Exploring Mercari And Two Other High Insider Ownership Growth Stocks On The Japanese Exchange

In recent trading sessions, Japan's Nikkei 225 and TOPIX indices have experienced marginal weekly losses amid signals from the Bank of Japan hinting at potential interest rate hikes. This cautious market sentiment underlines the importance of focusing on growth companies with high insider ownership, as these firms often demonstrate a strong alignment between management’s interests and shareholder value, potentially offering resilience in uncertain economic times.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.5% | 27.2% |

Medley (TSE:4480) | 34.1% | 23.6% |

Hottolink (TSE:3680) | 27% | 54.3% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

Micronics Japan (TSE:6871) | 15.3% | 37.4% |

Money Forward (TSE:3994) | 21.4% | 63.3% |

ExaWizards (TSE:4259) | 24.8% | 84.3% |

Soracom (TSE:147A) | 17.2% | 59.1% |

giftee (TSE:4449) | 35% | 55.8% |

freee K.K (TSE:4478) | 24% | 79.8% |

Here's a peek at a few of the choices from the screener.

Mercari

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mercari, Inc. is a tech company that focuses on planning, developing, and operating the Mercari marketplace applications in Japan and the United States, with a market capitalization of approximately ¥313.91 billion.

Operations: The company generates revenue primarily through its marketplace applications active in Japan and the United States.

Insider Ownership: 36%

Return On Equity Forecast: 22% (2027 estimate)

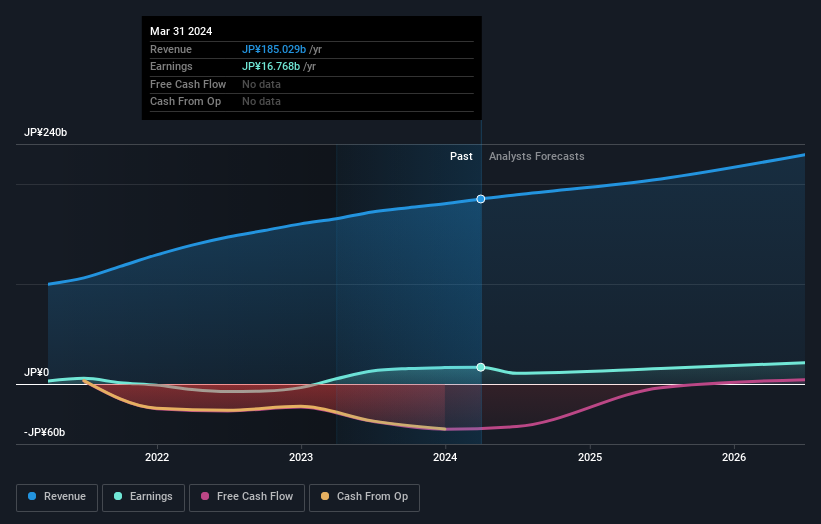

Mercari, a Japanese growth company with significant insider ownership, is experiencing robust financial trends. Its earnings have surged by 222.8% over the past year and are expected to grow at 17.6% annually, outpacing the Japanese market's average of 9.2%. Despite this strong performance, Mercari's revenue growth forecast of 8.9% per year slightly lags behind more aggressive growth benchmarks. Recently, Mercari has innovated its business model by eliminating selling fees and introducing a simplified returns policy aimed at enhancing user experience and competitiveness in the U.S. market.

PARK24

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PARK24 Co., Ltd. manages parking facilities both in Japan and internationally, with a market capitalization of approximately ¥303.95 billion.

Operations: The company generates revenue primarily from the operation and management of parking facilities globally.

Insider Ownership: 10.5%

Return On Equity Forecast: 24% (2027 estimate)

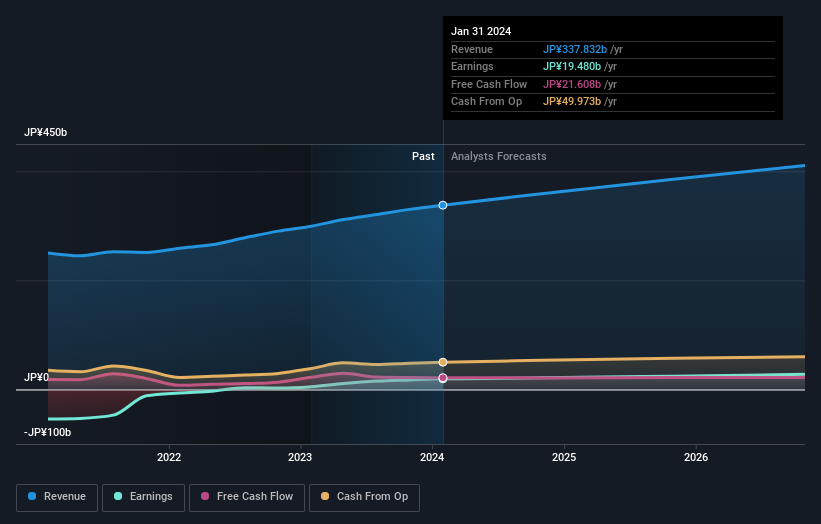

PARK24, a Japanese company with high insider ownership, is trading at 11.7% below its estimated fair value, indicating potential undervaluation. Over the past year, its earnings surged by 278.1%, with future earnings expected to grow by 11.23% annually—outperforming the Japanese market's forecast of 9.2%. Despite these positives, PARK24 carries a high level of debt which could pose risks. Recent board decisions to make personnel changes may influence future strategic directions and performance stability.

Get an in-depth perspective on PARK24's performance by reading our analyst estimates report here.

Our valuation report here indicates PARK24 may be undervalued.

Relo Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Relo Group, Inc. operates in property management services across Japan with a market capitalization of approximately ¥257.40 billion.

Operations: The firm specializes in property management services across Japan.

Insider Ownership: 27.5%

Return On Equity Forecast: 23% (2027 estimate)

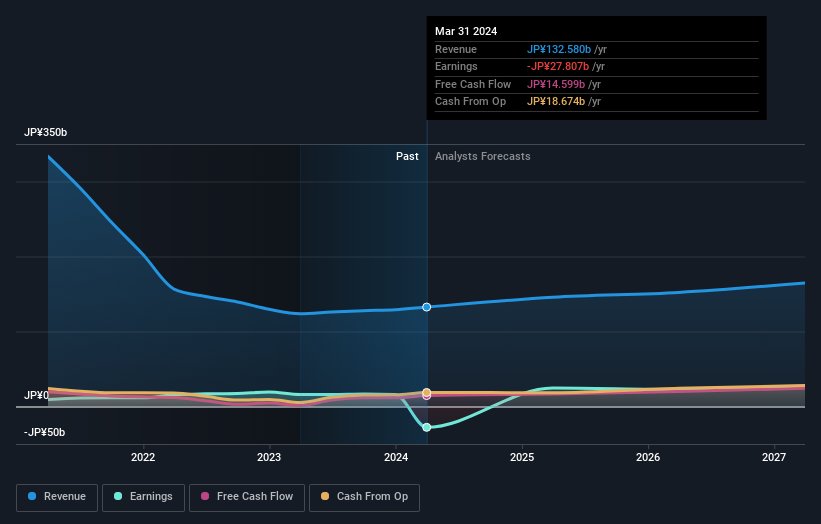

Relo Group, a Japanese growth company with high insider ownership, is trading at 34% below its estimated fair value, suggesting potential undervaluation. Despite a highly volatile share price and an unstable dividend track record, the company is forecasted to become profitable within three years with earnings expected to grow by 56.81% annually. Recent corporate actions include strategic executive changes and new agreements aimed at enhancing business operations and shareholder returns through increased dividends.

Turning Ideas Into Actions

Explore the 105 names from our Fast Growing Japanese Companies With High Insider Ownership screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4385 TSE:4666 and TSE:8876.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com