Time to Buy Walmart's Stock as Q1 Earnings Approach?

Reporting its first quarterly results since aiming to make its stock more affordable to retail investors and implementing a 3-1 stock split in February, many eyes will be on Walmart’s WMT Q1 report on Thursday, May 16.

Of course, Walmart’s report will give a glimpse into the current trend in consumer shopping behavior with earnings from fellow omnichannel retail giant Target TGT due next week. That said, let’s see if now is a good time to buy Walmart’s stock as Q1 earnings approach.

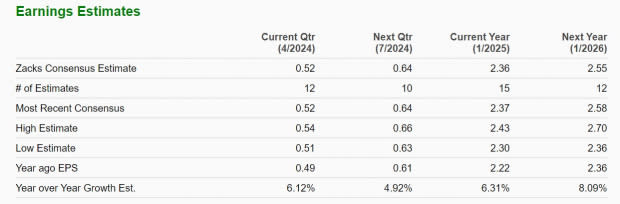

Q1 Expectations

Based on Zacks estimates, Walmart’s Q1 earnings are expected to rise 6% to $0.52 per share with quarterly sales thought to have risen 4% to $159.33 billion. Furthermore, the Zacks ESP (Expected Surprise Prediction) indicates Walmart could surpass earnings expectations with the Most Accurate Estimate having Q1 EPS pegged at $0.54 and 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

Notably, Walmart has exceeded bottom line expectations in three of its last four quarterly reports most recently beating Q2 EPS estimates by 9% in February with earnings at $0.60 per share compared to the Zacks Consensus of $0.55 a share.

Image Source: Zacks Investment Research

Growth & Outlook

Walmart’s annual earnings are forecasted to be up 6% in its current fiscal 2025 and are projected to rise another 8% in FY26 to $2.55 per share. Total sales are expected to increase 4% in FY25 with Walmart’s top line projected to expand another 4% in FY26 to $699.86 billion.

Image Source: Zacks Investment Research

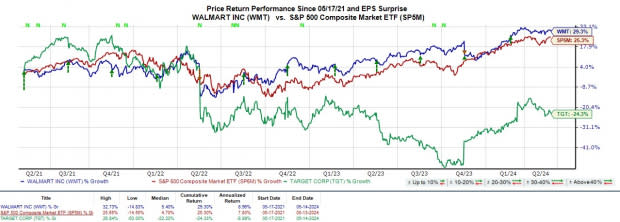

Recent Performance & Valuation

Walmart’s low-cost offerings and the ability to act as a defensive hedge against inflation in regard to its stock has helped WMT rise +18% over the last year which has trailed the S&P 500’s +26% but topped Target’s -1%. Year to date, WMT is up +14% to impressively edge the benchmark’s +10% and TGT at +11%.

Image Source: Zacks Investment Research

Checking Walmart’s valuation, WMT trades at 25.6X forward earnings and not a stretched premium to the S&P 500’s 21.9X although this is noticeably above Target’s 17.1X. In terms of price to sales, WMT has a forward P/S ratio of 0.7X which is nicely beneath the optimum level of less than 1X and roughly on par with Target while being well below the S&P 500’s 3.8X.

Image Source: Zacks Investment Research

Takeaway

Going into its Q1 report Walmart's stock lands a Zacks Rank #3 (Hold). With Walmart's stock off to a strong start this year the company's valuation does allude to the notion that there could be better buying opportunities ahead although long-term investors may still be rewarded from current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance