Vanda Pharmaceuticals Reports Mixed Q1 2024 Results, Misses Revenue Estimates

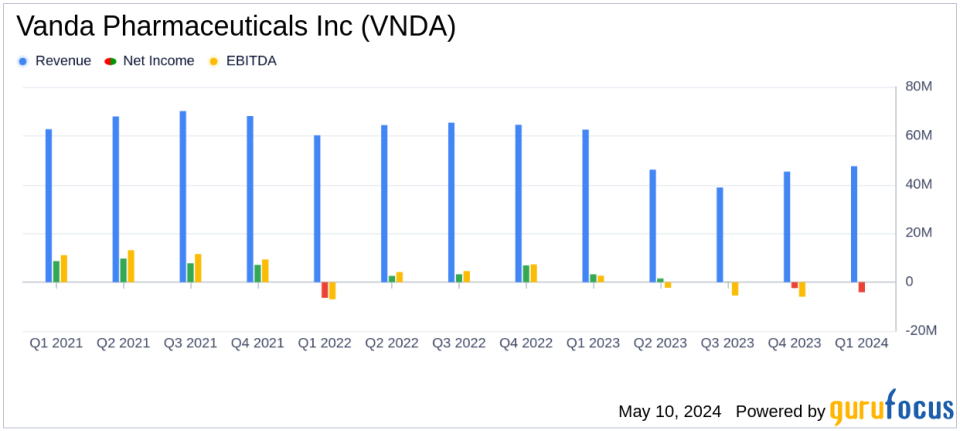

Revenue: Reported at $47.5 million for Q1 2024, showing a 5% increase from Q4 2023 but a 24% decrease year-over-year, falling short of estimates of $48.5 million.

Net Loss: Posted a net loss of $4.1 million in Q1 2024, compared to a net income of $3.3 million in Q1 2023, and below the estimated net loss of $3.10 million.

Earnings Per Share (EPS): Recorded a loss of $0.07 per share, falling short of the estimated loss of $0.05 per share.

Cash Position: Increased to $394.1 million by the end of Q1 2024, up by $5.9 million from the end of Q4 2023.

Fanapt Sales: Net sales decreased to $20.6 million in Q1 2024, down by 10% from Q1 2023 and 9% from Q4 2023.

HETLIOZ Sales: Faced a significant drop to $20.1 million in Q1 2024, a 49% decrease from Q1 2023, primarily due to ongoing generic competition.

PONVORY Sales: Recorded $6.8 million in net sales for Q1 2024 following its recent acquisition.

Vanda Pharmaceuticals Inc (NASDAQ:VNDA) disclosed its financial outcomes for the first quarter of 2024 on May 8, 2024, through its 8-K filing. The company, known for its focus on developing treatments for unmet medical needs, reported a revenue of $47.5 million, marking a 24% decrease from the same quarter last year but a 5% increase from the previous quarter.

Financial Performance Overview

The reported revenue of $47.5 million fell short of the analyst expectations of $48.5 million. This decline is primarily attributed to the significant drop in HETLIOZ sales, which plummeted by 49% year-over-year due to increasing generic competition in the U.S. market. Conversely, Vanda saw a modest quarter-over-quarter revenue growth, driven by incremental sales in other product lines.

Fanapt, one of Vanda's key products, also saw a decrease in sales, contributing to the company's challenges this quarter. The net loss stood at $4.1 million, a shift from a net income of $3.3 million in Q1 2023, and a deeper loss compared to $2.4 million in Q4 2023. This financial strain underscores the impact of competitive pressures and market dynamics on Vanda's profitability.

Strategic Developments and Future Outlook

Despite the financial downturn, Vanda Pharmaceuticals is gearing up for several strategic initiatives aimed at broadening its market reach and enhancing its product portfolio. Notable among these is the FDA's recent approval of Fanapt for the treatment of acute bipolar I disorder, with a commercial launch anticipated in Q3 2024. This approval could potentially expand the addressable market for Fanapt significantly.

Additionally, Vanda is preparing for the commercial launch of PONVORY for multiple sclerosis, also expected in Q3 2024. The company is also advancing its pipeline with ongoing clinical programs and upcoming new drug applications (NDAs) for other treatments, including tradipitant for gastroparesis and motion sickness, which are expected to create new growth avenues.

Operational and Market Challenges

The loss in revenue from HETLIOZ due to generic competition poses a significant challenge, impacting the overall financial stability of the company. Vanda's ability to navigate these market dynamics while scaling up new products will be crucial for its future success. The company's strategic focus on expanding indications for existing products and pushing forward with new NDAs highlights its proactive approach to overcoming these hurdles.

Conclusion

Vanda Pharmaceuticals Inc (NASDAQ:VNDA) faces a complex landscape marked by both challenges and opportunities. While the first quarter of 2024 saw financial setbacks, the company's robust pipeline and strategic expansions provide a pathway for recovery and growth. Investors and stakeholders will likely watch closely as Vanda moves towards its upcoming product launches and navigates the competitive pressures in the biopharmaceutical sector.

Explore the complete 8-K earnings release (here) from Vanda Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance