3 SGX Dividend Stocks Offering Yields From 5.8% To 7.5%

As the digital transformation accelerates, with a significant shift towards online banking as evidenced by widespread branch closures in the UK, investors might look for stability and consistent returns in their portfolios. In this context, high-yield dividend stocks listed on the SGX present an appealing option for those seeking to generate regular income from their investments amidst changing economic landscapes.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.27% | ★★★★★★ |

China Sunsine Chemical Holdings (SGX:QES) | 6.33% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.68% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.67% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.51% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.58% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.98% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.08% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

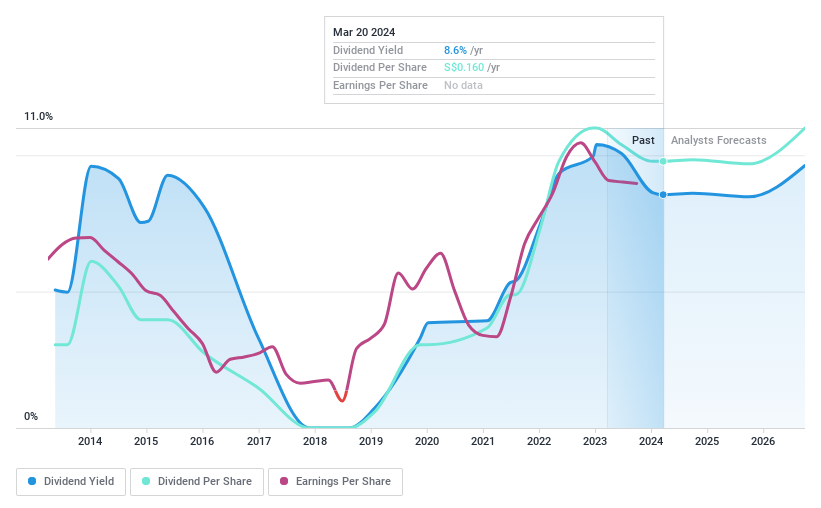

BRC Asia

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete, serving markets including Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and internationally; it has a market capitalization of approximately SGD 0.58 billion.

Operations: BRC Asia Limited generates revenue primarily through two segments: Trading, which contributes SGD 413.27 million, and Fabrication and Manufacturing, accounting for SGD 1.21 billion.

Dividend Yield: 7.5%

BRC Asia offers a dividend yield of 7.51%, higher than the average in the Singapore market, indicating attractive income potential for investors. The company's dividends are sustainably supported by earnings with a payout ratio of 38% and cash flows with a cash payout ratio of 28.1%. However, its dividend history shows volatility and unreliability over the past decade, posing risks to consistency in future payouts. Additionally, BRC Asia carries a high level of debt which may impact financial flexibility.

Click to explore a detailed breakdown of our findings in BRC Asia's dividend report.

The valuation report we've compiled suggests that BRC Asia's current price could be quite moderate.

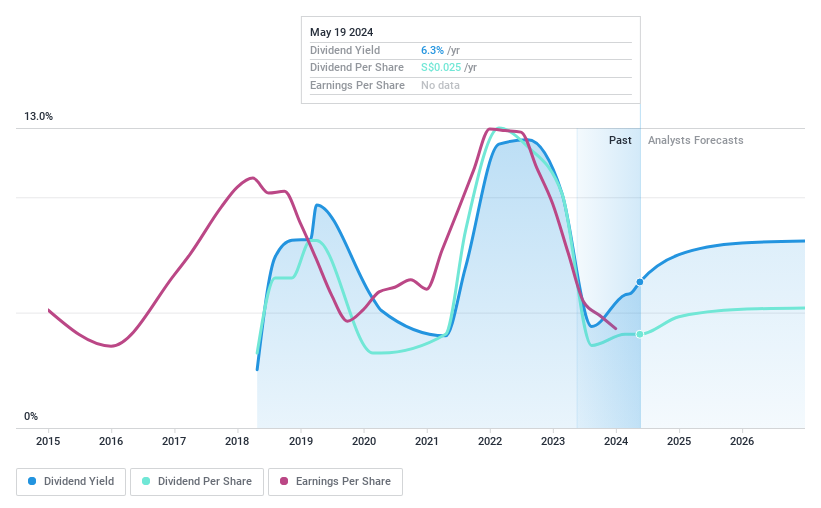

APAC Realty

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: APAC Realty Limited operates as an investment holding company, offering real estate services across Singapore, Indonesia, Vietnam, and other international markets with a market capitalization of approximately SGD 140.30 million.

Operations: APAC Realty Limited generates revenue primarily through real estate brokerage, contributing SGD 548.88 million, and a smaller portion from rental income amounting to SGD 2.15 million.

Dividend Yield: 6.3%

APAC Realty, despite a recent dividend cut to 1.4 Singapore cents per share, maintains a competitive yield of 5.4% based on its latest closing price. The company's dividends are relatively well-covered with a payout ratio of 78%, aligning with its policy to distribute 50%-80% of profits. However, profitability has declined, as evidenced by a drop in net income from SGD 26.56 million to SGD 11.78 million year-over-year and reduced profit margins from 3.8% to 2.1%. Additionally, the firm's dividend history is marked by instability over its six years of payments.

Navigate through the intricacies of APAC Realty with our comprehensive dividend report here.

Upon reviewing our latest valuation report, APAC Realty's share price might be too pessimistic.

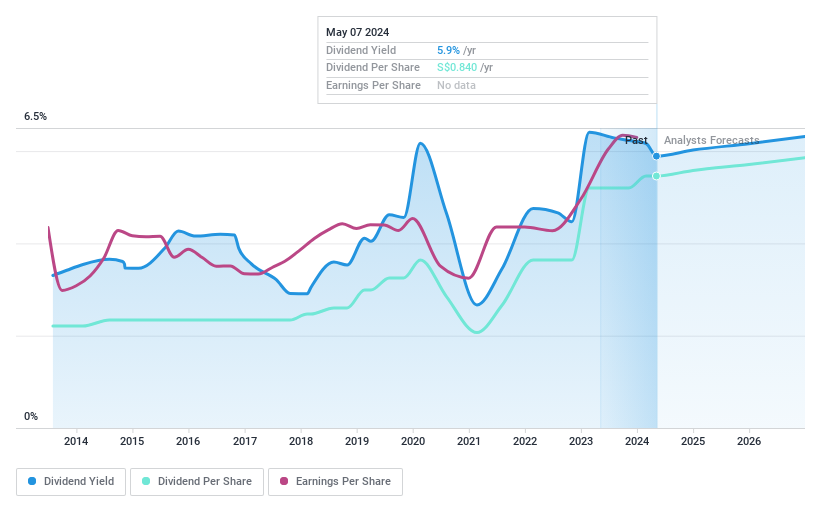

Oversea-Chinese Banking

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited operates as a provider of various financial services across regions including Singapore, Malaysia, Indonesia, Greater China, and other parts of the Asia Pacific, with a market capitalization of SGD 64.99 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates revenue through financial services across Singapore, Malaysia, Indonesia, Greater China, and the rest of the Asia Pacific.

Dividend Yield: 5.8%

Oversea-Chinese Banking Corporation reported a rise in Q1 2024 net interest income to SGD 2.44 billion, up from SGD 2.34 billion year-over-year, with net income also increasing to SGD 1.98 billion from SGD 1.88 billion. Despite a history of volatile dividends, the recent dividend announcement for fiscal year 2023 is set at 42 cents per share, payable on May 21, reflecting some level of commitment to shareholder returns. The bank's dividend coverage is reasonable with current earnings covering payouts at a ratio of approximately 52.9%. However, its dividend yield of approximately 5.82% remains below the top quartile for Singapore market payers.

Key Takeaways

Gain an insight into the universe of 21 Top SGX Dividend Stocks by clicking here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BECSGX:CLN SGX:O39

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance