OraSure Technologies Inc (OSUR) Q1 2024 Earnings: Revenue Decline Amidst Strategic Restructuring

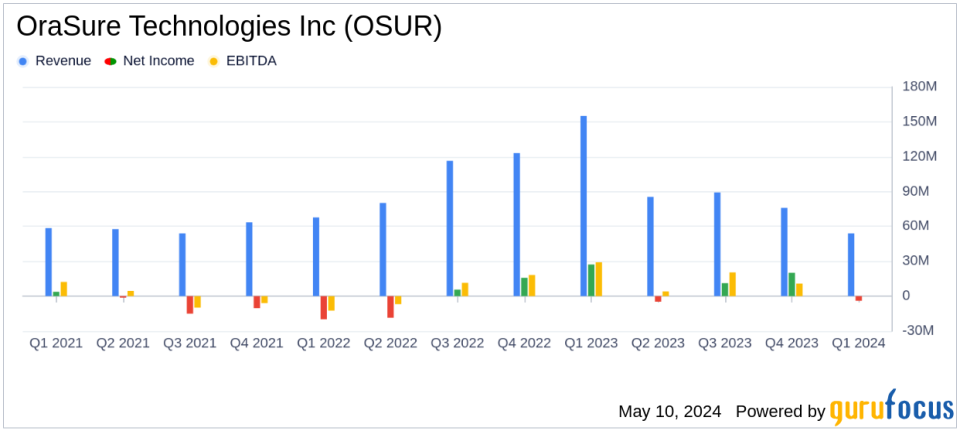

Revenue: Reported $54.1 million for Q1 2024, a decrease of 65% year-over-year, exceeding the estimated $52.10 million.

Net Income: Recorded a net loss of $3.58 million in Q1 2024, significantly below the estimated net loss of $1.03 million.

Earnings Per Share (EPS): Non-GAAP EPS was $0.04, surpassing the estimated EPS of $0.01; GAAP EPS was $(0.05).

Gross Margin: Improved to 44.5% in Q1 2024 from 42.5% in the same period last year, reflecting higher average selling prices and reduced manufacturing scrap expenses.

Operating Cash Flow: Achieved $6.7 million in Q1 2024, contributing towards the company's goal of reaching cash flow breakeven for its core business by the end of 2024.

Cost Reductions: Restructuring initiatives are expected to yield $15 million in annualized expense reductions, aligning with strategic goals to enhance financial stability.

Investment: Invested $28.3 million in Sapphiros, a consumer diagnostics company, as part of its strategy to expand capabilities and market reach.

OraSure Technologies Inc (NASDAQ:OSUR), a prominent player in the medical devices sector, disclosed its financial outcomes for the first quarter of 2024 on May 8, 2024. The company released its 8-K filing, revealing a significant revenue decline compared to the previous year, yet surpassing analyst revenue forecasts. However, its earnings per share (EPS) fell short of expectations.

OraSure Technologies, headquartered in Bethlehem, PA, operates primarily in two segments: diagnostics and molecular solutions. The company is renowned for its innovative oral fluid diagnostic and collection devices, which cater to a variety of infectious diseases, including HIV and HCV. Its molecular solutions segment focuses on products for the collection, stabilization, and transport of genetic material for molecular testing.

Financial Performance Overview

For Q1 2024, OraSure reported a total net revenue of $54.1 million, a sharp decrease of 65% from $155.0 million in Q1 2023. This decline was primarily due to an 80% reduction in COVID-19 related revenue, which was anticipated as government contract volumes decreased. Nevertheless, the reported revenue slightly exceeded the analyst expectations of $52.10 million.

The company's GAAP EPS was $(0.05), missing the estimated earnings of $0.01 per share. On a non-GAAP basis, EPS stood at $0.04. The gross margin improved to 44.5% from 42.5% in the previous year, benefiting from higher average selling prices and reduced manufacturing scrap expenses.

OraSure's operating loss for the quarter was $7.1 million, a significant downturn from an operating income of $24.3 million in the same period last year. This loss reflects the ongoing costs associated with the company's strategic restructuring, including the winding down of its microbiome services and the insourcing of manufacturing activities.

Strategic Initiatives and Future Outlook

President and CEO Carrie Eglinton Manner emphasized the continuation of transformational initiatives aimed at streamlining operations and focusing on core strengths. The company expects these actions to yield $15 million in annualized cost savings and help achieve cash flow break-even by the end of 2024.

Recent business developments include the initiation of the microbiome laboratory exit, expected to save over $10 million annually, and the insourcing of certain production activities, projected to save $5 million annually. These steps are part of OraSure's broader strategy to enhance operational efficiency and leverage existing infrastructure.

Looking forward, OraSure has provided Q2 2024 revenue guidance in the range of $50 to $55 million, with core revenue expected between $33 to $36 million. This guidance includes anticipated revenue from the phasing out Diversigen business.

Investor and Market Implications

The first quarter results and ongoing strategic adjustments are critical for OraSure as it navigates through operational transformations and evolving market demands. While the substantial drop in revenue reflects the tapering off of pandemic-related sales, the company's efforts to strengthen its core business and improve operational efficiencies are pivotal for long-term growth.

Investors and stakeholders will likely monitor the effectiveness of the restructuring initiatives and their impact on the company's financial health, particularly its ability to achieve the projected cost savings and cash flow targets.

OraSure's focus on strategic partnerships and expansion into new market segments through products like InteliSwab and the Colli-Pee urine collection device also highlight its commitment to broadening its product portfolio and enhancing market reach.

For more detailed information and to stay updated on OraSure Technologies Inc's progress, visit the investor relations page on their website or follow their upcoming earnings calls and presentations.

Explore the complete 8-K earnings release (here) from OraSure Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance