Revance Therapeutics Reports Q1 2024 Financial Results: Revenue Growth Amidst Rising Operating ...

Total net product revenue: Reported at $51.7 million, marking a year-over-year increase of 13%, which fell short of the estimated revenue of $56.63 million.

DAXXIFY net revenue: Achieved $22.1 million, despite a $2.0 million reduction due to a consumer coupon program.

RHA Collection net revenue: Recorded at $29.6 million, with a market share increase to 9.8% in Q124 from 9.1% in Q423.

Net loss from continuing operations: Totaled $49.5 million, slightly improved from $48.5 million in the previous year, and exceeded the estimated net loss of $61.62 million.

Market share growth: DAXXIFY market share increased to 3.7% in Q124 from 3.0% in Q423, and aesthetic units sold surged by 105% year-over-year.

Research and Development (R&D) expenses: Decreased to $14.4 million from $17.5 million in the prior year, reflecting lower clinical trial and regulatory activity.

2024 Revenue Outlook: Continues to project at least $280 million in total net product revenue, maintaining a positive forecast for the year.

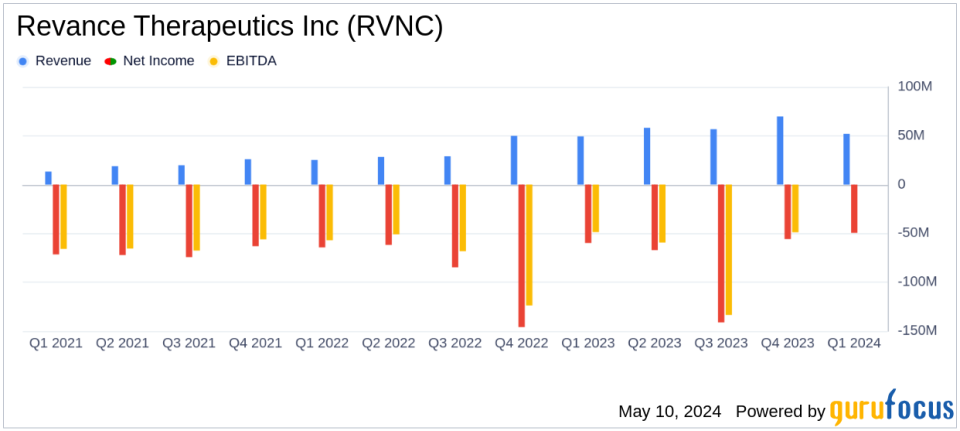

On May 9, 2024, Revance Therapeutics Inc (NASDAQ:RVNC) disclosed its financial outcomes for the first quarter of 2024 through an 8-K filing. The biotechnology firm, known for its aesthetic and therapeutic products, including the DAXXIFY injection and RHA Collection of dermal fillers, reported a notable year-over-year revenue increase but continues to face challenges with rising operational costs and a sustained net loss.

Financial Performance Overview

Revance's total net revenue for Q1 2024 reached $51.9 million, marking a 13% increase from the $45.8 million reported in the same period last year. This growth was primarily driven by a significant rise in DAXXIFY sales, which saw net revenues of $22.1 million despite a $2.0 million deduction due to a consumer coupon program. The RHA Collection also contributed with $29.6 million in net revenues. However, it's worth noting that the filler market experienced softness, impacting the overall revenue from the RHA Collection.

Expenses and Net Loss

Operating expenses for the quarter were substantial, totaling $98.8 million compared to $92.5 million in Q1 2023. The increase was largely attributed to heightened sales and marketing efforts for DAXXIFY and the RHA Collection. Consequently, Revance reported a net loss from continuing operations of $49.5 million, slightly deeper than the $48.5 million loss recorded in the previous year. This ongoing loss underscores the financial pressures the company faces despite its revenue growth.

Strategic Developments and Market Expansion

Revance has been actively expanding its market presence, particularly with the launch of DAXXIFY for cervical dystonia treatment, which now covers approximately 78% of commercial lives. This expansion into the therapeutic sector is expected to be a significant growth driver. Furthermore, the company's aesthetic portfolio continues to gain traction, with DAXXIFY increasing its toxin market share from 3.0% in Q4 2023 to 3.7% in Q1 2024.

2024 Financial Outlook

Looking ahead, Revance maintains its 2024 revenue forecast, expecting at least $280 million from net product sales, including DAXXIFY and the RHA Collection. Operating expenses are projected to range between $460 million and $490 million on a GAAP basis, with non-GAAP operating expenses anticipated between $290 million and $310 million. The company also projects reaching cash flow break-even and achieving positive Adjusted EBITDA by 2025, supported by its robust cash reserves of $277.1 million as of March 31, 2024.

Investor and Analyst Perspectives

Despite the challenges posed by increased expenses and net losses, Revance's strategic initiatives and market expansion provide a basis for potential future profitability. Investors and analysts will likely keep a close watch on the company's ability to manage costs and improve its bottom line in the coming quarters.

Revance Therapeutics Inc continues to navigate a complex landscape with strategic expansions and enhancements to its product offerings. The firm's progress in the aesthetic and therapeutic sectors, coupled with its financial strategies, will be critical in shaping its trajectory towards profitability and market leadership in biotechnology.

Explore the complete 8-K earnings release (here) from Revance Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance