Three Reasons to Retain AMN Healthcare (AMN) Stock for Now

AMN Healthcare Services, Inc. AMN is well-poised for growth in the coming quarters, courtesy of its broad array of services. The optimism led by a solid first-quarter 2024 performance and its healthcare Managed Services Program (MSP) are expected to contribute further. However, changing marketplace conditions and stiff competition are major downsides.

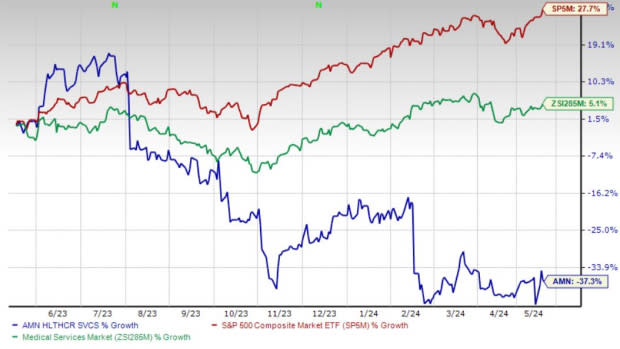

Over the past year, this Zacks Rank #3 (Hold) stock has lost 37.3% against the 5.1% rise of the industry and the S&P 500’s 27.7% growth.

The renowned player in the healthcare total talent services space has a market capitalization of $2.29 billion. The company’s earnings yield of 5.5% compares favorably with the industry’s 3.7%. AMN Healthcare surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 9.9%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Broad Array of Services: We are upbeat about AMN Healthcare’s business’ gradual evolution beyond traditional healthcare staffing. The company has become a strategic total talent solutions partner for its clients. Its suite of healthcare workforce solutions includes MSPs, vendor management systems and medical language interpretation services.

On first-quarter 2024 earnings call in May, AMN Healthcare’s management stated that the One AMN transformation strategy has been proceeding well, with some promising gains visible in the quarter. New technology and internal process improvements have greatly accelerated the company’s speed in fulfilling orders.

Healthcare MSP: AMN Healthcare’s unique MSP is helping the company gain market traction. Notably, the program helps streamline the entire workforce planning process, which facilitates the delivery of improved patient care. This has resulted in a large network of improved patient care and efficiency.

For the three months ended Mar 31, 2024, revenues under AMN Healthcare’s MSP arrangements comprised approximately 48% of its consolidated revenues, 70% of its Nurse and Allied Solutions segment revenues, 13% of its Physician and Leadership Solutions segment revenues and 3% of its Technology and Workforce Solutions segment revenues.

Strong Q1 Results: AMN Healthcare’s first-quarter 2024 performance raises our optimism. It witnessed an uptick in the Physician and Leadership Solutions segment’s revenues, locum tenens revenues and Language interpretation services revenues. On the earnings call, management confirmed witnessing strong year-over-year growth in volume and net week's book for therapy and imaging. AMN Healthcare’s school's business also grew on assignment headcount year over year.

Downsides

Changing Marketplace Conditions: AMN Healthcare’s success depends upon its ability to develop innovative workforce solutions, quickly adapt to changing marketplace conditions (such as reimbursement changes and evolving client needs), comply with new federal or state regulations and differentiate its services and abilities from those of its competitors.

Stiff Competition: AMN Healthcare faces significant competition in the Medical Services industry. The company competes in national, regional and local markets for healthcare organization clients and healthcare professionals. In the nurse and allied healthcare staffing business, it competes with a few national competitors, along with numerous smaller, regional and local companies.

Estimate Trend

AMN Healthcare has been witnessing a negative estimate revision trend for 2024. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 29.5% south to $3.32.

The Zacks Consensus Estimate for second-quarter 2024 revenues is pegged at $739.1 million, suggesting a 25.4% decline from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Veeva Systems Inc. VEEV and Ecolab Inc. ECL.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 40.2% compared with the industry’s 24.3% rise in the past year.

Veeva Systems, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 24.1%. VEEV’s earnings surpassed estimates in each of the trailing four quarters, with the average being 8.5%.

Veeva Systems has gained 27.7% compared with the industry’s 51.4% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.5%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.3%.

Ecolab’s shares have rallied 33.3% against the industry’s 10.1% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance