The crumbling wall of prohibition: The long-standing prohibition against marijuana is showing signs of collapse. Germany, projected to be Europe's largest marijuana market, has recently initiated the legalization of small amounts of cannabis for adult recreational use. This step is widely interpreted as a precursor to full legalization within the next ten years.

Adding to the momentum, President Joe Biden announced a significant policy shift last week. The administration intends to reschedule marijuana from Schedule I to Schedule III under the Controlled Substances Act. This proposed change will facilitate clinical research and could be the harbinger of nationwide legalization -- unless Congress passes one of the plethora of existing bills for full legalization sooner.

With this backdrop, the question arises: Should moderately risk-tolerant investors join the cannabis rally by investing in a top-tier company like Tilray Brands? To answer this, let's break down Tilray's core value proposition and weigh it against alternative investment vehicles, such as the cannabis-focused Amplify Alternative Harvest ETF, the Vanguard S&P 500 ETF, and the Vanguard Total Bond Market Index Fund.

Tilray's core value proposition

Tilray presents itself as a premier player in the cannabis lifestyle industry, boasting an expansive presence that extends across North America, Europe, Australia, and Latin America. The company offers a diverse range of products, including cannabis in various forms, CBD items, and artisanal alcoholic drinks.

In regards to cannabis, Tilray competes in both the recreational and medicinal segments, claiming to hold the top market positions in some categories in Canada and Germany, based on its internal data. While Tilray's presence in the U.S. market is not yet significant, the company plans to broaden its reach through calculated acquisitions soon.

Considering the regulatory and operational hurdles involved in such expansion, the average Wall Street price target for Tilray's stock suggests a modest 18% growth potential over the forthcoming year. This meager price target also reflects the considerable operational challenges in the company's core commercial territories.

How does Tilray stock up against these diversified ETFs?

When assessing Tilray's investment appeal compared to a range of diversified ETFs, it's essential to weigh the company against standard benchmarks such as the S&P 500, secure assets like high-quality corporate bonds, or sector-specific ETFs.

The table below contrasts Tilray's performance with that of the Vanguard S&P 500 ETF, the Vanguard Total Bond Market ETF, and the cannabis-focused Amplify Alternative Harvest ETF over the past year and five-year periods, factoring in share price growth and dividends.

Equity | Year-to-date performance (%) | 5-yr performance (%) |

|---|---|---|

Tilray Brands | -13.9 | -75.7 |

Vanguard S&P 500 ETF | 11.8 | 101.2 |

Vanguard Total Bond Index Fund ETF | -1.22 | 0.78 |

Amplify Alternative Harvest ETF | 35.3 | -84.5 |

Table 1: Company and ETF performance, including dividend payments and share price appreciation. Data provided by Yahoo! Finance.

During this period, Tilray has outperformed only the Amplify Alternative Harvest ETF. However, this particular ETF has seen a resurgence in 2024, yielding significantly higher returns than Tilray within the year.

Verdict

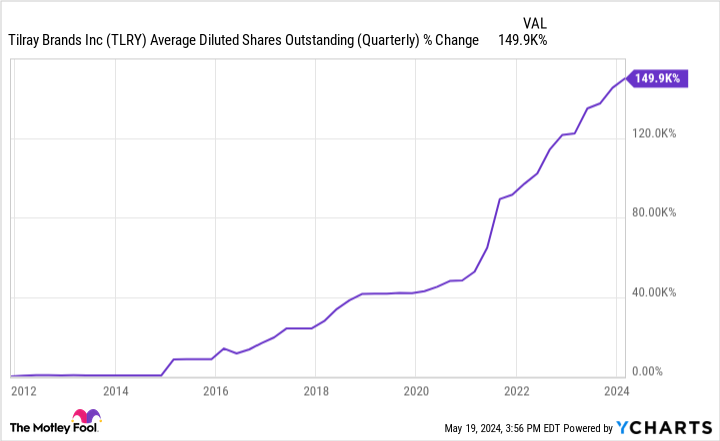

Tilray has the foundational elements to emerge as a worldwide cannabis powerhouse. Nonetheless, the company may be compelled to keep diluting shareholders to nurture its core business and await the end of the global prohibition era.

The graph below underscores this concern:

TLRY Average Diluted Shares Outstanding (Quarterly) data by YCharts

Moreover, the timing of this all-important milestone is unpredictable. As a result, this marijuana stock carries a substantial level of risk that may eclipse its immediate growth potential. Therefore, investors might be better off buying in one of the three ETFs mentioned above, rather than purchasing Tilray shares.

Should you invest $1,000 in Tilray Brands right now?

Before you buy stock in Tilray Brands, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tilray Brands wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

George Budwell has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Green Thumb Industries, Innovative Industrial Properties, Vanguard Bond Index Funds-Vanguard Total Bond Market ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.

Is Tilray Brands Stock a Buy? was originally published by The Motley Fool