Outbrain Inc (OB) Q1 2024 Earnings: Navigating Challenges with Strategic Gains

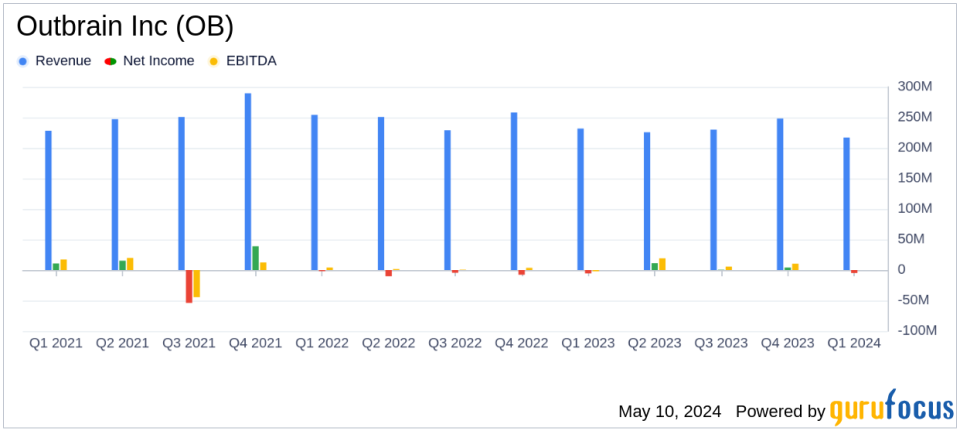

Revenue: Reported at $217.0 million, a decrease of 6% year-over-year, falling short of estimates of $220.96 million.

Net Loss: Improved to $5.0 million from a previous $5.6 million, falling short of estimates of a $6.48 million loss.

Gross Margin: Increased to 19.2% from 17.8% in the prior year, indicating improved profitability.

Free Cash Flow: Positive at $4.6 million, a significant improvement from a cash use of $27.1 million in the prior year.

Net Cash from Operating Activities: Turned positive at $8.6 million, compared to a use of $20.5 million in the previous year, reflecting stronger operational efficiency.

Adjusted EBITDA: Increased to $1.4 million from $0.7 million in the prior year, showing enhanced earnings before interest, taxes, depreciation, and amortization.

Stock Repurchase: Repurchased 945,947 shares for $3.9 million under the ongoing stock repurchase program.

On May 9, 2024, Outbrain Inc (NASDAQ:OB) disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The company, a pivotal player in the technology platform sector for the Open Internet, reported a revenue of $217.0 million for the quarter, marking a 6% decrease from the previous year's $231.8 million. Despite this decline, Outbrain managed to generate a net loss improvement and a significant increase in cash flow from operations.

Company Overview

Outbrain Inc operates as a premier technology platform that enhances business outcomes by engaging users across the Open Internet. The platform specializes in delivering personalized content and ads, generating revenue from advertisers based on user interactions. With a strong presence in regions like Europe, the Middle East, Africa, and the USA, Outbrain continues to expand its influence and operational scope in the interactive media industry.

Financial Performance Insights

The first quarter of 2024 saw Outbrain achieving a gross profit of $41.6 million, slightly up from $41.2 million in the same quarter of the previous year. This improvement is underscored by a gross margin increase from 17.8% to 19.2%. However, the net loss was reported at $5.0 million, an improvement over the previous year's net loss of $5.6 million.

Significantly, the net cash provided by operating activities reached $8.6 million, a dramatic shift from a net cash use of $20.5 million in the prior year. This represents a 142% improvement, demonstrating Outbrain's enhanced cash flow management and operational efficiency. Free cash flow also turned positive, reported at $4.6 million compared to a negative $27.1 million last year.

Strategic Developments and Operational Highlights

Outbrain's strategic maneuvers in Q1 2024 included the launch of OnyxGreen in partnership with Scope3, aimed at reducing carbon emissions in advertising. The company also reported a 40% increase in advertiser spend on the Zemanta DSP compared to Q1 2023, and significant growth in premium publisher logo retention and new wins. These initiatives are part of Outbrain's broader strategy to diversify its revenue streams and solidify its market position.

Challenges and Market Position

Despite the revenue decrease, Outbrain's strategic investments and cost management initiatives appear to be aligning with its long-term financial targets. The company faces ongoing challenges in a competitive and rapidly evolving digital advertising market, which demands continuous innovation and adaptation.

Future Outlook

Looking ahead to Q2 2024, Outbrain anticipates an Ex-TAC gross profit between $53 million and $57 million and an Adjusted EBITDA ranging from $1 million to $4 million. For the full year, the company expects to maintain its growth trajectory, targeting an Ex-TAC gross profit of $238 million to $248 million and an Adjusted EBITDA of $30 million to $35 million.

In conclusion, Outbrain Inc's first quarter of 2024 reflects a resilient performance amidst revenue challenges, highlighted by improved profitability margins and positive cash flow generation. As the company continues to execute its strategic initiatives, it remains poised to navigate the complexities of the digital advertising landscape effectively.

For further details, investors and interested parties can access the full earnings report and listen to the earnings call on the Investor Relations section of Outbrain's website.

Explore the complete 8-K earnings release (here) from Outbrain Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance