After Big Oil, It Is Time for Refining Stocks to Soar

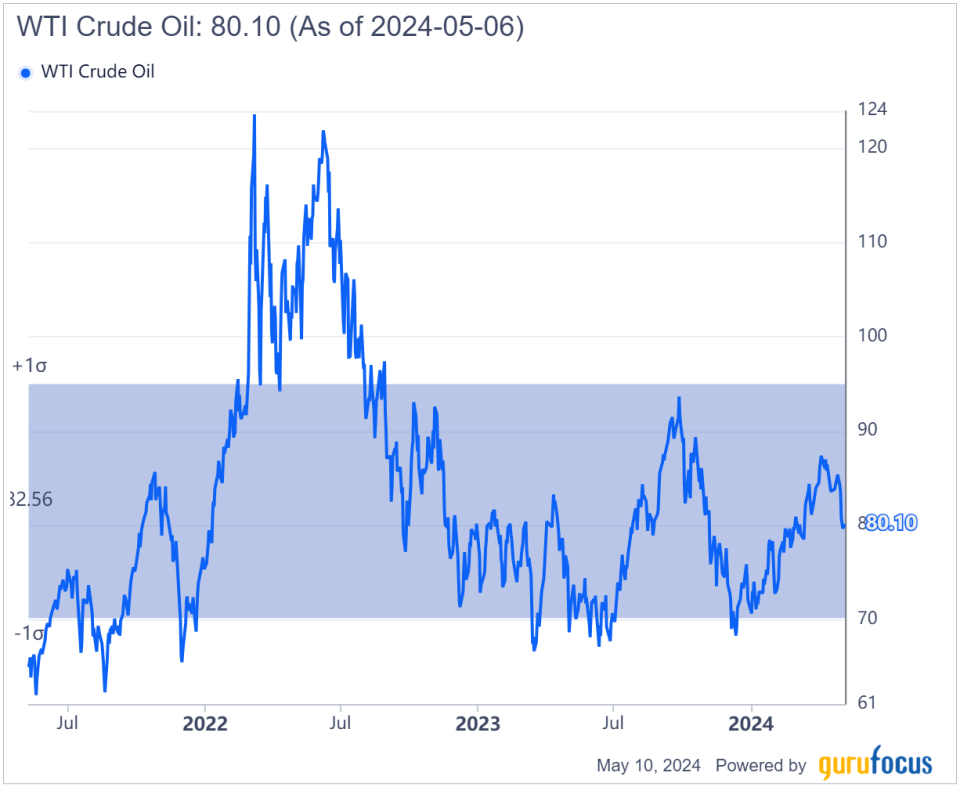

The three main U.S. oil refiners hit new all-time highs in the first quarter. Their extraordinary stock performance over the last several quarters, despite West Texas Intermediate crude oil still being down by around 30% versus its own 2022 high, indicates underlying strength beyond oil prices.

In my opinion, oil refiners are attractive stocks to own in a diversified or energy-heavy portfolio, and two of the main refiners are in the best position of the refining sector to outperform in the long term.

Stock performance and market outlook

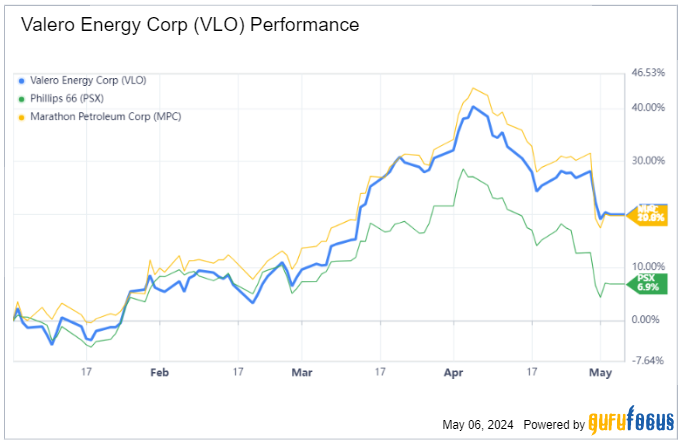

There are major macro factors that carry large tailwinds in favor of the oil refining stocks, such as global demand growth for energy powered by the high growth of populated countries like India, Indonesia and Brazil. The main U.S.-listed refiners are Valero Energy Corp. (NYSE:VLO), Marathon Petroleum Corp. (NYSE:MPC) and Phillips 66 (NYSE:PSX). Valero manufactures and sells petrochemical products and fuels in the U.S., Canada, U.K., Ireland and Latin America. Marathon focuses primarily on the U.S., while Phillips 66 targets the U.S., U.K. and Germany.

Despite the recent performance of the refining sector, it is somewhat overlooked as the low valuation of the refiners indicates. Big oil stocks such as Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) trade closer to a price-earnings ratio of 15, while these main refiners trade in a range of roughly 8 to 11. Market participants are just starting to realize the refiners are trading at a relative discount, and that could explain the excellent performance.

Year-to-date stock performance of oil refiners

20-year stock performance of oil refiners

One of the reasons the industry has been overlooked as an energy play is because refining companies do not have the same political weight and, therefore risk, that big oil does. They are also not always subject to the same public protests, or even regulatory measures, that big oil can suffer from because their perceived impact on the environment is lower. Politics aside, we will focus on the hard figures.

Financials and valuation

The following table was compiled based on data extracted from GuruFocus screening tools and we will analyse it in this section, as the most revealing figures are displayed below.

Tickers | Market Cap ($M) | Price-Earnings | Price-to-FCF | Operating Margin | Return on Equity | Return on Assets | Dividend Yield | Current Ratio |

VLO | 51,286 | 7.77 | 7.65 | 6.78% | 27.14% | 11.32% | 2.63% | 1.59 |

MPC | 64,318 | 9.12 | 7.61 | 6.85% | 31.39% | 9.07% | 1.73% | 1.43 |

PSX | 60,884 | 11.05 | 22.08 | 4.37% | 19.18% | 7.60% | 2.92% | 1.17 |

The three stocks have similar market caps, and hence the comparison is actually fairly easy and relevant to perform. The two favored valuation metrics the markets like to use are price-earnings and price-to-cash flow. We saw in the previous section that Valero and Marathon are currently outperforming year to date and have done so over the last two decades. Despite their multiyear rallies, they remain cheaper than Phillips 66 because their rapid growth rates have continuously kept the valuation multiples down. The price-to-free cash flow ratio is actually even more revealing as Valero and Marathon accumulate more cash that can be reinvested than Phillips 66. Valero ended 2023 with $8.30 billion (down 23.60% from year prior) of free cash flow, while Marathon had $12.27 billion (down 12.3%) and Phillips 66 recorded a disappointing $4.61 billion of free cash flow, roughly cut in half from the year prior (-46.5%). This demonstrates a lower capability for Phillips 66 to withstand oil price declines like the ones we witnessed in 2023.

Furthermore, while Valero and Marathon are better at generating free cash flows, they are also better at investing them. The returns on equity are significantly higher for both companies. When ROE is higher, it gives an indication that future free cash flow is likely to grow. Every dollar invested produces roughly $1.30 for Valero and Marathon, while for Phillips 66 is at $1.20 (which is still a healthy figure). Phillips 66 has a higher dividend yield; but the combination of lower free cash flows, lower ROE and higher dividend yield cause increased stress to the company relative to its competitors. Although the current ratio is comfortably above 1 (a current ratio below 1 means the company has a higher probability to go bankrupt as it does not have enough current assets to cover current liabilities), in my opinion both Valero and Marathon are significantly more attractive plays for a long-term investor wishing to gain exposure to the oil refining sector.

Risk factors to my case

As with every investment, there are specific risks to be considered when gaining exposure to refining stocks. The main risk is the U.S. monetary policy and its implications on the economy. While most stocks would see their valuations benefit from interest rate cuts, which are likely to occur at the end of this year and next year (possibly after a recession hits the U.S. economy), oil refining stocks are not as sensitive to the rates. They are overall more sensitive to energy demand, so the possible recession that could trigger the interest rate cuts could cause the demand for oil-related products to fade and hence to negatively impact the oil refining companies' revenues. A second risk is that we are in an election year and energy is often at the center of heated political debates. Therefore, although valuations and financials are highly attractive, diversification is necessary when initiating a buy position at this point in time, despite the quality of the underlying businesses.

Bottom line

Oil refining stocks represent an attractive energy play because of their relative resistance to oil price declines and also thanks to their financial health. Amongst the oil refining stocks, the most interesting stocks to buy are Valero and Marathon Petroleum as they have better hard figures and multiyear performance in relation to Phillips 66. Given the potential recession and a U.S. election year, it is more interesting to own the stocks within a diversified portfolio. Oil refinining stocks are significantly undervalued in relation to big oil. However, the performance over the last couple of decades and cheap valuation may indicate that we are in the middle of a multiyear rally in this industry.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance