Jeremy Grantham's Strategic Moves in Q1 2024: A Closer Look at Alphabet Inc's Impact

Insights into Grantham's Latest 13F Filings and Portfolio Adjustments

Jeremy Grantham (Trades, Portfolio), the Chairman of the Board at Grantham Mayo van Otterloo (GMO) LLC, continues to influence the investment landscape with his strategic decisions. Known for his acute ability to identify and avoid market bubbles, Grantham's latest 13F filing for the first quarter of 2024 reveals significant transactions that underline his investment philosophy. His firm, based in Boston, is renowned for its expertise across various asset classes, including stocks, bonds, and commodities.

Summary of New Buys

Jeremy Grantham (Trades, Portfolio)'s portfolio saw the addition of 83 new stocks in this quarter. Noteworthy new positions include:

United States Steel Corp (NYSE:X), acquiring 861,481 shares, which now comprise 0.13% of the portfolio, valued at $35.13 million.

McGrath RentCorp (NASDAQ:MGRC), with 264,563 shares, making up about 0.12% of the portfolio, valued at $32.64 million.

GE HealthCare Technologies Inc (NASDAQ:GEHC), adding 300,328 shares, accounting for 0.1% of the portfolio, valued at $27.30 million.

Key Position Increases

Grantham also strategically increased his stakes in several key holdings:

Alphabet Inc (NASDAQ:GOOGL), with an additional 1,753,839 shares, bringing the total to 6,813,493 shares. This adjustment marks a significant 34.66% increase in share count, impacting the portfolio by 0.96%, with a total value of approximately $1.03 billion.

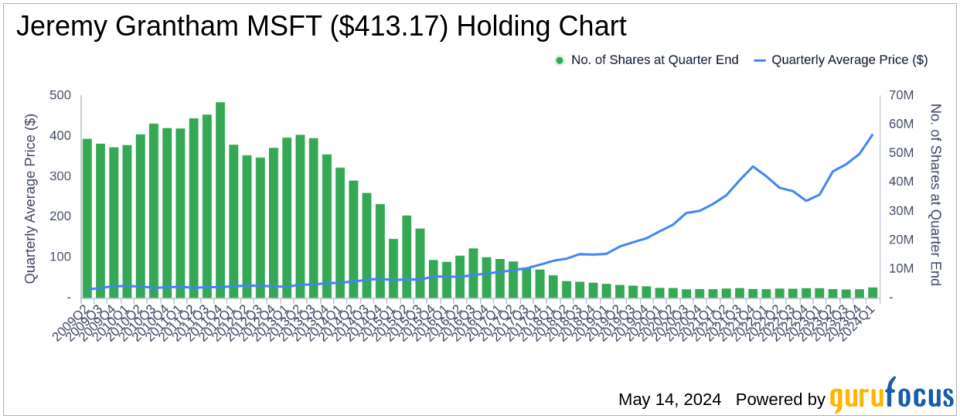

Microsoft Corp (NASDAQ:MSFT), increasing by 598,476 shares to a total of 3,597,068 shares. This represents a 19.96% increase in share count, with a total value of approximately $1.51 billion.

Summary of Sold Out Positions

During the first quarter of 2024, Jeremy Grantham (Trades, Portfolio) exited 55 positions, including:

Splunk Inc (SPLK), selling all 264,674 shares, impacting the portfolio by -0.18%.

PNM Resources Inc (NYSE:PNM), liquidating all 892,692 shares, with a -0.16% impact on the portfolio.

Key Position Reductions

Significant reductions were made in several holdings:

Canadian Solar Inc (NASDAQ:CSIQ), reduced by 2,852,042 shares, resulting in a -53.41% decrease in shares and a -0.33% impact on the portfolio. The stock traded at an average price of $21.55 during the quarter and has seen a -26.63% return over the past three months and -38.77% year-to-date.

Novartis AG (NYSE:NVS), reduced by 581,499 shares, marking a -38.07% reduction in shares and a -0.26% impact on the portfolio. The stock traded at an average price of $102.53 during the quarter and has returned 7.17% over the past three months and 5.15% year-to-date.

Portfolio Overview

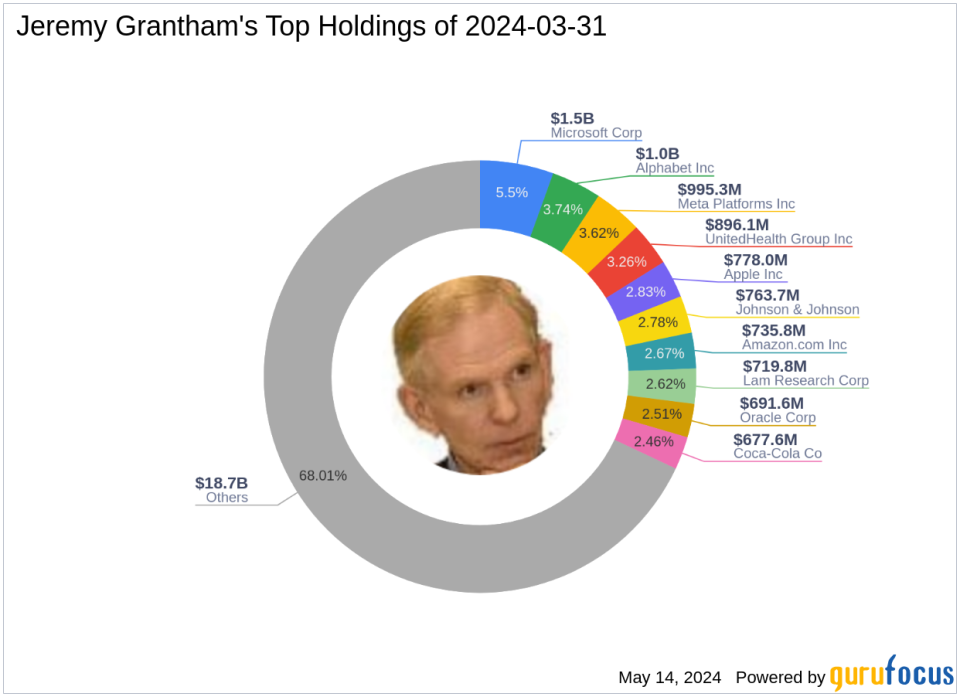

As of the first quarter of 2024, Jeremy Grantham (Trades, Portfolio)'s portfolio included 515 stocks. The top holdings were 5.5% in Microsoft Corp (NASDAQ:MSFT), 3.74% in Alphabet Inc (NASDAQ:GOOGL), 3.62% in Meta Platforms Inc (NASDAQ:META), 3.26% in UnitedHealth Group Inc (NYSE:UNH), and 2.83% in Apple Inc (NASDAQ:AAPL). The holdings are predominantly concentrated in 11 industries, reflecting a diverse yet focused investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance