Uniswap (UNI-USD) CEO Hayden Adams is asking President Biden to rethink how his administration handles crypto policies. He’s concerned about the political impact, suggesting that Biden’s decisions, influenced by Senator Elizabeth Warren and the SEC, might be a mistake. Adams thinks Republicans are becoming more open to crypto, so there’s growing pressure to change course.

A Political Gamble

In a May 12 post, Adams pointed out that Biden doesn’t have a lot of time to turn around how many crypto-focused voters feel about his administration’s policies. He took a jab at Biden for underestimating how important crypto could be in the 2024 elections. Adams didn’t hold back, blaming Senator Warren and the SEC for going all out against crypto.

Adams said, “Republicans smell blood in the water and are turning hard towards crypto. Not much time for Biden to save it. Anyone close to him or Democratic leadership should be expressing how serious this is and pushing for an immediate reversal on his approach to crypto (public support/plan and reigning in SEC + Warren).”

Since taking office in 2021, Biden has taken steps that don’t exactly scream “crypto-friendly.” One of his early moves was scribbling his name on an executive order to set up rules for digital assets and putting Gary Gensler in charge of the SEC. And under Gensler’s watch, the SEC has been cracking down on crypto companies, dragging names like Kraken, Coinbase (NASDAQ: COIN), Ripple (XRP-USD), and Binance (BNB-USD) into court.

Since he stepped into the big chair in 2021, Biden’s done some things that don’t exactly shout “crypto-friendly.” One of his early moves was scribbling his name on an executive order to set up rules for digital assets and putting Gary Gensler in charge of the SEC. And under Gensler’s watch, the SEC has been cracking down on crypto companies, dragging names like Kraken, Coinbase (NASDAQ: COIN), Ripple (XRP-USD), and Binance (BNB-USD) into court.

In November, American voters will decide if Biden gets another shot. How he handles crypto could be a big deal, especially with a recent House vote to scrap an SEC rule blocking banks from holding customers’ crypto. Biden plans to veto this, sticking with the SEC’s Special Accounting Bulletin 121.

Uniswap’s Fee Hike Impact

While Adams battles political tides, Uniswap’s operations are feeling the squeeze. In mid-April, Uniswap Labs increased the fee for swaps on its interface from 0.15% to 0.25%. This fee applies to most, but not all, swaps using the Uniswap web interface and wallet.

The fee increase really hit home. Uniswap’s share of DEX activity fell from 35.8% in March to 30% in April. But don’t count it out – it’s still making bank, pulling in over $145,000 every day just from its Ethereum (ETH-USD) interface. However, revenue’s been up and down. Right after the fee hike, they were raking in over $300,000 on some days, but since April 21, only four days hit that mark. It might be because the whole market’s been slowing down, but fees did go up a bit as asset prices bounced back.

Come early May, the frontend volume made up just 20% of the action, maybe because more folks were hitting up the 1inch(1INCH-USD) website. Uniswap’s still a big deal, but with the fee increase and all the regulatory heat, things aren’t looking too rosy.

Is Uniswap a Buy?

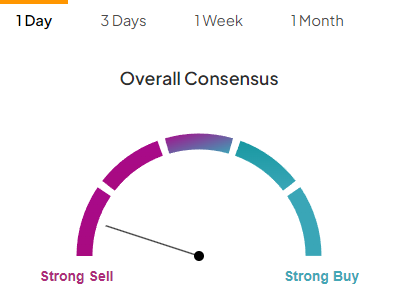

According to TipRanks’ Summary of Technical Indicators, Uniswap is a Sell.

Don’t let crypto give you a run for your money. Track coin prices here.