Exploring Three Japanese Growth Companies With High Insider Ownership On The Tokyo Stock Exchange

Despite a backdrop of economic contraction and modestly rising bond yields, Japanese equities showed resilience last week, with the Nikkei 225 Index gaining 1.5%. In this context, exploring growth companies with high insider ownership on the Tokyo Stock Exchange could offer intriguing insights into firms that are potentially well-positioned to navigate Japan's complex market dynamics.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.5% | 27.2% |

Hottolink (TSE:3680) | 27% | 57.3% |

Micronics Japan (TSE:6871) | 15.3% | 39.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.4% | 44.6% |

ExaWizards (TSE:4259) | 24.8% | 80.2% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Medley (TSE:4480) | 34% | 24.4% |

Soiken Holdings (TSE:2385) | 19.8% | 118.4% |

Soracom (TSE:147A) | 17.2% | 59.1% |

freee K.K (TSE:4478) | 24% | 82.8% |

Underneath we present a selection of stocks filtered out by our screen.

Eternal Hospitality GroupLtd

Simply Wall St Growth Rating: ★★★★☆☆

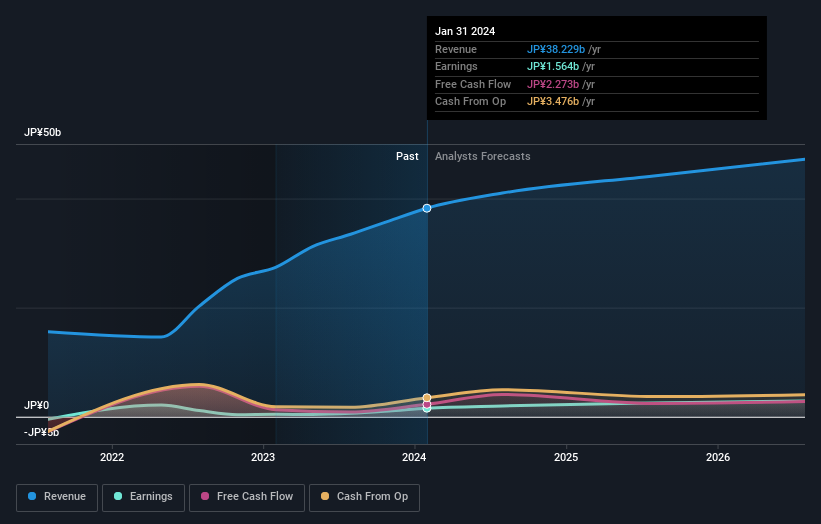

Overview: Eternal Hospitality Group Co., Ltd. operates a chain of restaurants in Japan and has a market capitalization of approximately ¥46.07 billion.

Operations: The company generates approximately ¥38.23 billion primarily through its food and beverage operations.

Insider Ownership: 35.5%

Earnings Growth Forecast: 23.3% p.a.

Eternal Hospitality GroupLtd, a growth-oriented company in Japan, has demonstrated robust earnings growth of 256.3% over the past year with expectations of continued significant expansion at 23.3% per annum, outpacing the Japanese market average of 8.7%. Despite trading at an 18.2% discount to its estimated fair value and showing slower revenue growth at 8.2% annually compared to anticipated higher rates, the firm benefits from strong insider ownership which aligns management with shareholder interests.

Mimaki Engineering

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mimaki Engineering Co., Ltd. is a company that specializes in developing, manufacturing, and selling computer devices and software both in Japan and internationally, with a market capitalization of ¥40.54 billion.

Operations: The company operates primarily in the development, manufacture, and sale of computer devices and software across domestic and international markets.

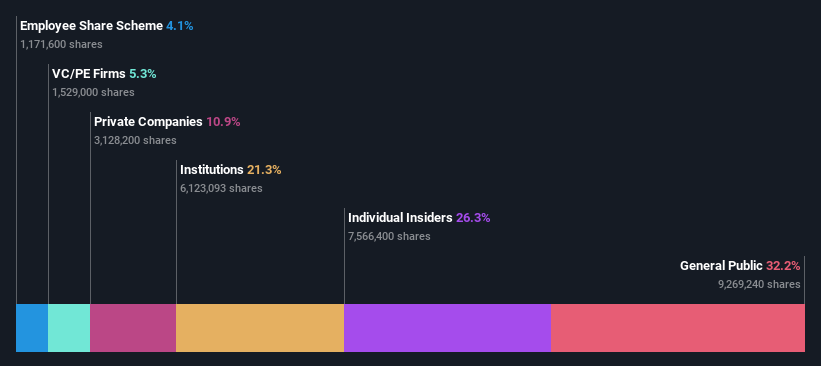

Insider Ownership: 26.3%

Earnings Growth Forecast: 21.9% p.a.

Mimaki Engineering, recognized for its growth potential in Japan, is currently trading at 27.4% below its estimated fair value. The company has experienced a substantial earnings increase of 32.1% over the past year and is projected to continue this trend with an earnings growth forecast of 21.93% annually, outperforming the Japanese market forecast of 8.7%. However, it faces challenges with an unstable dividend track record and revenue growth predictions not exceeding the high benchmark of 20% annually.

Fujimori Kogyo

Simply Wall St Growth Rating: ★★★★☆☆

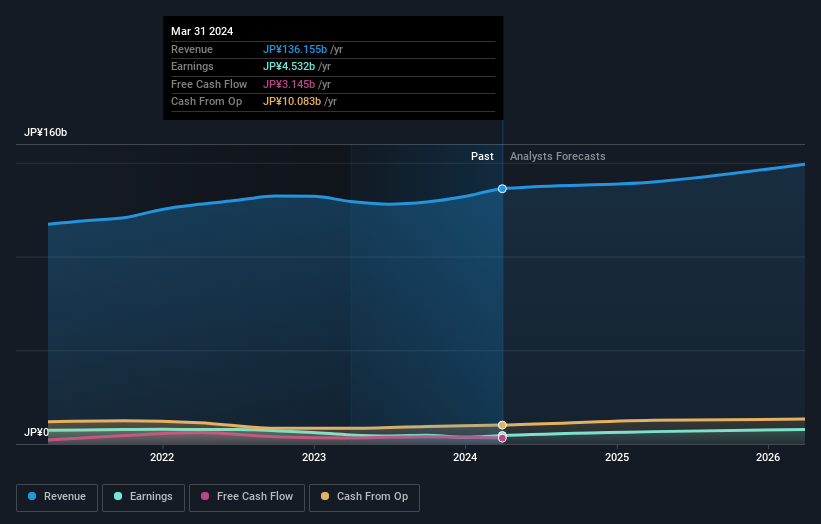

Overview: Fujimori Kogyo Co., Ltd. specializes in producing packaging materials, medical and pharmaceutical packaging, and materials for functional fields both domestically and globally, with a market capitalization of ¥78.31 billion.

Operations: The company generates revenue from the production of packaging materials, medical and pharmaceutical packaging, and functional materials.

Insider Ownership: 16.6%

Earnings Growth Forecast: 25.6% p.a.

Fujimori Kogyo, a Japanese company with significant insider ownership, is poised for robust growth with earnings expected to increase by 25.58% annually over the next three years, outpacing the broader Japanese market's 8.7%. Despite this strong profit outlook, its Return on Equity is projected to remain low at 8.4%. The firm recently completed a share buyback program for ¥973.91 million, underscoring confidence in its future prospects although revenue growth forecasts of 4.6% per year are modest compared to more aggressive benchmarks.

Make It Happen

Get an in-depth perspective on all 108 Fast Growing Japanese Companies With High Insider Ownership by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3193 TSE:6638 and TSE:7917.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance