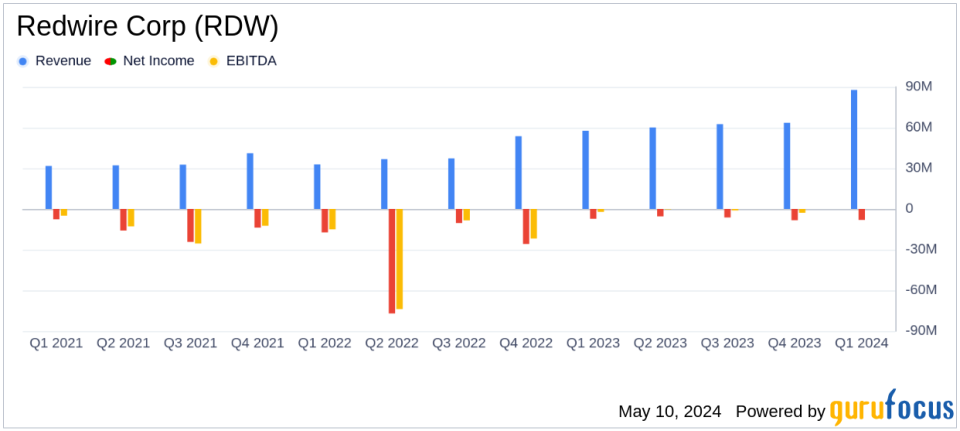

Redwire Corp (RDW) Q1 2024 Earnings: Revenue Surges, Aligns with Analyst Projections

Revenue: $87.8M, up by 52.4% year-over-year, exceeding estimates of $66.02M.

Net Loss: $(8.1)M, increased by $0.8M year-over-year, above estimates of -$5.21M.

Free Cash Flow: Improved by $15.2M to $0.4M, compared to $(14.8)M in the previous year.

Net Cash from Operating Activities: Improved by $16.8M to $2.8M year-over-year.

Adjusted EBITDA: Remained flat at $4.3M year-over-year.

Book-to-Bill Ratio: Decreased to 1.11 LTM as of Q1 2024 from 1.76 LTM as of Q1 2023.

2024 Revenue Forecast: Affirmed at $300M, inline with the annual estimate of $301.55M.

On May 8, 2024, Redwire Corp (NYSE:RDW) unveiled its financial results for the first quarter of 2024, demonstrating significant revenue growth and operational improvements. The company's detailed financial outcomes were disclosed in its 8-K filing. Redwire, a pivotal player in the space infrastructure sector, continues to support complex space missions with its innovative solutions.

Financial Highlights and Performance

Redwire reported a robust increase in its first quarter revenue, reaching $87.8 million, up 52.4% from $57.6 million in the same quarter the previous year. This growth significantly outpaced analyst expectations, which had projected revenues of $66.02 million. However, the company recorded a net loss of $8.1 million, slightly widening from a net loss of $7.3 million year-over-year, aligning closely with the anticipated net loss of $5.21 million by analysts.

The company also reported a stable Adjusted EBITDA of $4.3 million, maintaining the level from the first quarter of 2023. Notably, net cash provided by operating activities showed a remarkable improvement, turning positive at $2.8 million compared to a cash use of $14.0 million in the prior year. Free Cash Flow also turned positive, reaching $0.4 million, a significant recovery from a negative $14.8 million in the first quarter of 2023.

Strategic Developments and Future Outlook

Redwire's strategic initiatives have been fruitful, as evidenced by the meaningful increase in its pipeline to approximately $6.3 billion, with $610.0 million in bids submitted year-to-date through March 31, 2024. The company remains under contract for 18 ship sets of antennas and RF hardware for the SDA Transport Layer and was awarded its first study related to the SabreSat VLEO platform.

Looking ahead, Redwire reaffirms its full-year 2024 revenue forecast of $300 million, indicating confidence in continued growth and operational efficiency. The company's management expressed optimism about maintaining this momentum, with significant bids and a diversified business model that supports a path to profitability.

Analysis of Financial Statements

The balance sheet reflects a total asset value of $259.542 million as of March 31, 2024, with current assets totaling $99.915 million. The company's liabilities stood at $213.006 million, with current liabilities accounting for $103.413 million. This financial structure underscores the ongoing investments in research and development, which reached $1.040 million, up significantly from $388,000 in the prior year's first quarter.

Redwire's commitment to innovation and expansion is clear from its operational and financial strategies, which are crucial for sustaining its leadership in the competitive space infrastructure sector.

Investor and Market Implications

The first quarter results from Redwire Corp (NYSE:RDW) reflect a solid start to the year, with significant revenue growth and improvements in cash flow metrics. While the net loss has slightly increased, the company's strategic investments and expanding market opportunities suggest a positive outlook for future profitability and value creation for shareholders. Investors and market watchers will likely keep a close eye on how Redwire's strategic initiatives unfold in the coming quarters.

For detailed financial metrics and further information, please refer to the official 8-K filing and join the upcoming investor presentation on May 9, 2024.

Explore the complete 8-K earnings release (here) from Redwire Corp for further details.

This article first appeared on GuruFocus.