- Crypto trading firm QCP Capital predicts Bitcoin will return to the $74,000 all-time high seen in March.

- The firm cites macroeconomic catalysts, rising institutional demand and sizable buys of $100,000 to $120,000 Bitcoin calls as the main bullish drivers.

- Bitcoin price rises above $66,000 on Thursday.

Bitcoin (BTC) price is likely to rally back to $74,000 in the coming weeks, it's all-time high reached in March, riding on three bullish catalysts, according to crypto trading firm QCP Capital. The expected BTC price rally would be in response to favorable macroeconomic conditions, increased institutional investor activity and statistics from the firm’s trading desk.

Trading firm predicts Bitcoin rally to $74,000

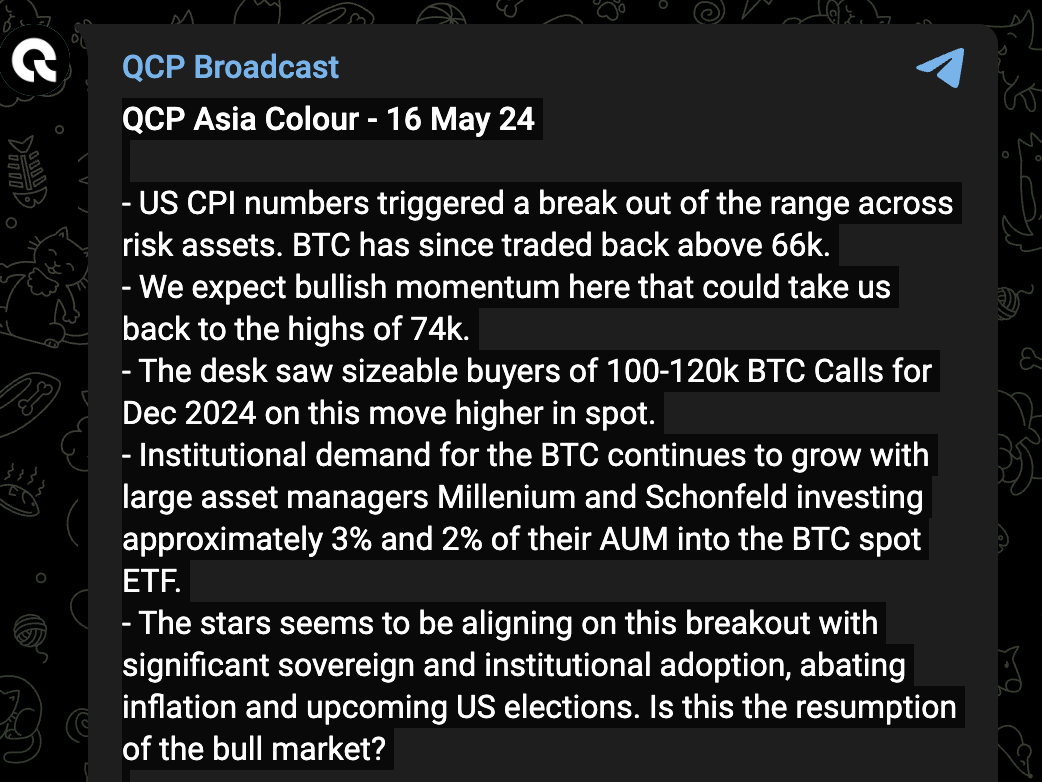

Through its official Telegram account, QCP Capital analyzed on Thursday the current market conditions and predicted a Bitcoin price rally to the highs of $74,000. QCP Capital expects bullish momentum in Bitcoin price in response to macroeconomic developments in the US, as the gradual decline in inflation and the subsequent cut in interest rates should support risk assets.

The US Consumer Price Index (CPI) numbers released on Wednesday, which pointed to a decline in inflation after three months of persisting price pressures, triggered a breakout across risk assets, including crypto markets.

QCP Capital Broadcast

Since the news, Bitcoin has traded close to the $66,000 level. Analysts at QCP Capital identified sizeable buyers of $100,000 to $120,000 Bitcoin calls for December 2024 in response to the recent price gains in the spot market.

At the same time, institutional demand for Bitcoin is growing. Large asset managers like Millenium and Schonfeld have invested 3% and 2% of their Assets Under Management (AUM) into the Bitcoin Spot ETF.

Analysts note that the breakout in Bitcoin price comes alongside sovereign and institutional adoption ahead of the upcoming US elections. Citing the timing, the firm wonders if this could be “the resumption of the bull market”, according to a comment on its official Telegram account.

In its note, the firm suggests that Bitcoin price dips could continue to be bought as the market continues to see rising liquidity from global rate cuts and higher fiscal spending and there is an increasing institutional adoption of BTC in the US.

Bitcoin trades at $66,100 on Binance at the time of writing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin sets the stage for a potential “destruction of fiat currency“

In a recent tweet on the social media platform X, formerly Twitter, Peter Brandt, a seasoned analyst, suggested that Bitcoin (BTC) price could be due for a massive uptrend. He compared the current BTC consolidation to the Stagflation Crisis of 1970.

Whales are quietly sizing up on this Ethereum Layer 2 token Premium

During times of muted volatility, it is better to be in the trenches instead of figuring out if and what button you should be clicking. And whales are doing exactly that with Polygon (MATIC), a well-known Ethereum Layer 2 token.

Arkham price consolidation could yield fruitful double-digit returns

Arkham (ARKM) price has shown signs of consolidation that could easily propel higher. Due to the current volatility, it is unlikely to break out without providing an accumulation opportunity.

Why are meme coins crashing?

Meme coins like Shiba Inu, Dogwifhat and Floki are all down nearly double digits. The social volume of these dog-themed crypto coins has plummeted even more in the past 24 hours.

Bitcoin: BTC likely to provide another buying opportunity Premium

Bitcoin (BTC) price looks weak on the lower timeframes, which might provide opportunities to accumulate. The daily and weekly charts retain their bullish outlook and suggest that the continuation of the 2023 bull run is not a question of “if” but “when.”