Constellation Energy Corp (CEG) Q1 2024 Earnings: Aligns with EPS Projections, Surpasses ...

Adjusted (non-GAAP) Operating Earnings per Share: $1.82, aligning perfectly with analyst estimates of $1.82.

GAAP Net Income per Share: Increased significantly to $2.78 from $0.29 year-over-year, reflecting strong financial performance.

Revenue: Reported at $6.161 billion, surpassing the estimated $5.695 billion.

Net Income: $883 million, significantly exceeding the estimated $571.10 million.

Share Repurchase: Over $500 million deployed for share repurchases in Q1, with total repurchases exceeding $1.5 billion since the program's commencement.

Credit Rating Upgrade: Moodys upgraded the issuer credit rating to Baa1 from Baa2, indicating improved financial stability and performance.

Green Bond Issuance: Issued the nation's first corporate green bond including nuclear energy, amounting to $900 million.

On May 9, 2024, Constellation Energy Corp (NASDAQ:CEG) released its first-quarter financial results for the year, showcasing a robust performance with significant strategic developments. The detailed financial outcomes were disclosed in the company's 8-K filing. Constellation, a leading entity in the clean energy sector, continues to strengthen its market position by delivering comprehensive energy solutions across the United States.

Financial Highlights and Performance

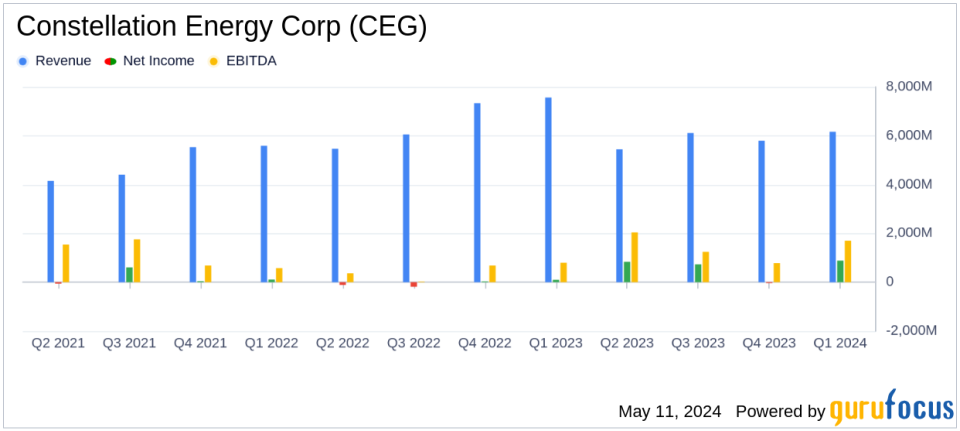

For Q1 2024, Constellation reported a GAAP Net Income of $2.78 per share, a significant increase from $0.29 per share in Q1 2023. The Adjusted (non-GAAP) Operating Earnings were $1.82 per share, aligning perfectly with analyst estimates and showing a considerable rise from the previous year's $0.78 per share. This performance reflects favorable market conditions, nuclear production tax credits (PTCs), and the impact of nuclear outages, offset partially by unfavorable Zero Emission Credit (ZEC) and Capacity Market Credit (CMC) revenues, alongside increased labor and material costs.

Revenue for the quarter stood at $6.16 billion, a decrease from the previous year's $7.57 billion but still surpassing analyst expectations of $5.69 billion. This revenue performance, coupled with controlled operating expenses, underscored Constellation's operational efficiency and strategic market positioning.

Strategic Developments and Operational Efficiency

Constellation's commitment to shareholder value was evident with the repurchase of nearly 3 million shares, amounting to approximately $500 million in Q1, part of a broader $1.5 billion buyback since 2023. Furthermore, the Board authorized an additional $1 billion for share repurchases, reflecting confidence in the company's financial health and future prospects.

The company also made headlines by issuing the nation's first corporate green bond that includes nuclear energy, amounting to $900 million. This pioneering financial instrument underscores Constellation's leadership in the clean energy transition and its innovative approach to financing.

Operationally, Constellation's nuclear operations saw an increase in output, with a total generation of 45,391 gigawatt-hours (GWhs) in Q1 2024, compared to 42,463 GWhs in the same period last year. The company achieved a 93.3% capacity factor, slightly up from 92.8% in Q1 2023, reflecting high operational reliability and efficiency.

Financial Stability and Outlook

The company's financial stability was further reinforced by an upgrade in its issuer credit rating by Moodys from Baa2 to Baa1. This upgrade is a testament to Constellation's solid financial performance and robust credit metrics, driven by supportive climate policies and the inherent stability of nuclear energy as a clean power source.

Constellation is reaffirming its full-year 2024 Adjusted (non-GAAP) Operating Earnings guidance range of $7.23 to $8.03 per share, indicating confidence in continued strong performance throughout the year.

Conclusion

Constellation Energy Corp's first quarter of 2024 demonstrates a potent combination of strategic foresight, operational excellence, and financial robustness. As the company continues to lead the charge towards a sustainable, clean energy future, it remains a compelling choice for investors looking for stability and growth in the renewable energy sector.

For more detailed information and to follow Constellation's progress, investors and interested parties are encouraged to access the full earnings report and supplementary materials available on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Constellation Energy Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance