Exploring Three Dividend Stocks In May 2024

As of May 2024, the US stock market has shown robust performance with major indices nearing record highs, buoyed by optimistic economic indicators such as a cooling April CPI report which has fueled hopes for potential Federal Reserve interest rate cuts. In this context of economic optimism and potential shifts in monetary policy, dividend stocks may offer investors a blend of income generation and stability.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.05% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 4.89% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.78% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.80% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.76% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 4.87% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.84% | ★★★★★★ |

Credicorp (NYSE:BAP) | 5.70% | ★★★★★☆ |

West Bancorporation (NasdaqGS:WTBA) | 5.60% | ★★★★★☆ |

Marine Products (NYSE:MPX) | 5.41% | ★★★★★☆ |

Click here to see the full list of 198 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

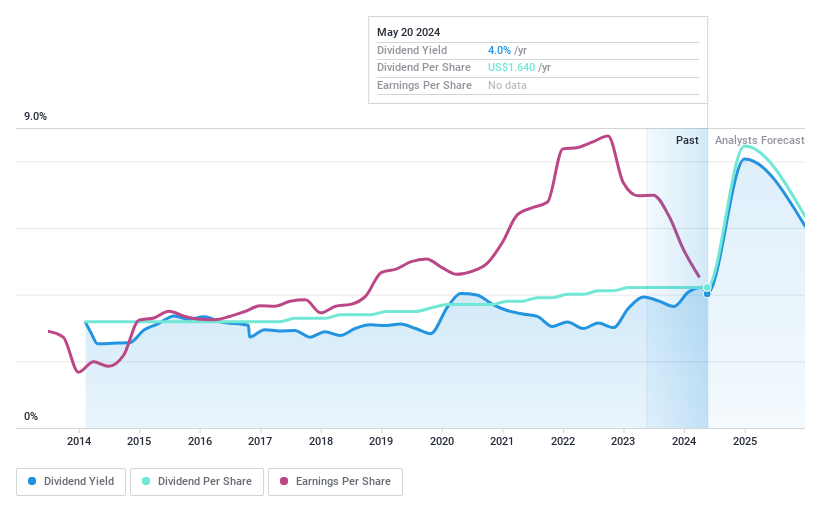

Peoples Financial Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Peoples Financial Services Corp., with a market cap of $287.58 million, serves as the bank holding company for Peoples Security Bank and Trust Company, offering a range of commercial and retail banking services.

Operations: Peoples Financial Services Corp. generates its revenue primarily through banking services, which amounted to $96.88 million.

Dividend Yield: 4%

Peoples Financial Services maintains a consistent dividend, reaffirming a quarterly payment of US$0.41 per share, mirroring its previous distributions. Despite stable dividends over the past decade and coverage by a modest payout ratio of 49.9%, recent financials show a downturn with net interest income and net income declining from the previous year. The stock's valuation suggests it trades well below estimated fair value, yet its dividend yield at 4.02% remains below the top quartile of US dividend payers.

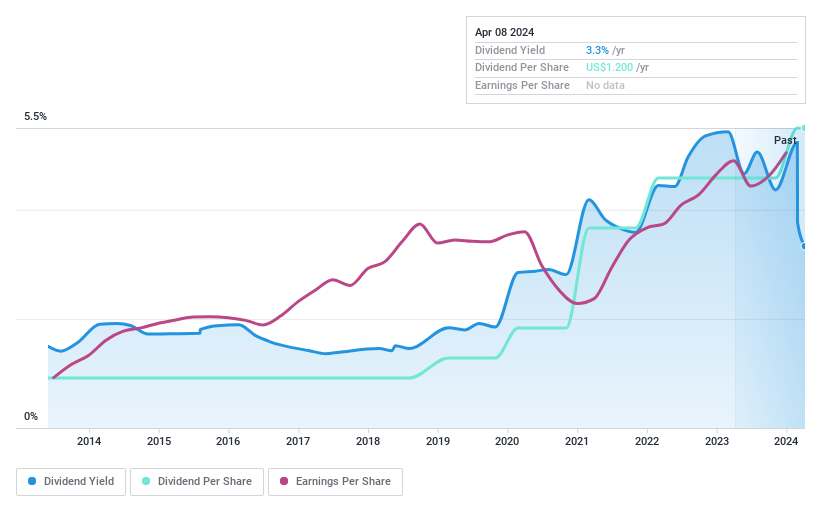

CompX International

Simply Wall St Dividend Rating: ★★★★★★

Overview: CompX International Inc., primarily operating in North America, focuses on manufacturing and selling security products and recreational marine components, with a market capitalization of approximately $303.16 million.

Operations: CompX International Inc. generates revenue from two main segments: marine components, which brought in $34.38 million, and security products, contributing $123.73 million.

Dividend Yield: 4.9%

CompX International reported a decrease in quarterly sales and net income as of March 2024, with sales dropping to US$37.97 million and net income to US$3.75 million. Despite this, the company increased its quarterly dividend by US$0.05 to US$0.30 per share recently, maintaining a stable dividend history over the past decade. The dividends are well-covered by both earnings and cash flows, with payout ratios of 63.8% and 63.5% respectively, supporting sustainability despite recent financial pressures.

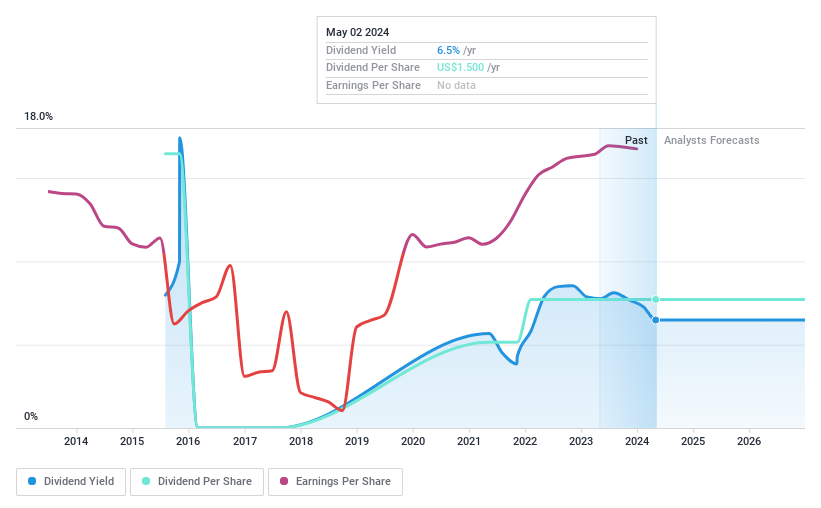

Global Ship Lease

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. operates by owning and chartering out containerships on fixed-rate charters to various container shipping companies globally, with a market capitalization of approximately $939.87 million.

Operations: Global Ship Lease, Inc. generates its revenue primarily through the ownership and chartering of containerships to global shipping companies under fixed-rate agreements.

Dividend Yield: 5.6%

Global Ship Lease maintains a dividend of US$0.375 for Q1 2024, supported by a low payout ratio of 12.7% and cash payout ratio of 22.4%, indicating strong coverage from both earnings and cash flows. Despite trading at 25.8% below estimated fair value and offering a competitive yield in the top quartile for US markets, its dividend history is marked by instability, with payments showing volatility over its nine-year history of distributions. Additionally, the firm faces challenges with high debt levels and forecasted earnings decline averaging 27.3% annually over the next three years.

Navigate through the intricacies of Global Ship Lease with our comprehensive dividend report here.

Our valuation report here indicates Global Ship Lease may be undervalued.

Where To Now?

Get an in-depth perspective on all 198 Top Dividend Stocks by using our screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:PFIS NYSEAM:CIX and NYSE:GSL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance