CF Industries Holdings Inc's Dividend Analysis

Exploring the Sustainability and Growth of CF Industries Holdings Inc's Dividend

CF Industries Holdings Inc (NYSE:CF) recently announced a dividend of $0.5 per share, payable on 2024-05-31, with the ex-dividend date set for 2024-05-14. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into CF Industries Holdings Inc's dividend performance and assess its sustainability.

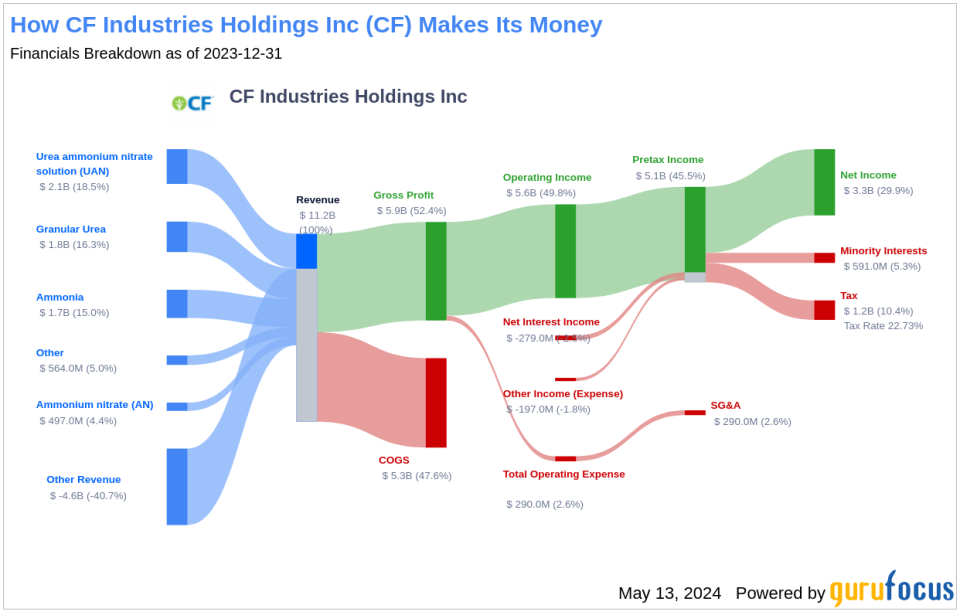

What Does CF Industries Holdings Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

CF Industries is a leading producer and distributor of nitrogen, primarily used in fertilizers. The company operates nitrogen manufacturing plants mainly in North America, with additional production in the United Kingdom and a joint venture in Trinidad and Tobago. Leveraging low-cost US natural gas as its feedstock, CF Industries stands as one of the lowest-cost nitrogen producers globally. The company is also pioneering investments in carbon-free blue and green ammonia, which serves as an alternative fuel to hydrogen or a means to transport hydrogen.

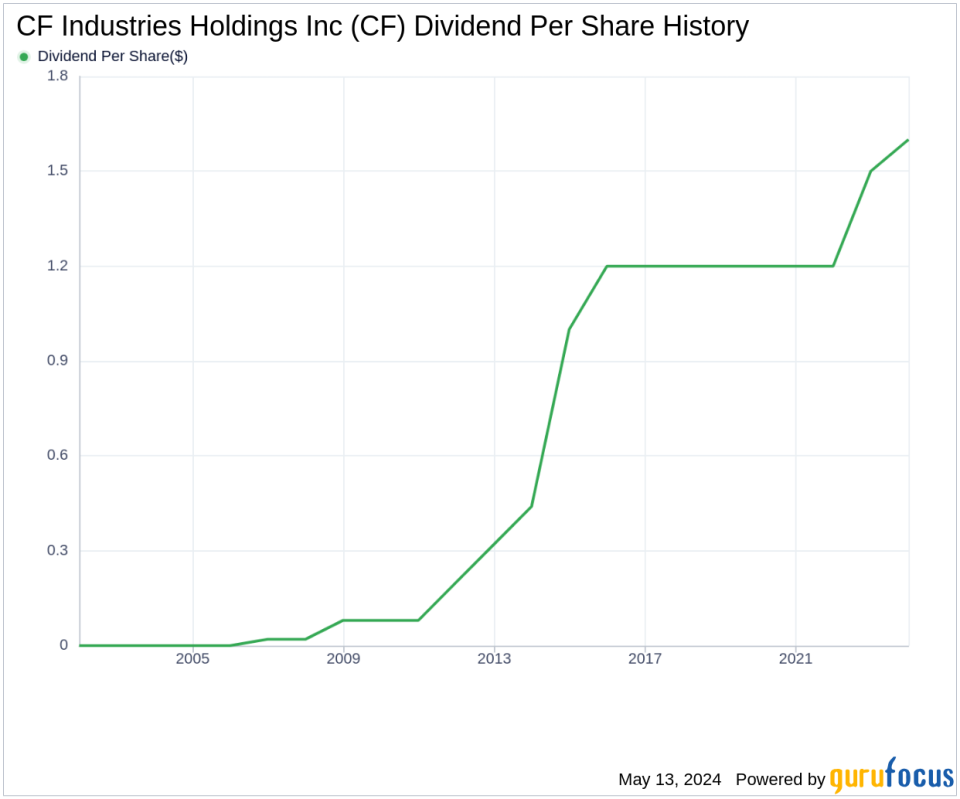

A Glimpse at CF Industries Holdings Inc's Dividend History

CF Industries Holdings Inc has upheld a consistent dividend payment record since 2005, distributing dividends quarterly. The company has progressively increased its dividend each year since then, earning the status of a dividend achievera title awarded to companies that have raised their dividend annually for at least the past 19 years.

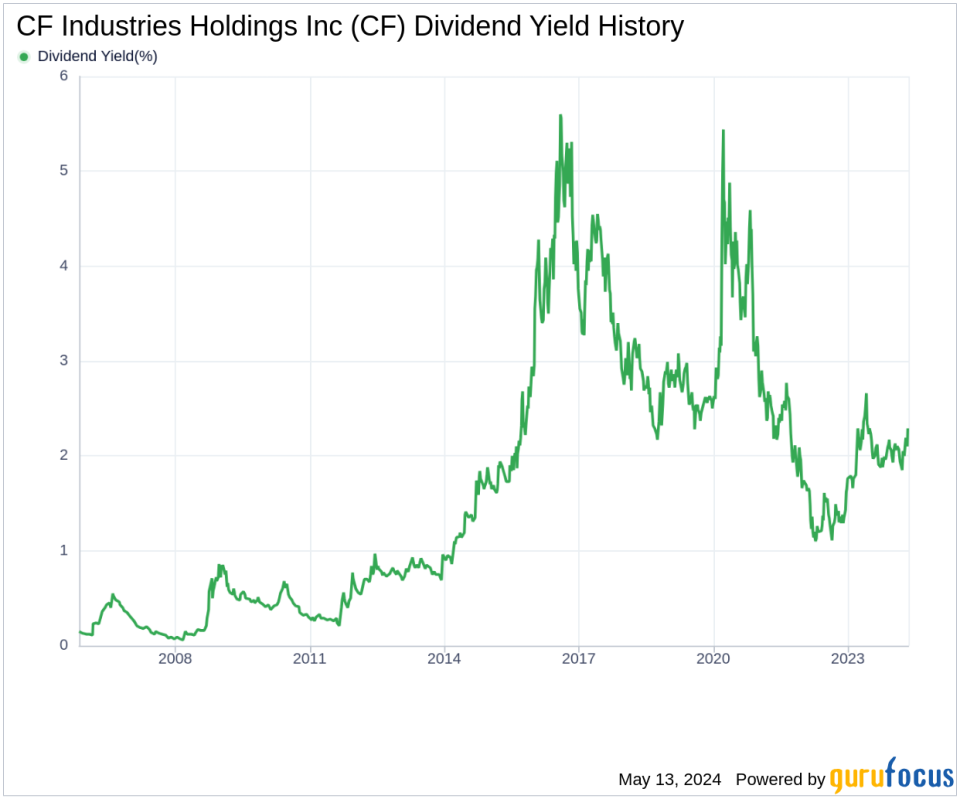

Breaking Down CF Industries Holdings Inc's Dividend Yield and Growth

As of today, CF Industries Holdings Inc boasts a 12-month trailing dividend yield of 2.30% and a 12-month forward dividend yield of 2.70%, indicating anticipated increases in dividend payments over the next year. Over the past three years, the company's annual dividend growth rate was 10.10%, which slowed to 6.20% over a five-year period, and a steady growth rate of 7.60% over the past decade. The 5-year yield on cost for CF Industries Holdings Inc stock is approximately 3.11% as of today.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of dividends is often gauged by the dividend payout ratio, which at 0.28 as of 2024-03-31, suggests CF Industries Holdings Inc retains a significant portion of its earnings for future growth and stability. The company's profitability rank of 9 out of 10, alongside its consistent net profit over 9 of the past 10 years, underscores its strong profitability relative to peers.

Growth Metrics: The Future Outlook

CF Industries Holdings Inc's growth rank of 9 out of 10 reflects its robust growth trajectory. The company's revenue per share and 3-year revenue growth rate of approximately 21.30% annually outperforms about 73.25% of global competitors. Additionally, its 3-year EPS growth rate and 5-year EBITDA growth rate of 64.20% further reinforce its capacity to sustain dividends.

Conclusion

Considering CF Industries Holdings Inc's consistent dividend increases, a manageable payout ratio, robust profitability, and strong growth metrics, the company appears well-positioned to maintain its dividend attractiveness. These factors make CF Industries Holdings Inc a compelling candidate for investors seeking stable and growing dividend income. For further exploration of high-dividend yield opportunities, consider using the High Dividend Yield Screener available to GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance