Up 7% in 1 Month, Is Coca-Cola Stock About to Hit a New All-Time High?

The S&P 500 and Nasdaq Composite are both up a little over 1% in the last month. Meanwhile, the consumer staples sector is up over 4% during that time, and Coca-Cola (NYSE: KO) has been a big part of that sector gain. Coke's stock price is up 7.4% in just the last month. The move has Coke trading within a couple of percentage points of its all-time high of $64.99 a share set back on April 24, 2023.

Here's why Coca-Cola has what it takes to hit a new all-time high, and why the dividend stock is worth buying now.

A model of consistency

Out of the thousands of businesses that trade on the U.S. stock market, Coke may be the most consistent and reliable company out there for a beautifully simple reason -- you know what you're getting when you buy the stock.

You're already probably familiar with many of Coke's beverage brands, such as Gold Peak tea, BodyArmor and Powerade sports drinks, Costa Coffee, Schweppes and Topo Chico seltzers, Dasani water, Minute Maid juices, Sprite sodas, Vitamin Water, and more. And even if you haven't extensively studied the business, you probably have a good grasp on how Coke makes money.

It's all about building a strong brand portfolio across different beverage categories and generating a return that can be used to reinvest in the business, grow the dividend, and repurchase stock. Of course, executing that strategy is complex. But the framework is easy to understand.

From an investment standpoint, Coke sets clear expectations for its shareholders. It's not going to grow sales or earnings at a breakneck pace, but it does need to deliver throughout the economic cycle and grow earnings at a similar rate to the dividend to avoid making its payout ratio too high. To do that, Coke has to make sure its acquisitions pay off, that it manages its supply chain well, and that it doesn't get so complacent that it becomes an inefficient business.

A successful turnaround

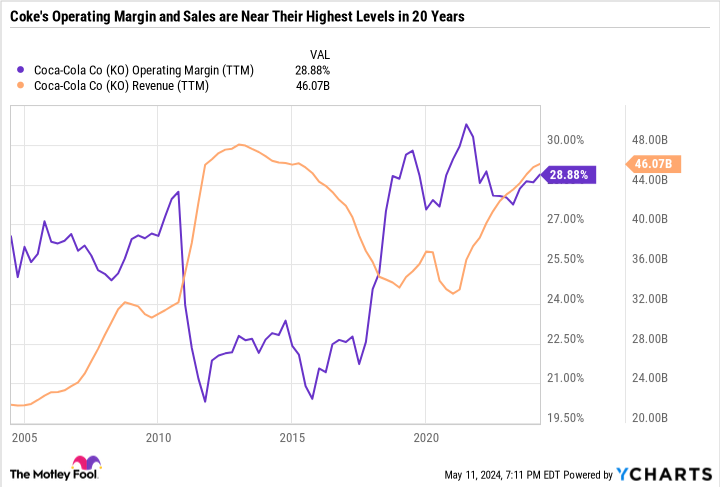

Historically, Coke has done a good job hitting the mark. But in 2017, Coke's sales fell 15% in a year and its margins were depressed. Coke has since turned its business around. And after breakneck sales growth over the last few years thanks to strong pricing power, Coke is finally on the brink of surpassing its sales record from more than a decade ago.

Coke's mid-to-late-2010s challenges are a good example of how even the best companies go through setbacks. However, a successful turnaround can help improve investor confidence and build a track record for reliability.

A yield built on quality and quantity

Speaking of reliability, Coke's dividend is one of the most rock-solid payouts on the market. The company has paid and raised its dividend annually for 62 consecutive years, making it a Dividend King. The recent 5.4% raise brings the dividend to $0.485 per share per quarter, or $1.94 per year -- good for a yield of 3.1%.

There are many well-known Dividend Kings with track records of increasing their payouts. But plenty don't have yields as high as Coca-Cola's. Like Coke, Walmart and Procter & Gamble are Dividend Kings in the consumer staples sector. But Walmart has a yield below 1.5%, and P&G has a yield of 2.4%.

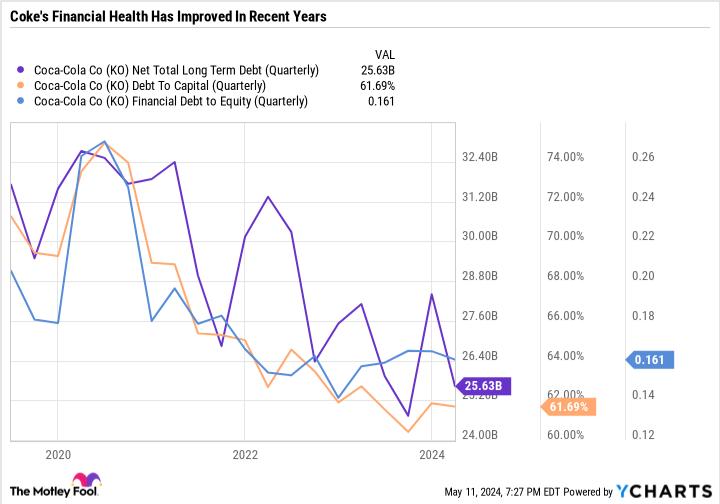

Coke's dividend is particularly secure thanks to the company's recession-resistant business model. Coke has also made meaningful improvements to its balance sheet.

The chart shows that its total net long-term debt, debt-to-capital ratio, and financial debt-to-equity ratio are all near their lowest levels in five years. Having a strong balance sheet and a manageable debt position leaves more room for dividend raises and buybacks.

As Coke has turned around its business, it has been able to repurchase more of its stock. Over the last 12 months, it has done $1.5 billion in buybacks, around the highest level in five years.

Coke also has a reasonable valuation, with a price-to-earnings ratio of 25.3 and a forward P/E of 22.4. It's not a bad deal for the stock, considering the 10-year median P/E is 27.3.

Coke remains a great buy now

Coke's internal inefficiencies and acquisitions of Costa in 2019 and BodyArmor in 2021 left the company vulnerable to sales and margin pressure. But since then, Coke has turned things around and reentered growth mode.

The business and the balance sheet are in their best shape in years, allowing Coke to make sizable dividend raises and stock repurchases.

Despite knocking on the door of an all-time stock price high, Coke remains a good value and has a high yield. It's the perfect passive income play for risk-averse investors or folks looking to supplement income in retirement.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $553,880!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool has a disclosure policy.

Up 7% in 1 Month, Is Coca-Cola Stock About to Hit a New All-Time High? was originally published by The Motley Fool